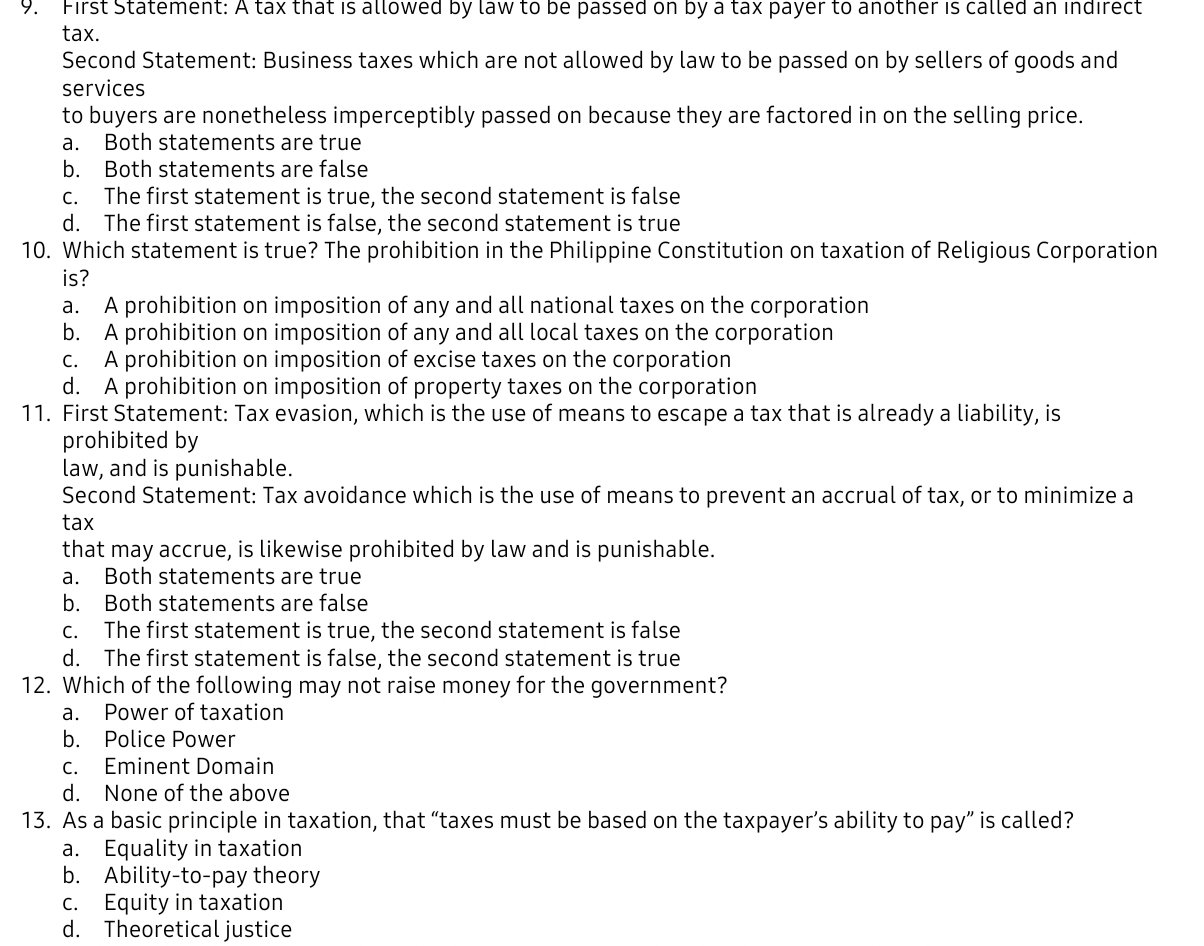

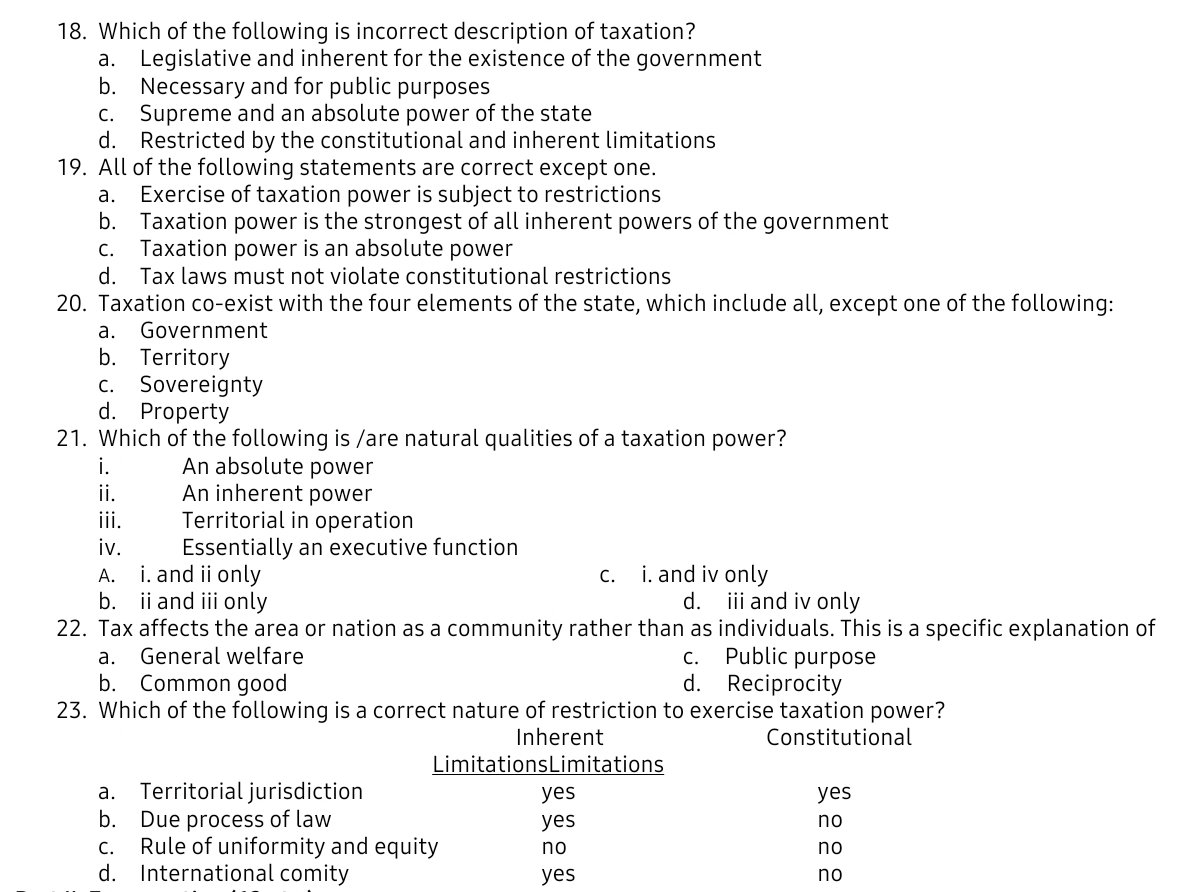

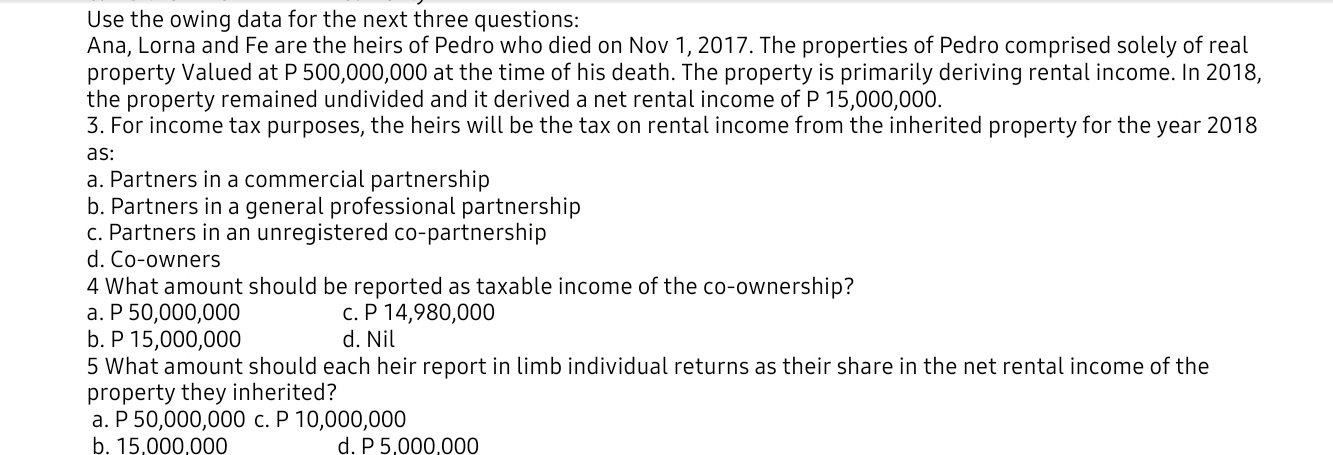

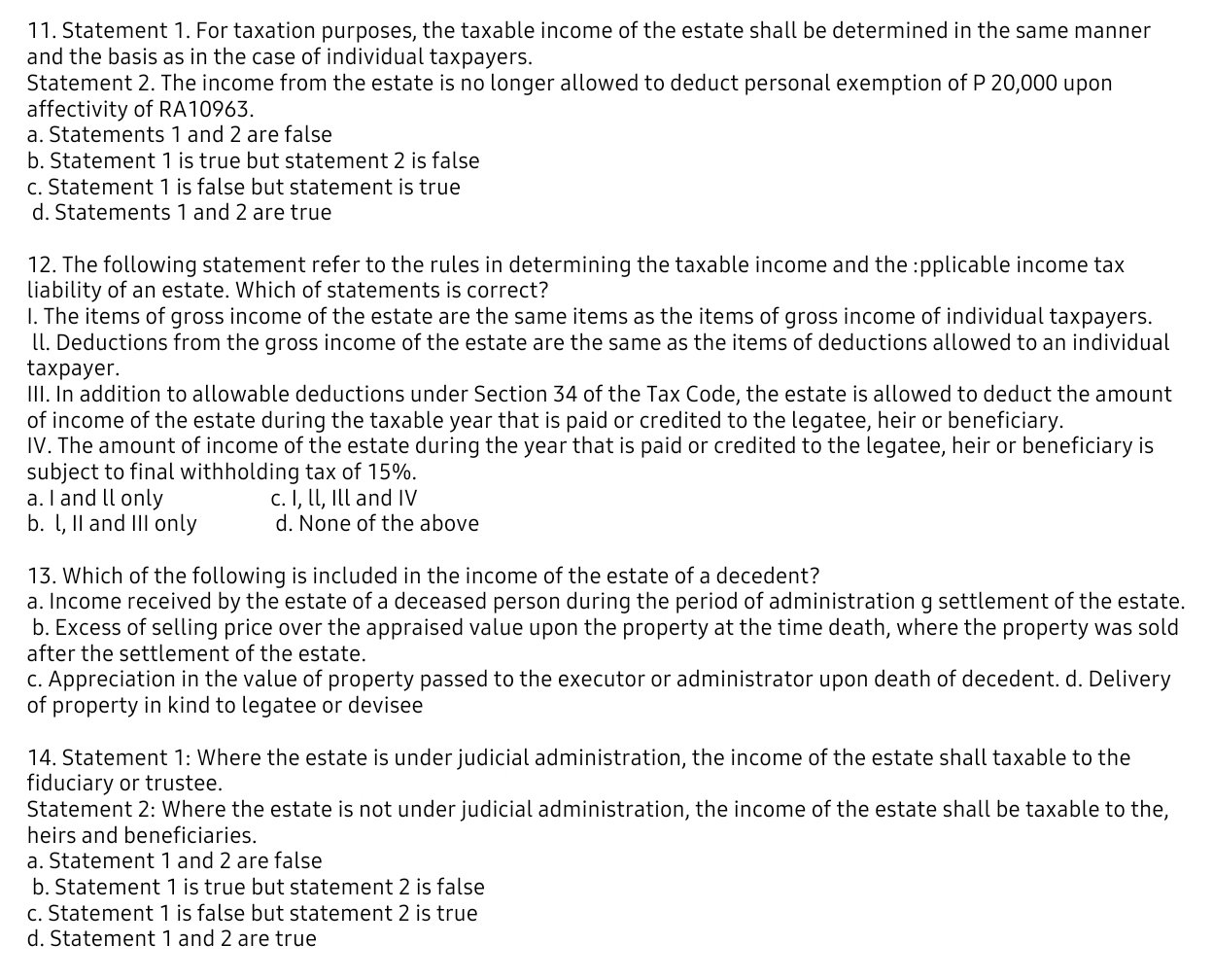

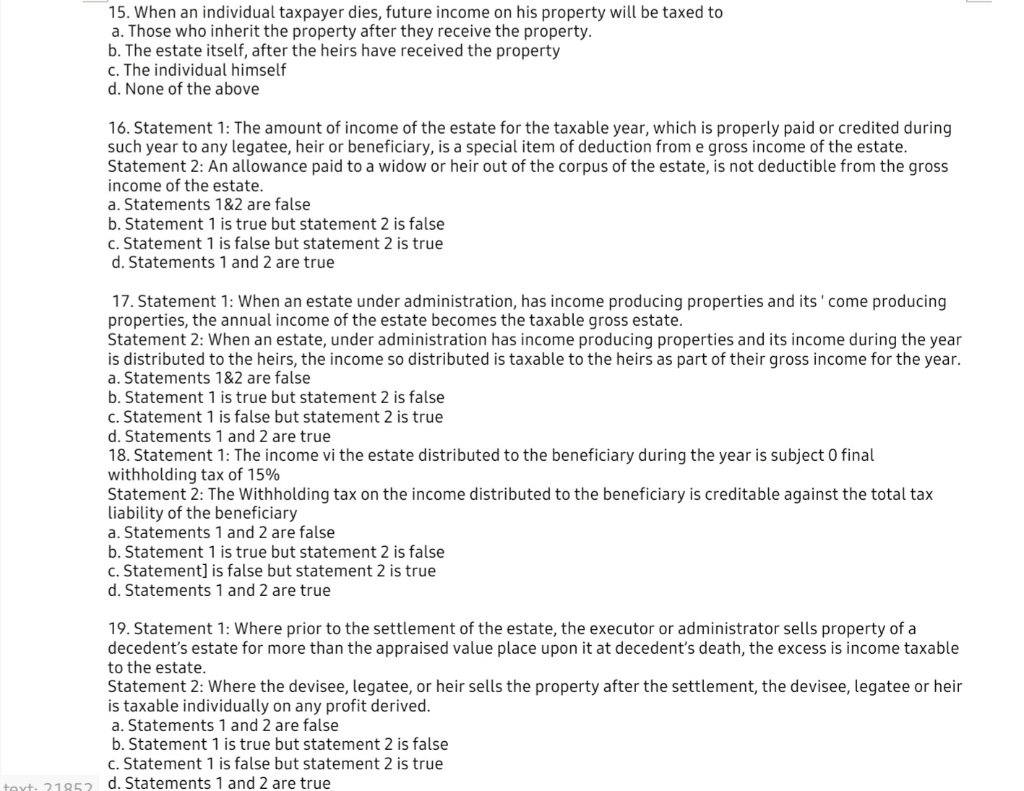

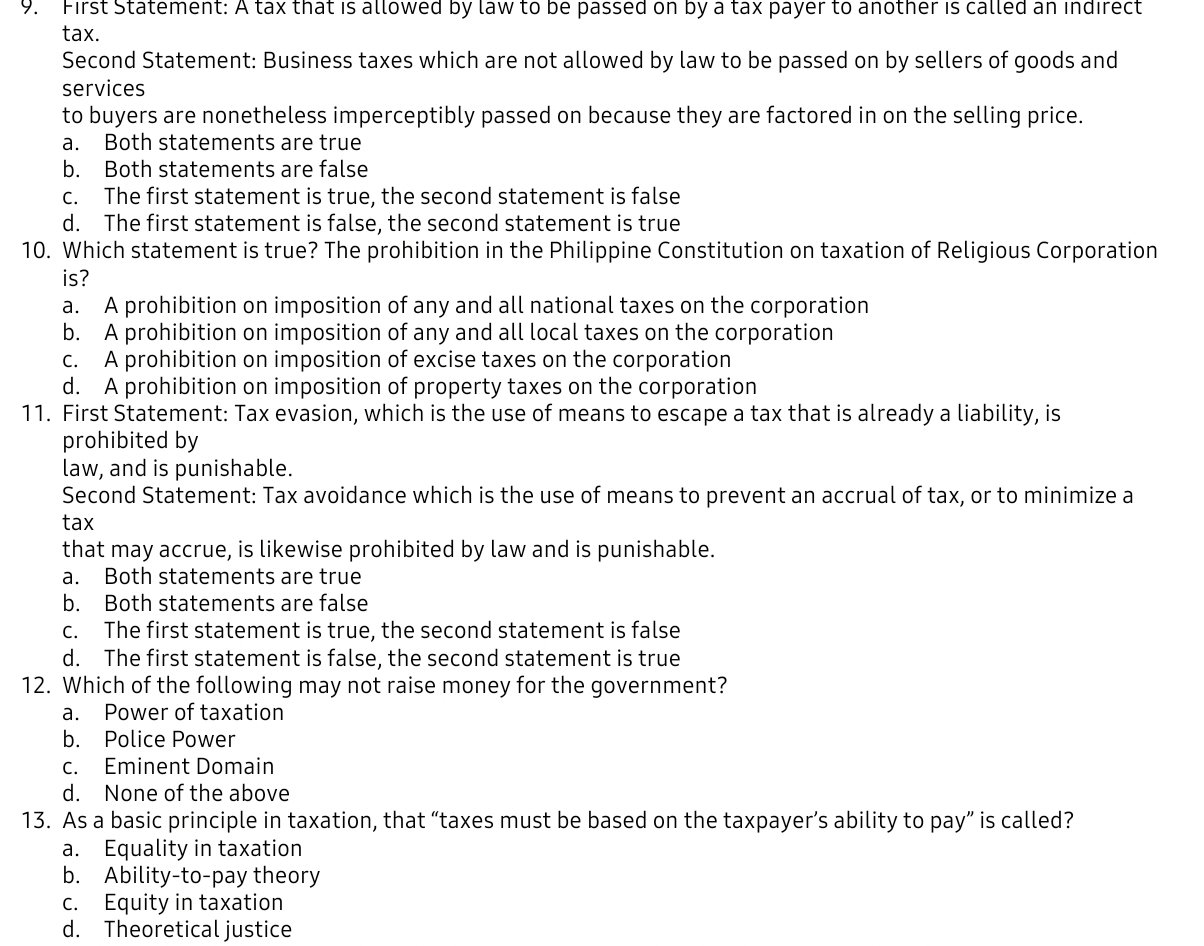

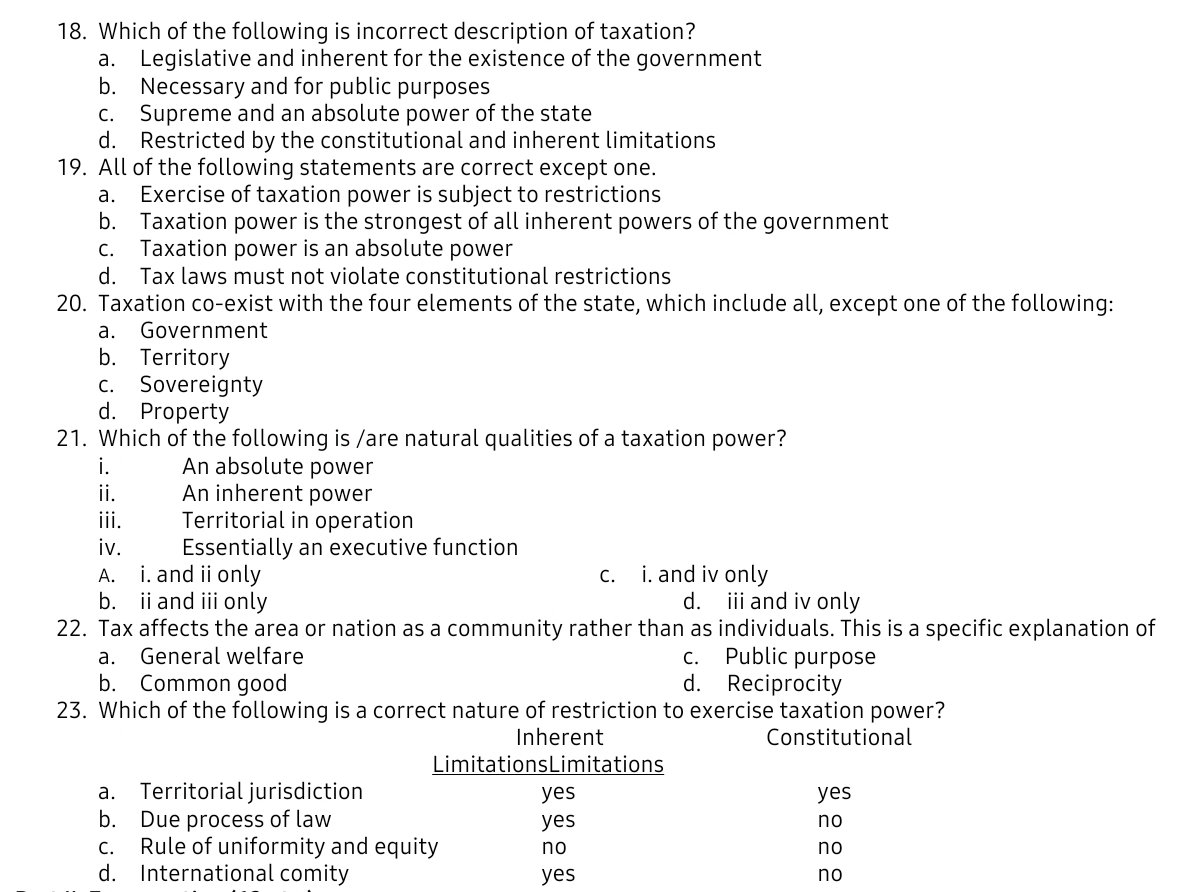

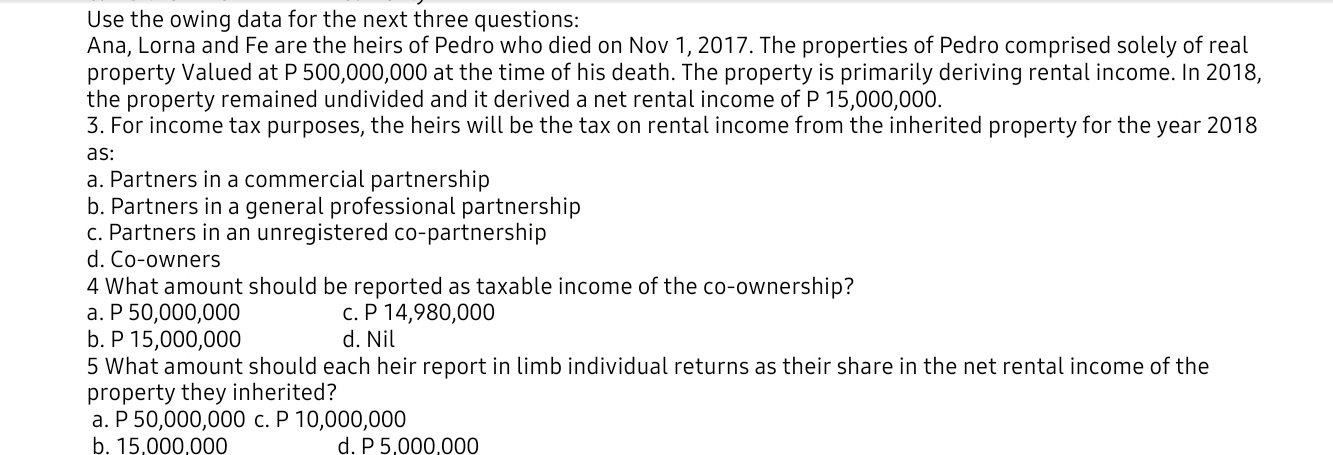

a. First Statement: A tax that is allowed by law to be passed on by a tax payer to another is called an indirect tax. Second Statement: Business taxes which are not allowed by law to be passed on by sellers of goods and services to buyers are nonetheless imperceptibly passed on because they are factored in on the selling price. a. Both statements are true b. Both statements are false C. The first statement is true, the second statement is false d. The first statement is false, the second statement is true 10. Which statement is true? The prohibition in the Philippine Constitution on taxation of Religious Corporation is? A prohibition on imposition of any and all national taxes on the corporation b. A prohibition on imposition of any and all local taxes on the corporation c. A prohibition on