Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A.) for each of the changes described above, decide whether : 1. The change involves an accounting principle, accounting estimate, or correction of an error.

A.) for each of the changes described above, decide whether :

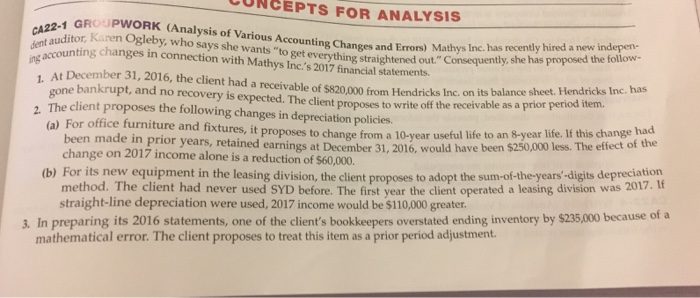

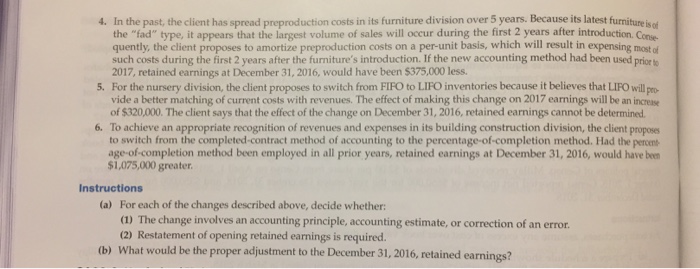

LUNCEPTS FOR ANALYSIS CA22-1 PwORK (Analysis of various Accounting changes recently hired a new indepen- ditor, Karen Ogleby, says she wants and Errors) Mathys Inc. has unting changes in connection everything Consequently, she has proposed the follow- At mber 31, 2016, the with Mathys Inc.'s 2017 financial out gone bankrupt, and client had a statements Inc. on its balance sheet. Hendricks Inc. has The client proposes no recovery receivable of $820,000 from Hendricks receivable as a prior period item. the is expected. The client proposes to write off the (a) For office following changes in depreciation policies. 10-year to 8-year If this had been furniture and fixtures, it proposes to change from a useful life an life. change the made in prior years, retained earnings at December $250,000 less. The effect of change on 2017 income 31, 2016, would have been (b) For its is a reduction of the client to the sum-oftheyears.digits new equipment in the leasing method. The client had never used sYD before. The first year the client operated a leasing division was 2017. dent a ing straight-line depreciation were used, 2017 income would be greater. 3. In preparing its 2016 statements, one of the client's bookkeepers overstated ending inventory by s235,000 because of a mathematical error. The client proposes to treat this item as a prior period adjustment 1. The change involves an accounting principle, accounting estimate, or correction of an error.

2. Restatement of opening retained earnings is required.

B.) what would be the proper adjustment to the December 31, 2016 Retained earnings?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started