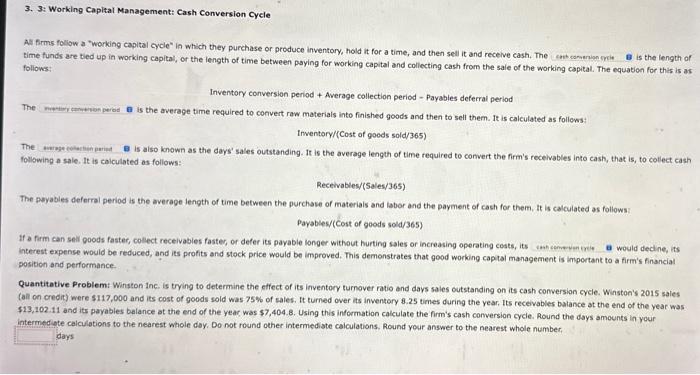

A. firms follow a "working capital cycle" in which they purchase or produce inventory, hold it for a time, and then sell it and recelve cash, The cmit cananion mit B is the length of time funds are tied up in working capital, or the length of time between paying for working capital and collecting cash from the sale of the working capital. The equation for this is as follows: Inventory conversion period + Average collection period - Payabies deferral period The is the average time required to convert raw materials into finished goods and then to sell them. It is calculated as follows: Inventory/(Cost of goods sold/365) following a sale. It is caiculated as follows: Recelvables/(5ales/365) The pwyables deferral period is the average length of time between the purchave of materiais and labor and the payment of cash for them, it is calculated as follows: Payables/(Cost of goods sold/365) If a firm can seil poods faster, collect receivables faster, or defer its payable longer without hurting sales or increasing operating cests, its interest expense would be reduced, and its profits and stock price would be improved. This demonstrates that good working captal management is inportant to a firm's financial position and performance. Quantitative Problemt Winston Inc. is trying to determine the effect of its inventory turnover ratio and days sales outstanding on its cash conversion cycle. Winston's 2015 sales (all on credit) were $117,000 and its cost of goods sold was 75% of sales. It turned over its inventory 8.25 times during the year. its receivables batance at the end of the year was $13,102.11 and its payables balance at the end of the year was \$7,404.8. Using this information calculate the firm's cash conversion cycle. Round the days amounts in your intermediote calculations to the nearest whole day. Do not round other intermediate calculations. Round your answer to the nearest whole number. days A. firms follow a "working capital cycle" in which they purchase or produce inventory, hold it for a time, and then sell it and recelve cash, The cmit cananion mit B is the length of time funds are tied up in working capital, or the length of time between paying for working capital and collecting cash from the sale of the working capital. The equation for this is as follows: Inventory conversion period + Average collection period - Payabies deferral period The is the average time required to convert raw materials into finished goods and then to sell them. It is calculated as follows: Inventory/(Cost of goods sold/365) following a sale. It is caiculated as follows: Recelvables/(5ales/365) The pwyables deferral period is the average length of time between the purchave of materiais and labor and the payment of cash for them, it is calculated as follows: Payables/(Cost of goods sold/365) If a firm can seil poods faster, collect receivables faster, or defer its payable longer without hurting sales or increasing operating cests, its interest expense would be reduced, and its profits and stock price would be improved. This demonstrates that good working captal management is inportant to a firm's financial position and performance. Quantitative Problemt Winston Inc. is trying to determine the effect of its inventory turnover ratio and days sales outstanding on its cash conversion cycle. Winston's 2015 sales (all on credit) were $117,000 and its cost of goods sold was 75% of sales. It turned over its inventory 8.25 times during the year. its receivables batance at the end of the year was $13,102.11 and its payables balance at the end of the year was \$7,404.8. Using this information calculate the firm's cash conversion cycle. Round the days amounts in your intermediote calculations to the nearest whole day. Do not round other intermediate calculations. Round your answer to the nearest whole number. days