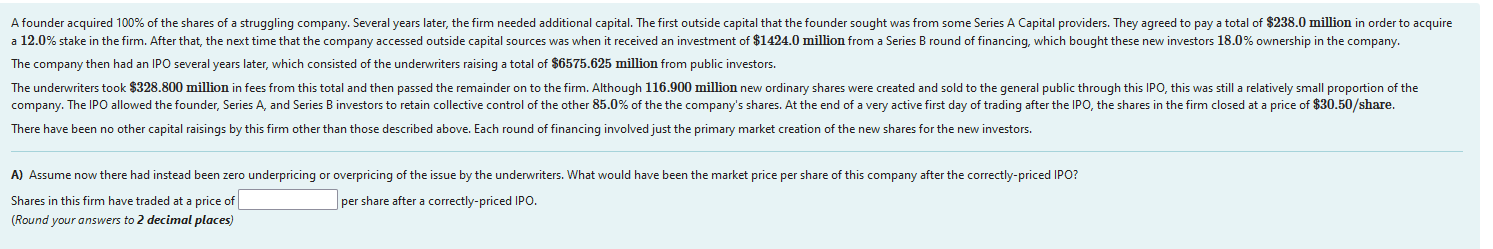

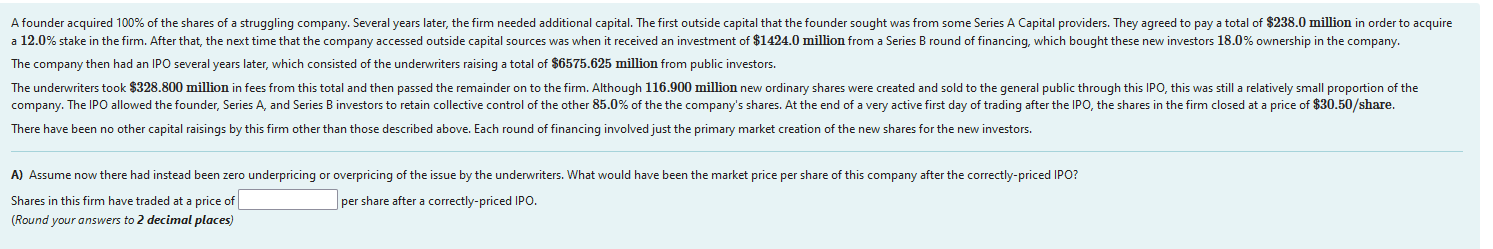

A founder acquired 100% of the shares of a struggling company. Several years later, the firm needed additional capital. The first outside capital that the founder sought was from some Series A Capital providers. They agreed to pay a total of $238.0 million in order to acquire a 12.0% stake in the firm. After that, the next time that the company accessed outside capital sources was when it received an investment of $1424.0 million from a Series B round of financing, which bought these new investors 18.0% ownership in the company. The company then had an IPO several years later, which consisted of the underwriters raising a total of $6575.625 million from public investors. The underwriters took $328.800 million in fees from this total and then passed the remainder on to the firm. Although 116.900 million new ordinary shares were created and sold to the general public through this IPO, this was still a relatively small proportion of the company. The IPO allowed the founder, Series A, and Series B investors to retain collective control of the other 85.0% of the the company's shares. At the end of a very active first day of trading after the IPO, the shares in the firm closed at a price of $30.50/share. There have been no other capital raisings by this firm other than those described above. Each round of financing involved just the primary market creation of the new shares for the new investors. A) Assume now there had instead been zero underpricing or overpricing of the issue by the underwriters. What would have been the market price per share of this company after the correctly-priced IPO? Shares in this firm have traded at a price of per share after a correctly-priced IPO. (Round your answers to 2 decimal places) A founder acquired 100% of the shares of a struggling company. Several years later, the firm needed additional capital. The first outside capital that the founder sought was from some Series A Capital providers. They agreed to pay a total of $238.0 million in order to acquire a 12.0% stake in the firm. After that, the next time that the company accessed outside capital sources was when it received an investment of $1424.0 million from a Series B round of financing, which bought these new investors 18.0% ownership in the company. The company then had an IPO several years later, which consisted of the underwriters raising a total of $6575.625 million from public investors. The underwriters took $328.800 million in fees from this total and then passed the remainder on to the firm. Although 116.900 million new ordinary shares were created and sold to the general public through this IPO, this was still a relatively small proportion of the company. The IPO allowed the founder, Series A, and Series B investors to retain collective control of the other 85.0% of the the company's shares. At the end of a very active first day of trading after the IPO, the shares in the firm closed at a price of $30.50/share. There have been no other capital raisings by this firm other than those described above. Each round of financing involved just the primary market creation of the new shares for the new investors. A) Assume now there had instead been zero underpricing or overpricing of the issue by the underwriters. What would have been the market price per share of this company after the correctly-priced IPO? Shares in this firm have traded at a price of per share after a correctly-priced IPO. (Round your answers to 2 decimal places)