a) Fixed costs; Variable costs and Mixed costs (semi-variable).

b) Separate from mixed costs variable cost (per unit) and fixed costs per week. Please show calculations.

c) calculate total production fixed costs per week.

d) total production variable cost per unit.

e) total non-production variable cost per unit?

f) total non-production fixed costs per week.

g) total fixed costs per week

h) total variable cost per unit?

i) If the selling price of the product is $ 7.00, how much is the contribution margin per unit?

j) If the selling price of the product is 7.00, What is the break-even point in units?

k) If (Table 5) selling price is $8.00 , commission increases to $ 1.20 per unit . How much is the contribution margin per unit? What is the break-even point in units?

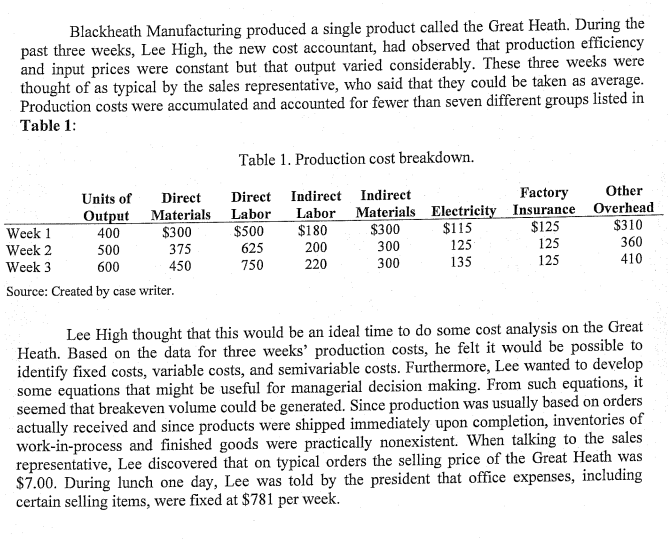

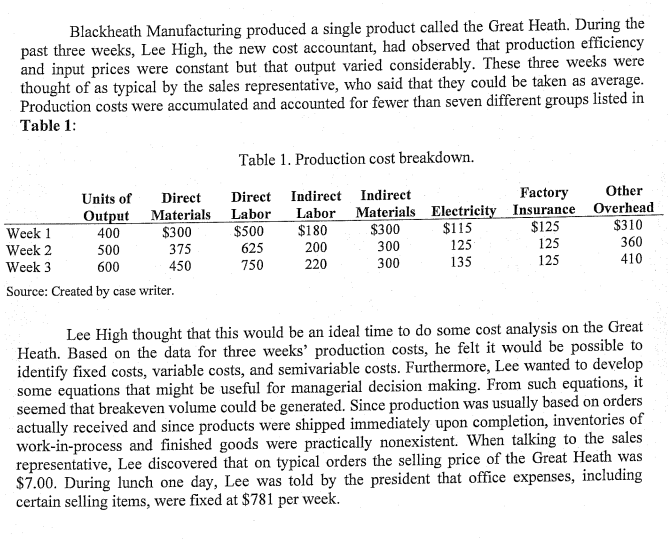

Blackheath Manufacturing produced a single product called the Great Heath. During the past three weeks, Lee High, the new cost accountant, had observed that production efficiency and input prices were constant but that output varied considerably. These three weeks were thought of as typical by the sales representative, who said that they could be taken as average. Production costs were accumulated and accounted for fewer than seven different groups listed in Table 1: Table 1. Production cost breakdown. Source: Created by case writer. Lee High thought that this would be an ideal time to do some cost analysis on the Great Heath. Based on the data for three weeks' production costs, he felt it would be possible to identify fixed costs, variable costs, and semivariable costs. Furthermore, Lee wanted to develop some equations that might be useful for managerial decision making. From such equations, it seemed that breakeven volume could be generated. Since production was usually based on orders actually received and since products were shipped immediately upon completion, inventories of work-in-process and finished goods were practically nonexistent. When talking to the sales representative, Lee discovered that on typical orders the selling price of the Great Heath was $7.00. During lunch one day, Lee was told by the president that office expenses, including certain selling items, were fixed at $781 per week. Blackheath Manufacturing produced a single product called the Great Heath. During the past three weeks, Lee High, the new cost accountant, had observed that production efficiency and input prices were constant but that output varied considerably. These three weeks were thought of as typical by the sales representative, who said that they could be taken as average. Production costs were accumulated and accounted for fewer than seven different groups listed in Table 1: Table 1. Production cost breakdown. Source: Created by case writer. Lee High thought that this would be an ideal time to do some cost analysis on the Great Heath. Based on the data for three weeks' production costs, he felt it would be possible to identify fixed costs, variable costs, and semivariable costs. Furthermore, Lee wanted to develop some equations that might be useful for managerial decision making. From such equations, it seemed that breakeven volume could be generated. Since production was usually based on orders actually received and since products were shipped immediately upon completion, inventories of work-in-process and finished goods were practically nonexistent. When talking to the sales representative, Lee discovered that on typical orders the selling price of the Great Heath was $7.00. During lunch one day, Lee was told by the president that office expenses, including certain selling items, were fixed at $781 per week