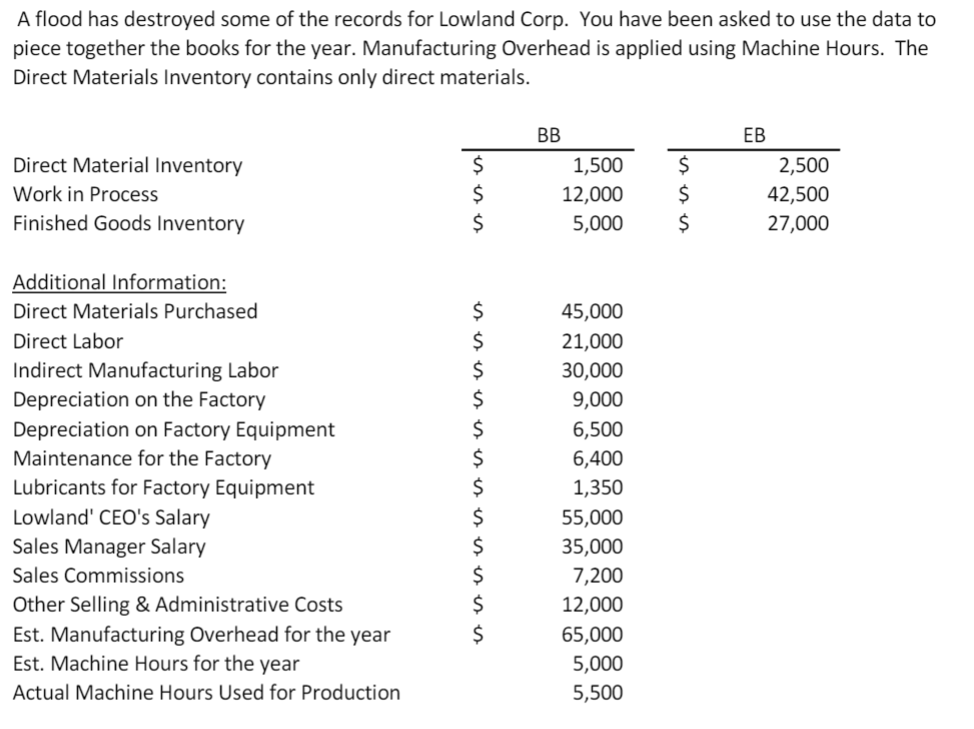

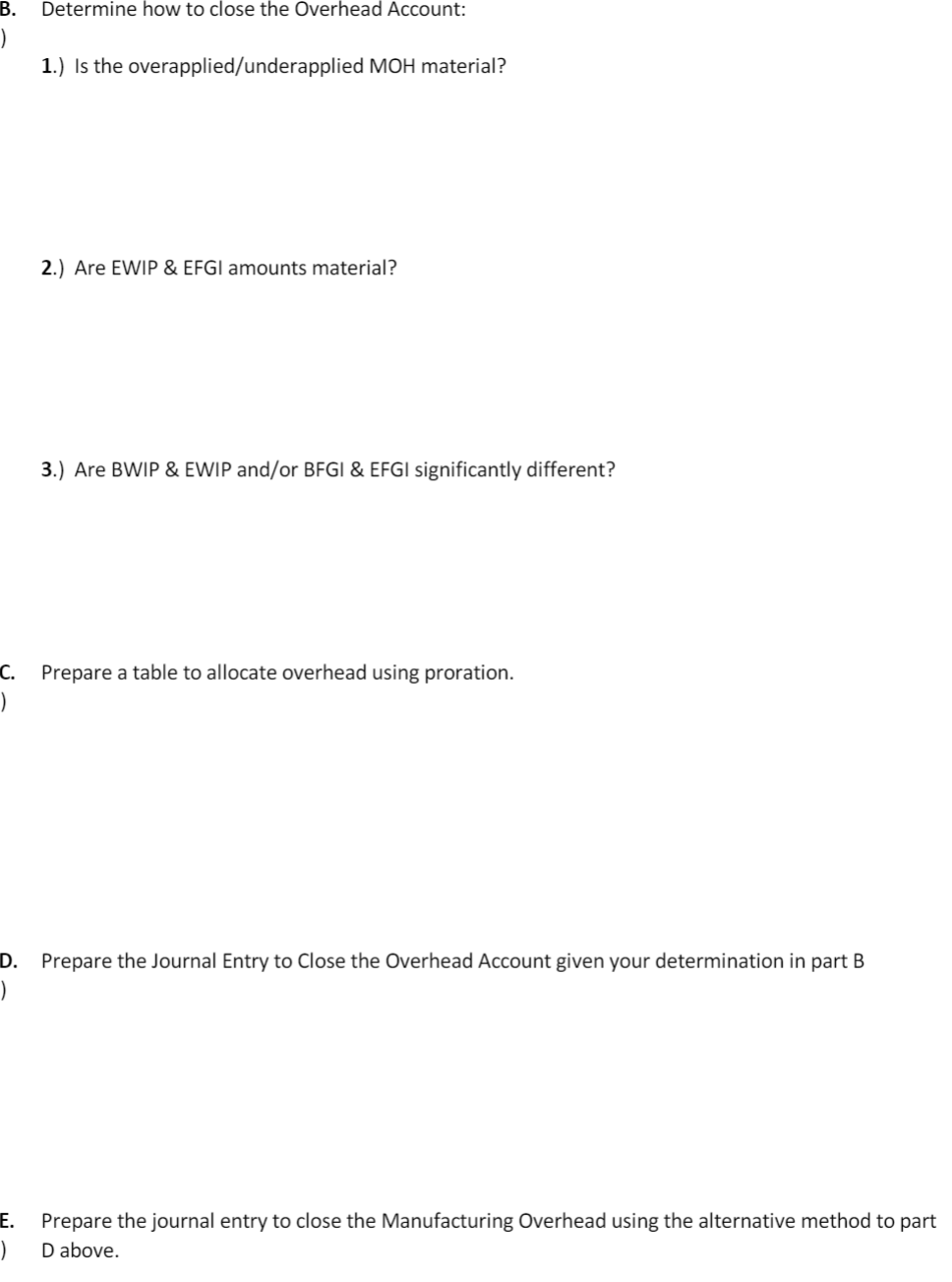

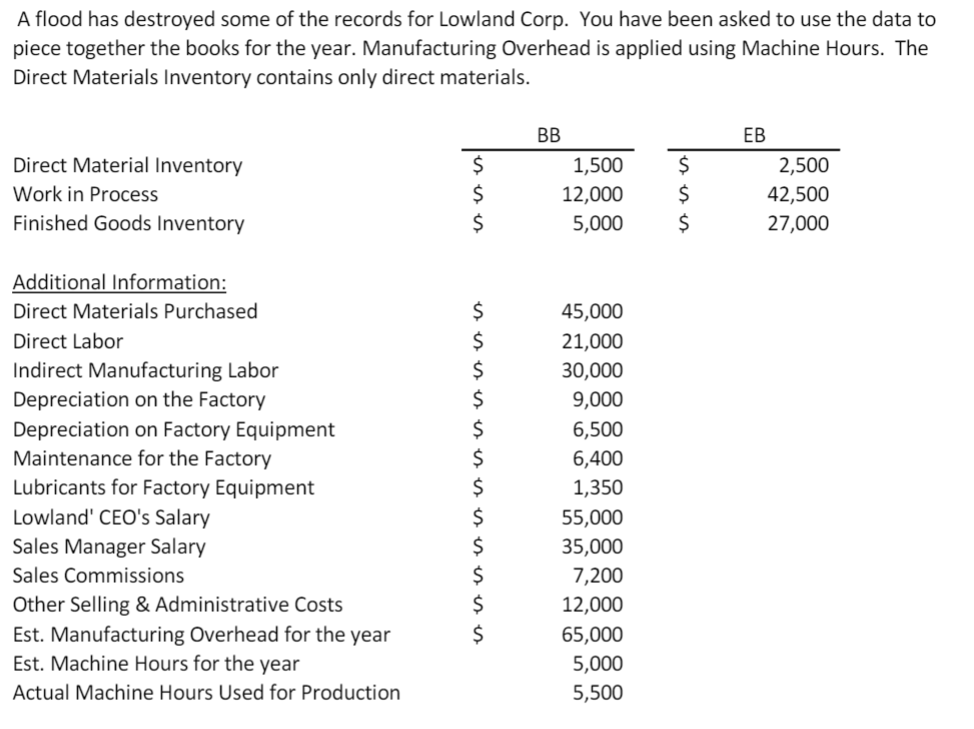

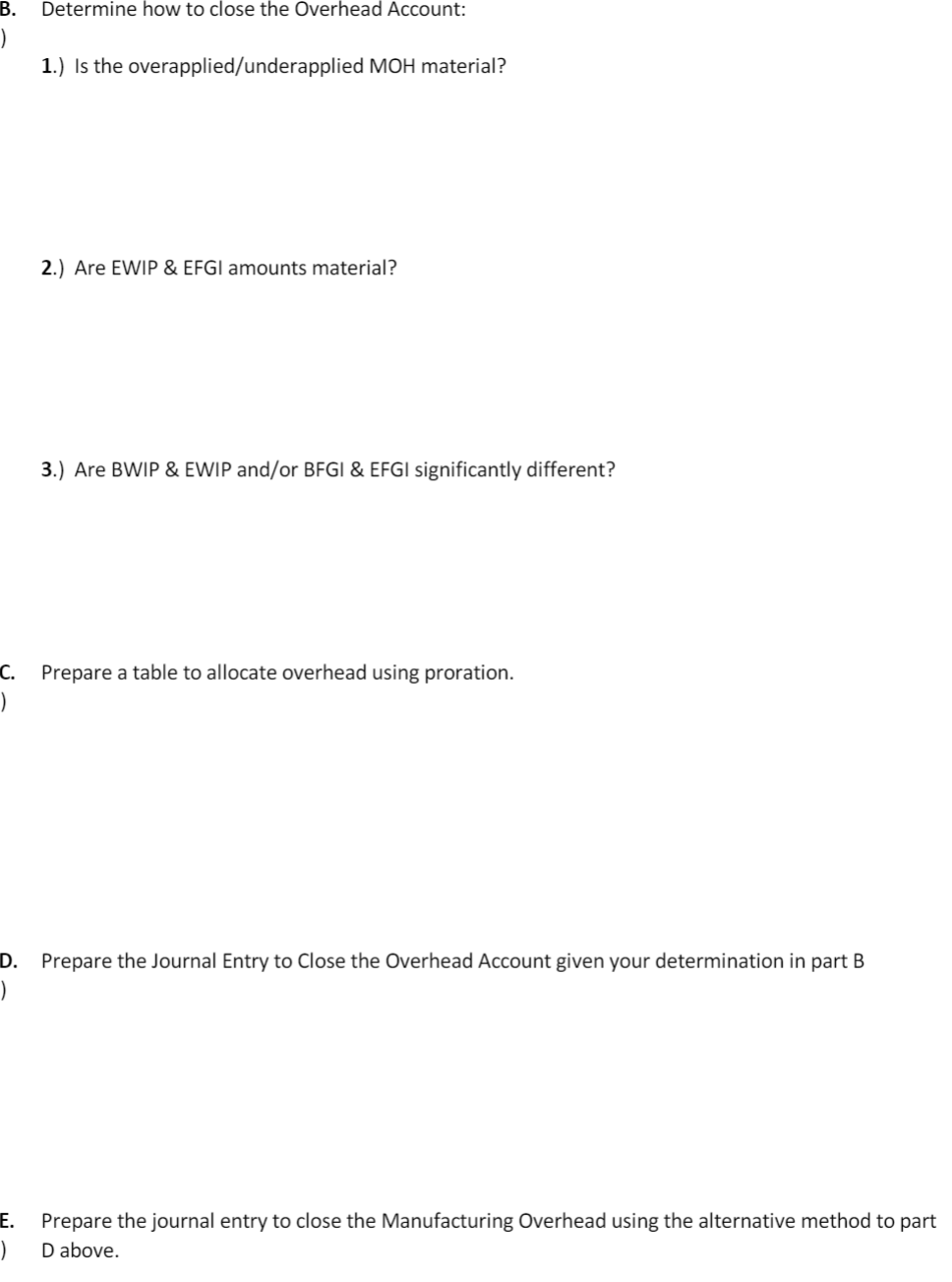

A flood has destroyed some of the records for Lowland Corp. You have been asked to use the data to piece together the books for the year. Manufacturing Overhead is applied using Machine Hours. The Direct Materials Inventory contains only direct materials. BB Direct Material Inventory Work in Process Finished Goods Inventory $ $ $ 1,500 12,000 5,000 $ $ $ EB 2,500 42,500 27,000 Additional Information: Direct Materials Purchased Direct Labor Indirect Manufacturing Labor Depreciation on the Factory Depreciation on Factory Equipment Maintenance for the Factory Lubricants