imposition of excise taxes on the corporation d. A prohibition on imposition of property taxes on the corporation 11. First Statement: Tax evasion, which is the use of means to escape a tax that is already a liability, is prohibited by law, and is punishable. Second Statement: Tax avoidance which is the use of means to prevent an accrual of tax, or to minimize a tax that may accrue, is likewise prohibited by law and is punishable. Both statements are true b. Both statements are false The first statement is true, the second statement is false d. The first statement is false, the second statement is true 12. Which of the following may not raise money for the government? Power of taxation b. Police Power Eminent Domain d. None of the above 13. As a basic principle in taxation, that taxes must be based on the taxpayer's ability to pay" is called? a. Equality in taxation b. Ability-to-pay theory C. Equity in taxation d. Theoretical justice a. C. a. C. C. a. a. 18. Which of the following is incorrect description of taxation? a. Legislative and inherent for the existence of the government b. Necessary and for public purposes Supreme and an absolute power of the state d. Restricted by the constitutional and inherent limitations 19. All of the following statements are correct except one. Exercise of taxation power is subject to restrictions b. Taxation power is the strongest of all inherent powers of the government C. Taxation power is an absolute power d. Tax laws must not violate constitutional restrictions 20. Taxation co-exist with the four elements of the state, which include all, except one of the following: Government b. Territory C. Sovereignty d. Property 21. Which of the following is /are natural qualities of a taxation power? i. An absolute power ii. An inherent power iii. Territorial in operation iv. Essentially an executive function A. i. and ii only i. and iv only b. ii and iii only d. iii and iv only 22. Tax affects the area or nation as a community rather than as individuals. This is a specific explanation of General welfare Public purpose b. Common good d. Reciprocity 23. Which of the following is a correct nature of restriction to exercise taxation power? Inherent Constitutional LimitationsLimitations a. Territorial jurisdiction yes yes b. Due