Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A friend has just come up with a new invention. She has called you to invest in her new company. She promises that, if you

A friend has just come up with a new invention. She has called you to invest in her new

company. She promises that, if you send her money today, she will return $ to you

year from now, with this payout increasing by per year through the end of Year If you

require a return of on this sort of venture, what is the most you should be willing to

invest?

ROUND YOUR ANSWER TO DECIMAL PLACES, AND DO NOT ENTER A DOLLAR SIGN

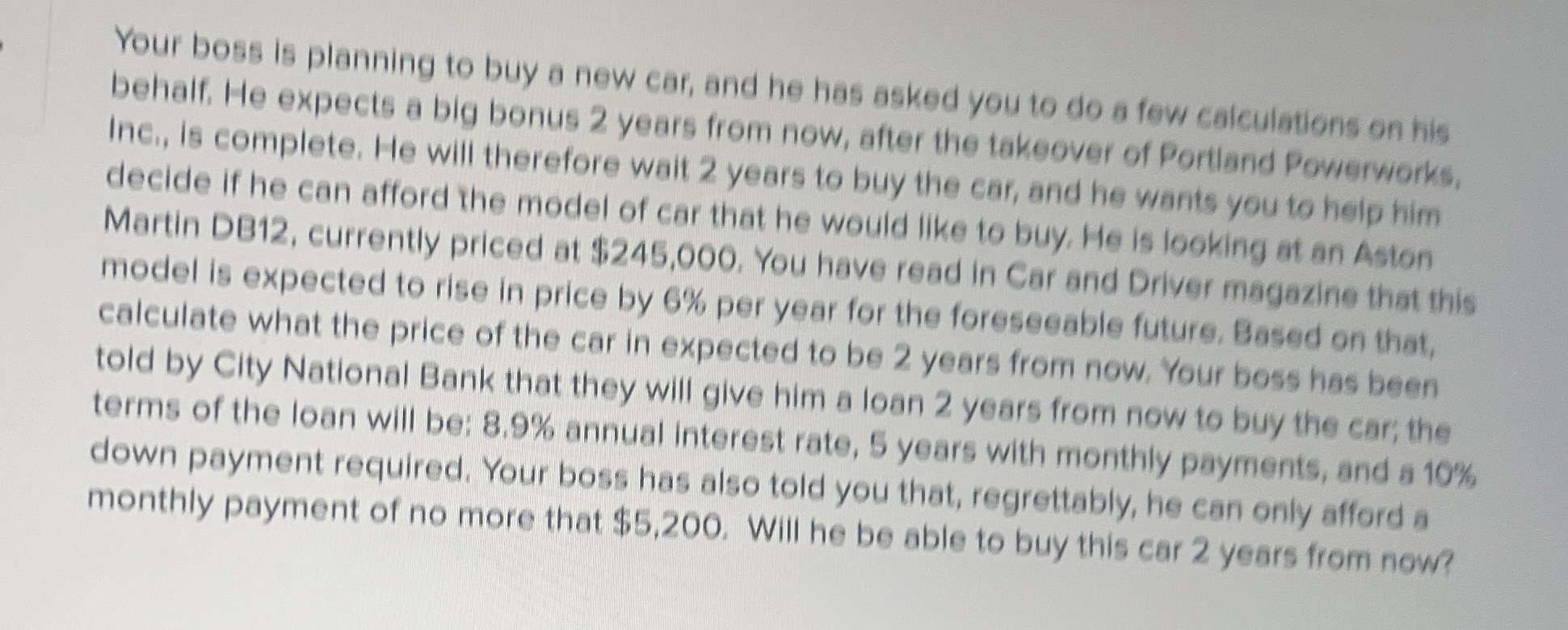

Your boss is planning to buy a new car, and he has asked you to do a few calculations on his

behalf. He expects a big bonus years from now, after the takeover of Portiand Powerworks.

Inc., is complete. He will therefore wait years to buy the car, and he wants you to help him

decide if he can afford the model of car that he would like to buy. He is looking at an Aston

Martin DB currently priced at $ You have read in Car and Driver magazine that this

model is expected to rise in price by per year for the foreseeable future. Based on that,

calculate what the price of the car in expected to be years from now. Your boss has been

told by City National Bank that they will give him a loan years from now to buy the car; the

terms of the loan will be: annual interest rate, years with monthly payments, and a

down payment required, Your boss has also told you that, regrettably, he can only afford a

monthly payment of no more that $ Will he be able to buy this car years from now?

Your boss is planning to buy a new car, and he has asked you to do a few calculations on his

behalf. He expects a big bonus years from now, after the takeover of Portiand Powerworks.

Inc., is complete. He will therefore wait years to buy the car, and he wants you to help him

decide if he can afford the model of car that he would like to buy. He is looking at an Aston

Martin DB currently priced at $ You have read in Car and Driver magazine that this

model is expected to rise in price by per year for the foreseeable future. Based on that,

calculate what the price of the car in expected to be years from now. Your boss has been

told by City National Bank that they will give him a loan years from now to buy the car; the

terms of the loan will be: annual interest rate, years with monthly payments, and a

down payment required, Your boss has also told you that, regrettably, he can only afford a

monthly payment of no more that $ Will he be able to buy this car years from now? answer is yes or no

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started