A firm with an asset beta of 0.5 has a quarter of its assets as excess cash (excess cash means that this cash is

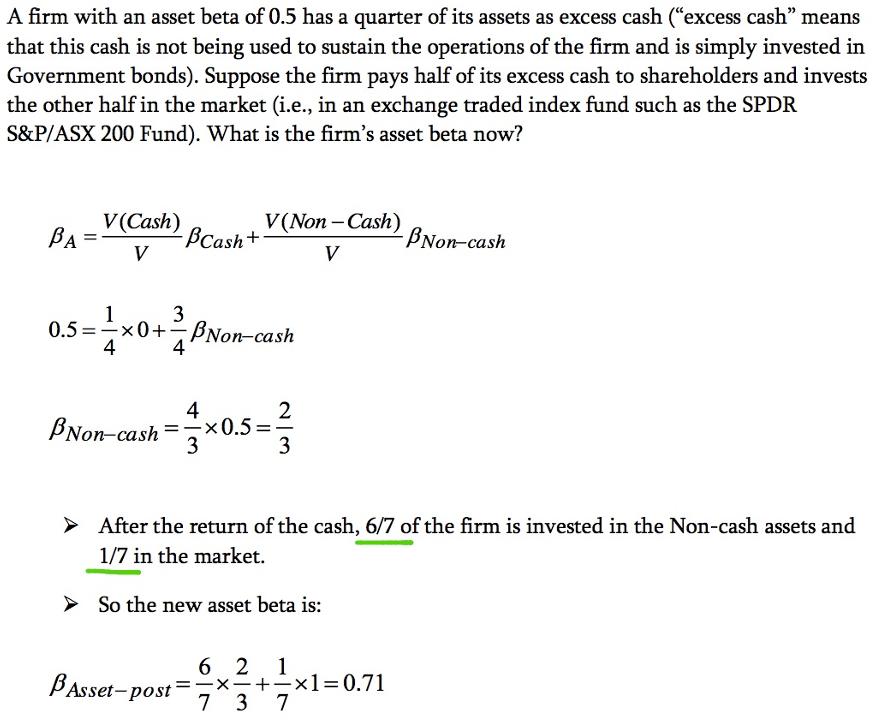

A firm with an asset beta of 0.5 has a quarter of its assets as excess cash ("excess cash" means that this cash is not being used to sustain the operations of the firm and is simply invested in Government bonds). Suppose the firm pays half of its excess cash to shareholders and invests the other half in the market (i.e., in an exchange traded index fund such as the SPDR S&P/ASX 200 Fund). What is the firm's asset beta now? V(Cash) BA BCash+ V(Non -Cash) BNon-cash %3D V V 0.5 =x0+ BNon-cash 4 4 4 2 BNon-cash =* 10.5 10.5%3D 3 3 > After the return of the cash, 6/7 of the firm is invested in the Non-cash assets and 1/7 in the market. So the new asset beta is: BAsset- post 6 2 1 x-+-x1=D0.71 7 3 7

Step by Step Solution

3.46 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Assume initial available total asset wasX One fourth of it was in excess cashnot being used in opera...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started