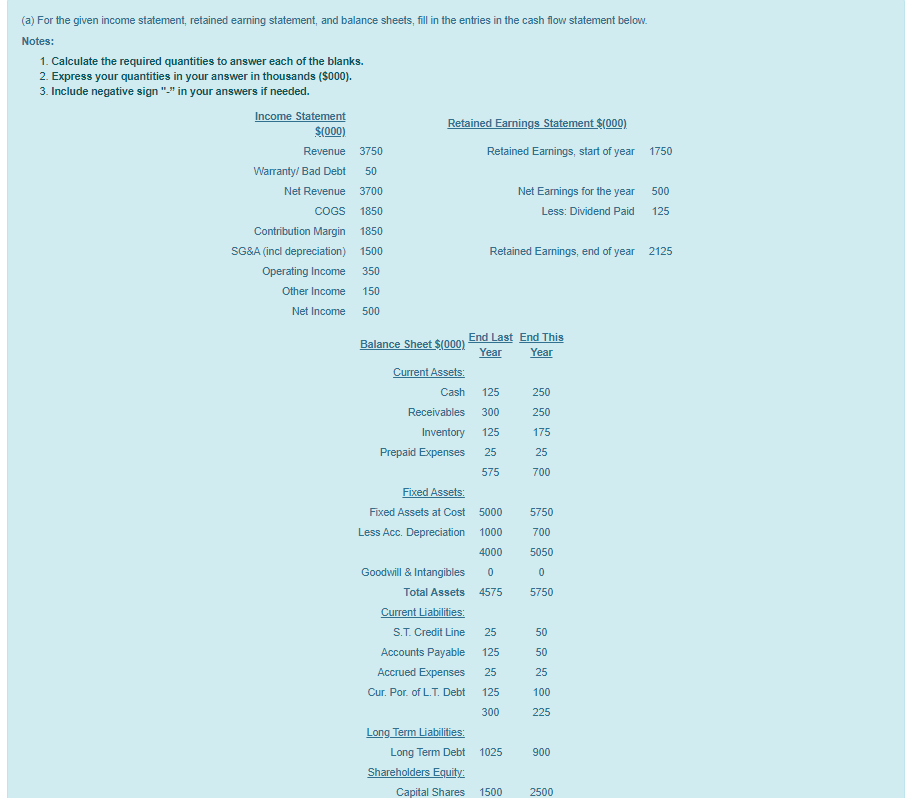

(a) For the given income statement, retained earning statement, and balance sheets, fill in the entries in the cash flow statement below.

Notes:

- Calculate the required quantities to answer each of the blanks.

- Express your quantities in your answer in thousands ($000).

- Include negative sign "- in your answers if needed.

