Question

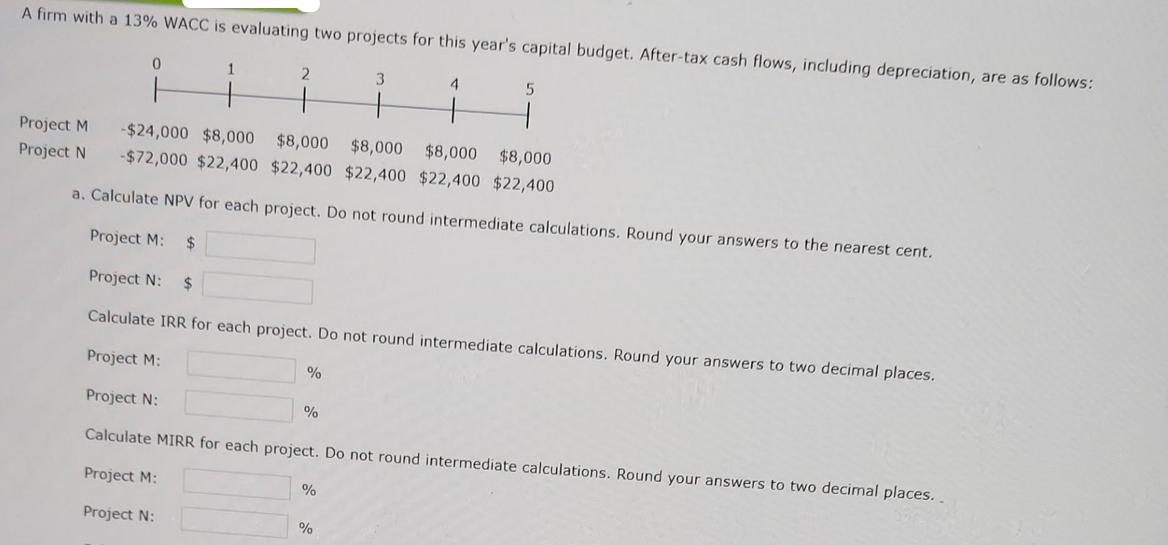

A firm with a 13% WACC is evaluating two projects for this year's capital budget. After-tax cash flows, including depreciation, are as follows: 0

A firm with a 13% WACC is evaluating two projects for this year's capital budget. After-tax cash flows, including depreciation, are as follows: 0 ii 2 3 4 5 H Project M -$24,000 $8,000 $8,000 $8,000 $8,000 $8,000 Project N -$72,000 $22,400 $22,400 $22,400 $22,400 $22,400 a. Calculate NPV for each project. Do not round intermediate calculations. Round your answers to the nearest cent. Project M: $ Project N: $ Calculate IRR for each project. Do not round intermediate calculations. Round your answers to two decimal places. Project M: Project N: % % Calculate MIRR for each project. Do not round intermediate calculations. Round your answers to two decimal places.. Project M: Project N: % %

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of Financial Management

Authors: Eugene F. Brigham, Joel F. Houston

15th edition

1337671002, 978-1337395250

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App