Answered step by step

Verified Expert Solution

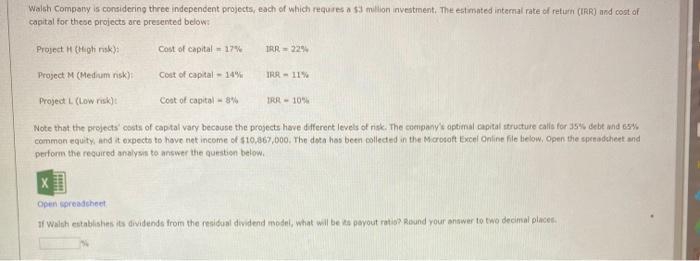

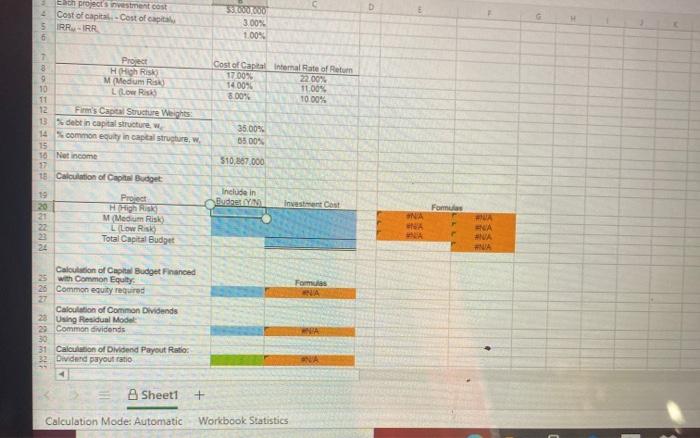

Question

1 Approved Answer

A firm's value depends on its expected free cash filow and its cost of capital. Distributions made in the form of dividends or stock repurchses

A firm's value depends on its expected free cash filow and its cost of capital. Distributions made in the form of dividends or stock repurchses impact the firm's lue and the investors in different ways. Some analysts have argued that a firm's value should solely be determined by its basic earning power and the business risk of the firm. Which of these concepts would support these analysts' argument?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started