Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A firm's average cost of capital is 8.5%, the risk free rate is 0.25%. You are tasked to evaluate 4 projects: A, B, C

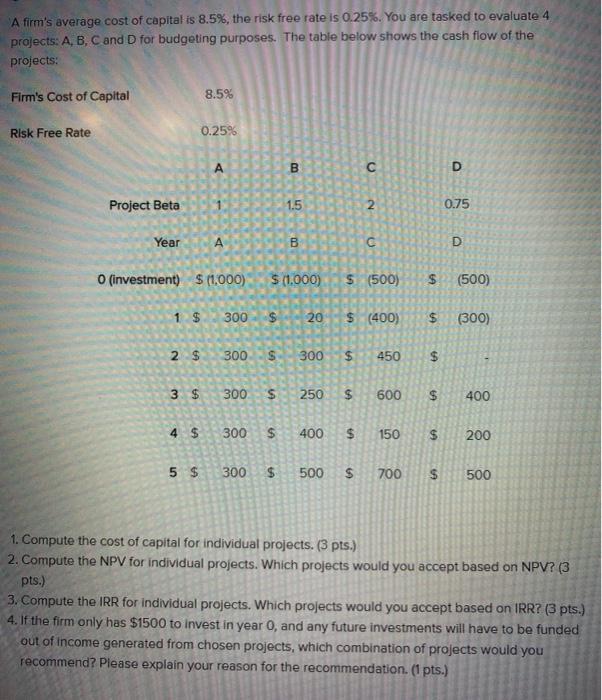

A firm's average cost of capital is 8.5%, the risk free rate is 0.25%. You are tasked to evaluate 4 projects: A, B, C and D for budgeting purposes. The table below shows the cash flow of the projects: Firm's Cost of Capital 8.5% Risk Free Rate 0.25% B C D Project Beta 1.5 2 0.75 Year A B C D 0 (investment) $ (1,000) $ (1,000) $ (500) $ (500) 1 $ 300-$ 20 20 $ (400) $ (300) 2 $ 300 $ 300 $ 450 $ 69 3 $ 300 4 $ 300 5 $ 300 5 S 250 5 600 $ 400 400 $ 150 $ 200 S 500 $ 700 $ 500 1. Compute the cost of capital for individual projects. (3 pts.) 2. Compute the NPV for individual projects. Which projects would you accept based on NPV? (3 pts.) 3. Compute the IRR for individual projects. Which projects would you accept based on IRR? (3 pts.). 4. If the firm only has $1500 to invest in year 0, and any future investments will have to be funded out of income generated from chosen projects, which combination of projects would you recommend? Please explain your reason for the recommendation. (1 pts.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started