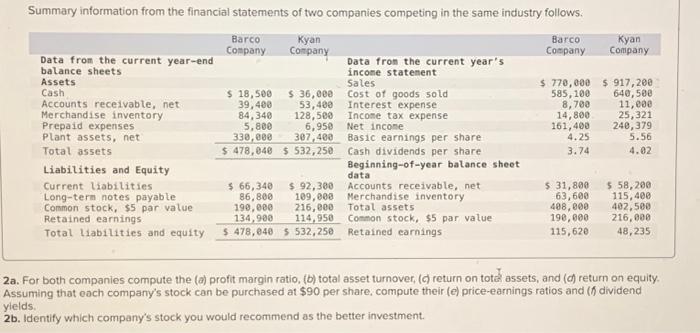

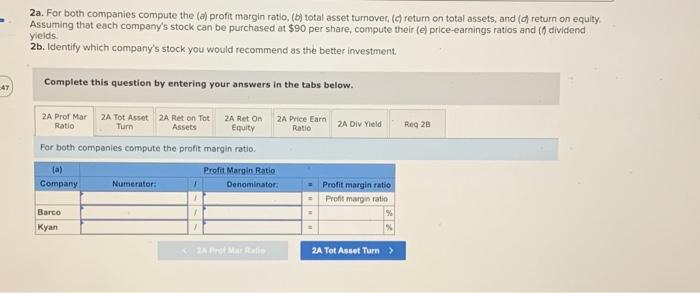

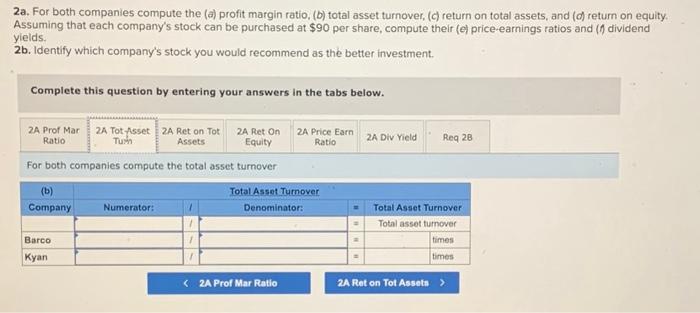

a. For both companies compute the (a) profit margin ratio, (b) total asset turnover, (c) return on total assets, and (d) return on equity. Assuming that each company's stock can be purchased at $90 per share, compute their (e) price-earnings ratios and ( () dividend relds. 2b. Identify which company's stock you would recommend as the better investment. Complete this question by entering your answers in the tabs below. Assuming that each company's stock can be purchased at $90 per share, compute their dividend yields. 2a. For both companies compute the (a) profit margin ratio, (b) total asset turnover, (c) return on total assets, and (c) return on equity. Assuming that each company's stock can be purchased at $90 per share, compute their (e) price-earnings ratios and (t) dividend yields. 2b. Identify which company's stock you would recommend as the better investment. Complete this question by entering your answers in the tabs below. 2a. For both companies compute the (a) profit margin ratio, (b) total asset tumover, (c) return on total assets, and (d) return on equity. Assuming that each company's stock can be purchased at $90 per share, compute their (e) price-earnings ratios and ( f dividend yields. 2b. Identify which company's stock you would recommend as the better investment. Complete this question by entering your answers in the tabs below. For both companies compute the return on equity. 2a. For both companies compute the (a) profit margin ratio, (b) total asset turnover, (C) return on tot assets, and (d) return on equity. Assuming that each company's stock can be purchased at $90 per share, compute their (c) price-earnings ratios and ( $ dividend yields. 2b. Identify which company's stock you would recommend as the better investment. 2a. For both companies compute the (a) profit margin ratio, (b) total asset turnover, (c) return on total assets, and ( d ) return on equity. Assuming that each company's stock can be purchased at $90 per share, compute their ( ) price-earnings ratios and ( ) dividend yields. 2b. Identify which company's stock you would recommend as the better investment. Complete this question by entering your answers in the tabs below. For both companies compute the total asset turnover 2a. For both companies compute the (a) profit margin ratio, (b) total asset turnover, (c) return on total assets, and ( d ) return on equity. Assuming that each company's stock can be purchased at $90 per share, compute their (e) price-earnings ratios and (f) dividend yields. 2b. Identify which company's stock you would recommend as the better investment. Complete this question by entering your answers in the tabs below. For both companies compute the profit margin ratio. 2a. For both companies compute the (a) profit matgin ratio, (b) total asset turnover, (c) return on total assets, and (d) return on equity. Assuming that each company's stock can be purchased at $90 per share, compute their (e) price-earnings ratios and (f) dividend yields. 2b. Identify which company's stock you would recommend as the better investment. Complete this question by entering your answers in the tabs below. Identify which company's stock you would recommend as the better investment. 2a. For both companies compute the (a) profit margin ratio, (b) total asset turnover, (c) return on total assets, and ( d ) return on equity. Assuming that each company's stock can be purchased at $90 per share, compute their (e) price-earnings ratios and ( f ) dividend yields. 2b. Identify which company's stock you would recommend as the better investment. Complete this question by entering your answers in the tabs below. For both companies compute the return on total assets