Question

A four-year corporate bond with a fixed 6% annual coupon rate and a par value of $1,000 is rated AA. Its modified duration is projected

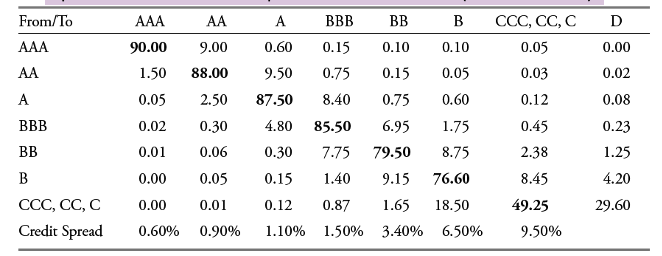

- A four-year corporate bond with a fixed 6% annual coupon rate and a par value of $1,000 is rated AA. Its modified duration is projected at 2.75 at the end of the first year. Given the representative One-Year Corporate Transition Matrix (entries are in %) and assuming no default, what's the expected return on the bond over the next year solely attributable to possible credit rating changes?

From/To AA A BBB BB B CCC, CC, C D AAA 90.00 9.00 0.60 0.15 0.10 0.10 0.05 0.00 AA 1.50 88.00 9.50 0.75 0.15 0.05 0.03 0.02 A 0.05 2.50 87.50 8.40 0.75 0.60 0.12 0.08 BBB 0.02 0.30 4.80 85.50 6.95 1.75 0.45 0.23 BB 0.01 0.06 0.30 7.75 79.50 8.75 2.38 1.25 B 0.00 0.05 0.15 1.40 9.15 76.60 8.45 4.20 CCC, CC, C 0.00 0.01 0.12 0.87 1.65 18.50 49.25 29.60 Credit Spread 0.60% 0.90% 1.10% 1.50% 3.40% 6.50% 9.50%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fixed Income Analysis

Authors: Barbara S. Petitt

5th Edition

1119850541, 978-1119850540

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App