Answered step by step

Verified Expert Solution

Question

1 Approved Answer

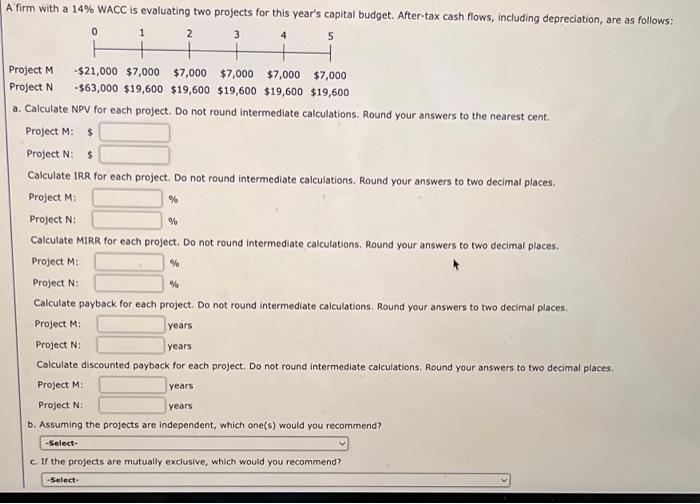

A firm with a 14% WACC is evaluating two projects for this year's capital budget. After-tax cash flows, including depreciation, are as follows: 0

A firm with a 14% WACC is evaluating two projects for this year's capital budget. After-tax cash flows, including depreciation, are as follows: 0 1 2 3 5 Project M Project N -$21,000 $7,000 $7,000 $7,000 $7,000 $7,000 -$63,000 $19,600 $19,600 $19,600 $19,600 $19,600 a. Calculate NPV for each project. Do not round intermediate calculations. Round your answers to the nearest cent. Project M: $ Project N: $. Calculate IRR for each project. Do not round intermediate calculations. Round your answers to two decimal places. Project M: % Project N: Calculate MIRR for each project. Do not round intermediate calculations. Round your answers to two decimal places. Project M: Project N: % Calculate payback for each project. Do not round intermediate calculations. Round your answers to two decimal places. Project M: years Project N: years Calculate discounted payback for each project. Do not round intermediate calculations. Round your answers to two decimal places. Project M: years Project N: years b. Assuming the projects are independent, which one(s) would you recommend? -Select- c. If the projects are mutually exclusive, which would you recommend? -Select- %

Step by Step Solution

★★★★★

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the metrics for the projects we will use the provided aftertax cash flows and a 14 weig...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started