| Income Statement $(000) | | | Retained Earnings Statement $(000) | |

| Revenue | 3750 | | Retained Earnings, start of year | 1750 |

| Warranty/ Bad Debt | 50 | | | |

| Net Revenue | 3700 | | Net Earnings for the year | 500 |

| COGS | 1850 | | Less: Dividend Paid | 125 |

| Contribution Margin | 1850 | | | |

| SG&A (incl depreciation) | 1500 | | Retained Earnings, end of year | 2125 |

| Operating Income | 350 | | | |

| Other Income | 150 | | | |

| Net Income | 500 | | | |

| Balance Sheet $(000) | End Last Year | End This Year |

| Current Assets: | | |

| Cash | 125 | 250 |

| Receivables | 300 | 250 |

| Inventory | 125 | 175 |

| Prepaid Expenses | 25 | 25 |

| | 575 | 700 |

| Fixed Assets: | | |

| Fixed Assets at Cost | 5000 | 5750 |

| Less Acc. Depreciation | 1000 | 700 |

| | 4000 | 5050 |

| | | |

| Goodwill & Intangibles | 0 | 0 |

| | | |

| Total Assets | 4575 | 5750 |

| | | |

| Current Liabilities: | | |

| S.T. Credit Line | 25 | 50 |

| Accounts Payable | 125 | 50 |

| Accrued Expenses | 25 | 25 |

| Cur. Por. of L.T. Debt | 125 | 100 |

| | 300 | 225 |

| Long Term Liabilities: | | |

| Long Term Debt | 1025 | 900 |

| | | |

| Shareholders Equity: | | |

| Capital Shares | 1500 | 2500 |

| Retained Earnings | 1750 | 2125 |

| | | |

| Tot. Liab. and Eq. | 4575 | 5750  |

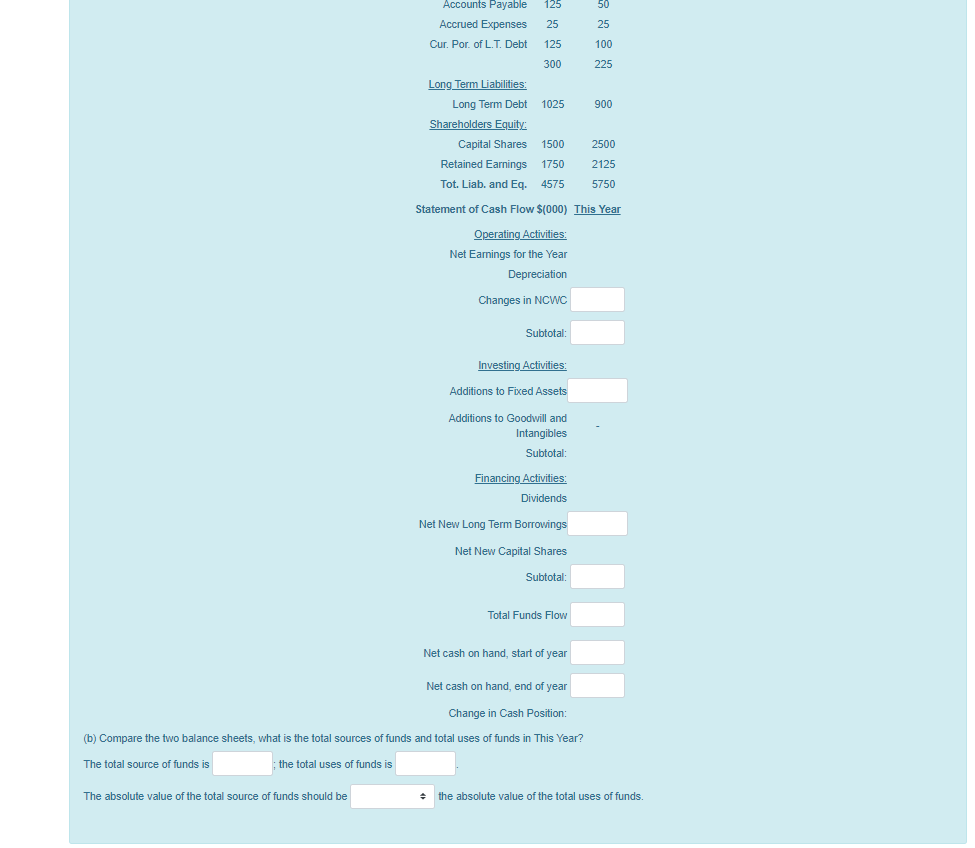

500 1850 125 (a) For the given income statement, retained earning statement, and balance sheets, fill in the entries in the cash flow statement below. Notes: 1. Calculate the required quantities to answer each of the blanks. 2. Express your quantities in your answer in thousands ($000). 3. Include negative sign "-" in your answers if needed. Income Statement Retained Earnings Statement $(000). $(000) Revenue 3750 Retained Earnings, start of year 1750 Warranty/ Bad Debt 50 Net Revenue 3700 Net Earnings for the year COGS Less: Dividend Paid Contribution Margin 1850 SG&A (incl depreciation) 1500 Retained Earnings, end of year 2125 Operating Income 350 Other Income 150 Net Income 500 Balance Sheet $(000) End Last End This Year Year Current Assets Cash 125 250 Receivables Inventory Prepaid Expenses 25 25 575 700 Fixed Assets Fixed Assets at Cost 5000 5750 Less Acc. Depreciation 1000 700 4000 5050 Goodwill & Intangibles 0 Total Assets 4575 5750 Current Liabilities: S.T. Credit Line Accounts Payable 50 Accrued Expenses 25 25 Cur. Por of L.T. Debt 125 300 225 Long Term Liabilities: Long Term Debt 1025 Shareholders Equity: Capital Shares 1500 300 250 125 175 0 25 50 125 100 900 2500 Accounts Payable 125 50 Accrued Expenses 25 25 Cur. Por of L.T. Debt 125 100 300 225 Long Term Liabilities: Long Term Debt 1025 900 Shareholders Equity Capital Shares 1500 2500 Retained Earnings 1750 2125 Tot. Liab. and Eq. 4575 5750 Statement