for Factory Equipment Lowland' CEO's Salary Sales Manager Salary Sales Commissions Other Selling & Administrative Costs Est. Manufacturing Overhead for the year Est. Machine Hours for the year Actual Machine Hours Used for Production $ $ $ $ $ $ $ $ $ $ $ $ 45,000 21,000 30,000 9,000 6,500 6,400 1,350 55,000 35,000 7,200 12,000 65,000 5,000 5,500 Determine how to close the Overhead Account: B. ) 1.) Is the overapplied/underapplied MOH material? 2.) Are EWIP & EFGI amounts material? 3.) Are BWIP & EWIP and/or BFGI & EFGI significantly different? Prepare a table to allocate overhead using proration. C. ) D. Prepare the Journal Entry to close the Overhead Account given your determination in part B ) E. ) Prepare the journal entry to close the Manufacturing Overhead using the alternative method to part D above. A flood has destroyed some of the records for Lowland Corp. You have been asked to use the data to piece together the books for the year. Manufacturing Overhead is applied using Machine Hours. The Direct Materials Inventory contains only direct materials. BB Direct Material Inventory Work in Process Finished Goods Inventory $ $ $ 1,500 12,000 5,000 $ $ $ EB 2,500 42,500 27,000 Additional Information: Direct Materials Purchased Direct Labor Indirect Manufacturing Labor Depreciation on the Factory Depreciation on Factory Equipment Maintenance for the Factory Lubricants for Factory Equipment Lowland' CEO's Salary Sales Manager Salary Sales Commissions Other Selling & Administrative Costs Est. Manufacturing Overhead for the year Est. Machine Hours for the year Actual Machine Hours Used for Production $ $ $ $ $ $ $ $ $ $ $ $ 45,000 21,000 30,000 9,000 6,500 6,400 1,350 55,000 35,000 7,200 12,000 65,000 5,000 5,500 Determine how to close the Overhead Account: B. ) 1.) Is the overapplied/underapplied MOH material? 2.) Are EWIP & EFGI amounts material? 3.) Are BWIP & EWIP and/or BFGI & EFGI significantly different? Prepare a table to allocate overhead using proration. C. ) D. Prepare the Journal Entry to close the Overhead Account given your determination in part B ) E. ) Prepare the journal entry to close the Manufacturing Overhead using the alternative method to part D above