process of law yes Rule of uniformity and equity d. International comity yes C. a. C. C. no no no no Use the owing data for the next three questions: Ana, Lorna and Fe are the heirs of Pedro who died on Nov 1, 2017. The properties of Pedro comprised solely of real property Valued at P 500,000,000 at the time of his death. The property is primarily deriving rental income. In 2018, the property remained undivided and it derived a net rental income of P 15,000,000. 3. For income tax purposes, the heirs will be the tax on rental income from the inherited property for the year 2018 as: a. Partners in a commercial partnership b. Partners in a general professional partnership c. Partners in an unregistered co-partnership d. Co-owners 4 What amount should be reported as taxable income of the co-ownership? a. P 50,000,000 c. P 14,980,000 b. P 15,000,000 d. Nil 5 What amount should each heir report in limb individual returns as their share in the net rental income of the property they inherited? a. P 50,000,000 c. P 10,000,000 b. 15,000,000 d. P 5,000,000 11. Statement 1. For taxation purposes, the taxable income of the estate shall be determined in the same manner and the basis as in the case of individual taxpayers. Statement 2. The income from the estate is no longer allowed to deduct personal exemption of P 20,000 upon affectivity of RA10963. a. Statements 1 and 2 are false b. Statement 1 is true but statement 2 is false C. Statement 1 is false but statement is true d. Statements 1 and 2 are true 12. The following statement refer to the rules in determining the taxable income and the :pplicable income tax liability of an estate. Which of statements is correct? 1. The items of gross income of the estate are the same items as the items of gross income of individual taxpayers. II. Deductions from the gross income of the estate are the same as the items of deductions allowed to an individual taxpayer. III. In addition to allowable deductions under Section 34 of the Tax Code, the estate is allowed to deduct the amount of income of the estate during the taxable year that is paid or credited to the legatee, heir or beneficiary. IV. The amount of income of the estate during the year that is paid or credited to the legatee, heir or beneficiary is subject to final