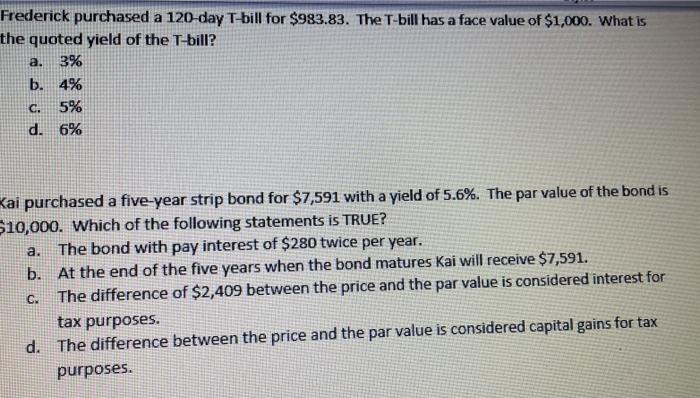

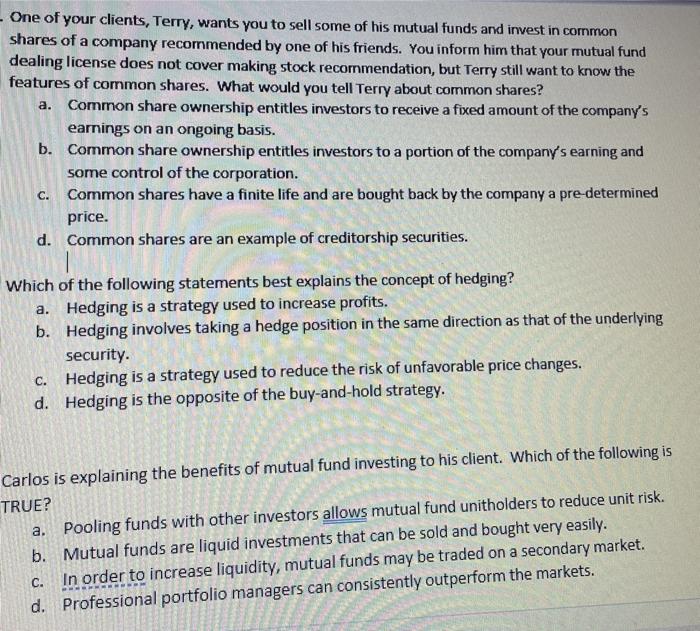

a. Frederick purchased a 120 day T-bill for $983.83. The T-bill has a face value of $1,000. What is the quoted yield of the T-bill? 3% b. 4% c. 5% d. 6% a. Kai purchased a five-year strip bond for $7,591 with a yield of 5.6%. The par value of the bond is $10,000. Which of the following statements is TRUE? The bond with pay interest of $280 twice per year. b. At the end of the five years when the bond matures Kai will receive $7,591. The difference of $2,409 between the price and the par value is considered interest for tax purposes. d. The difference between the price and the par value is considered capital gains for tax purposes. CH a. - One of your clients, Terry, wants you to sell some of his mutual funds and invest in common shares of a company recommended by one of his friends. You inform him that your mutual fund dealing license does not cover making stock recommendation, but Terry still want to know the features of common shares. What would you tell Terry about common shares? Common share ownership entitles investors to receive a fixed amount of the company's earnings on an ongoing basis. b. Common share ownership entitles investors to a portion of the company's earning and some control of the corporation. Common shares have a finite life and are bought back by the company a pre determined price. d. Common shares are an example of creditorship securities. C. Which of the following statements best explains the concept of hedging? a. Hedging is a strategy used to increase profits. b. Hedging involves taking a hedge position in the same direction as that of the underlying security. c. Hedging is a strategy used to reduce the risk of unfavorable price changes. d. Hedging is the opposite of the buy-and-hold strategy. Carlos is explaining the benefits of mutual fund investing to his client. Which of the following is TRUE? a. Pooling funds with other investors allows mutual fund unitholders to reduce unit risk. b. Mutual funds are liquid investments that can be sold and bought very easily. In order to increase liquidity, mutual funds may be traded on a secondary market. d. Professional portfolio managers can consistently outperform the markets. C