of Cash Flow $(000) This Year Operating Activities: Net Earnings for the Year Depreciation Changes in NCWC Subtotal: Investing Activities: Additions to Fixed Assets Additions to Goodwill and Intangibles Subtotal: Financing Activities: Dividends Net New Long Term Borrowings Net New Capital Shares Subtotal: Total Funds Flow Net cash on hand, start of year Net cash on hand, end of year Change in Cash Position: (b) Compare the two balance sheets, what is the total sources of funds and total uses of funds in This Year? The total source of funds is the total uses of funds is The absolute value of the total source of funds should be the absolute value of the total uses of funds. 500 1850 125 (a) For the given income statement, retained earning statement, and balance sheets, fill in the entries in the cash flow statement below. Notes: 1. Calculate the required quantities to answer each of the blanks. 2. Express your quantities in your answer in thousands ($000). 3. Include negative sign "-" in your answers if needed. Income Statement Retained Earnings Statement $(000). $(000) Revenue 3750 Retained Earnings, start of year 1750 Warranty/ Bad Debt 50 Net Revenue 3700 Net Earnings for the year COGS Less: Dividend Paid Contribution Margin 1850 SG&A (incl depreciation) 1500 Retained Earnings, end of year 2125 Operating Income 350 Other Income 150 Net Income 500 Balance Sheet $(000) End Last End This Year Year Current Assets Cash 125 250 Receivables Inventory Prepaid Expenses 25 25 575 700 Fixed Assets Fixed Assets at Cost 5000 5750 Less Acc. Depreciation 1000 700 4000 5050 Goodwill & Intangibles 0 Total Assets 4575 5750 Current Liabilities: S.T. Credit Line Accounts Payable 50 Accrued Expenses 25 25 Cur. Por of L.T. Debt 125 300 225 Long Term Liabilities: Long Term Debt 1025 Shareholders Equity: Capital Shares 1500 300 250 125 175 0 25 50 125 100 900 2500 Accounts Payable 125 50 Accrued Expenses 25 25 Cur. Por of L.T. Debt 125 100 300 225 Long Term Liabilities: Long Term Debt 1025 900 Shareholders Equity Capital Shares 1500 2500 Retained Earnings 1750 2125 Tot. Liab. and Eq. 4575 5750 Statement of Cash Flow $(000) This Year Operating Activities: Net Earnings for the Year Depreciation Changes in NCWC Subtotal: Investing Activities: Additions to Fixed Assets Additions to Goodwill and Intangibles Subtotal: Financing Activities: Dividends Net New Long Term Borrowings Net New Capital Shares Subtotal: Total Funds Flow Net cash on hand, start of year Net cash on hand, end of year Change in Cash Position: (b) Compare the two balance sheets, what is the total sources of funds and total uses of funds in This Year? The total source of funds is the total uses of funds is The absolute value of the total source of funds should be the absolute value of the total uses of funds