withholding tax of 15%. a. I and ll only c. I, ll, ill and IV b. I, II and III only d. None of the above 13. Which of the following is included in the income of the estate of a decedent? a. Income received by the estate of a deceased person during the period of administration g settlement of the estate. b. Excess of selling price over the appraised value upon the property at the time death, where the property was sold after the settlement of the estate. c. Appreciation in the value of property passed to the executor or administrator upon death of decedent. d. Delivery of property in kind to legatee or devisee 14. Statement 1: Where the estate is under judicial administration, the income of the estate shall taxable to the fiduciary or trustee. Statement 2: Where the estate is not under judicial administration, the income of the estate shall be taxable to the, heirs and beneficiaries. a. Statement 1 and 2 are false b. Statement 1 is true but statement 2 is false c. Statement 1 is false but statement 2 is true d. Statement 1 and 2 are true 15. When an individual taxpayer dies, future income on his property will be taxed to a. Those who inherit the property after they receive the property. b. The estate itself, after the heirs have received the property C. The individual himself d. None of the above 16. Statement 1: The amount of income of the estate for the taxable year, which is properly paid or credited during such year to any legatee, heir or beneficiary, is a special item of deduction from e gross income of the estate. Statement 2: An allowance paid to a widow or heir out of the corpus of the estate, is not deductible from the gross income of the estate. a. Statements 1&2 are false b. Statement 1 is true but statement 2 is false c. Statement 1 is false but statement 2 is true d. Statements 1 and 2 are true 17. Statement 1: When an estate under administration, has income producing properties and its' come producing properties, the annual income of the estate becomes the taxable gross estate. Statement 2: When an estate, under administration has income producing properties and its income during the year is distributed to the heirs, the income so distributed is taxable to the heirs as part of their gross income for the year. a. Statements 1&2 are false b. Statement 1 is true but statement 2 is false c. Statement 1 is false but statement 2 is true d. Statements 1 and 2 are true 18. Statement 1: The income vi the estate distributed to the beneficiary during the year is subject o final withholding tax of 15% Statement 2: The Withholding tax on the income distributed to the beneficiary is creditable against the total tax liability of the beneficiary a. Statements 1 and 2 are false b. Statement 1 is true but statement 2 is false c. Statement] is false but statement 2 is true d. Statements 1 and 2 are true 19. Statement 1: Where prior to the settlement of the estate, the executor or administrator sells property of a decedent's estate for more than the appraised value place upon it at decedent's death, the excess is income taxable to the estate Statement 2: Where the devisee, legatee, or heir sells the property after the settlement, the devisee, legatee or heir is taxable individually on any profit derived. a. Statements 1 and 2 are false b. Statement 1 is true but statement 2 is false c. Statement 1 is false but statement 2 is true d. Statements 1 and 2 are true tort. 21952