Question

A friend of yours is just starting a delivery service and has purchased a truck for $20,000. The friend expects the truck to last

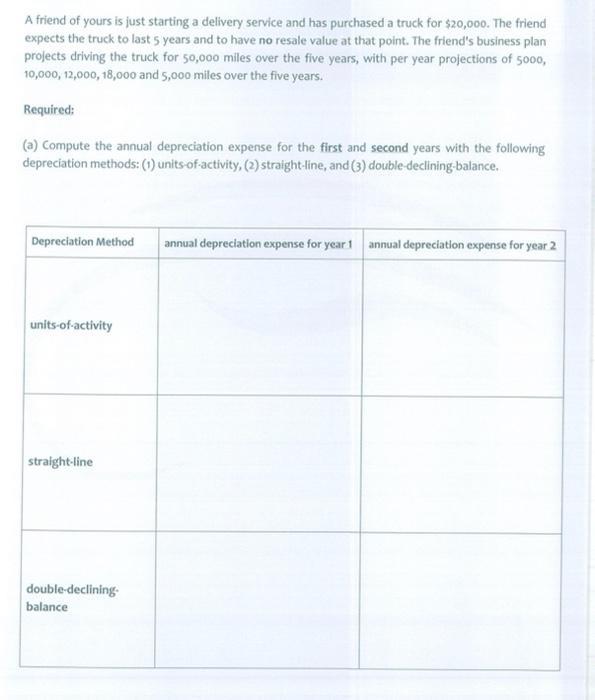

A friend of yours is just starting a delivery service and has purchased a truck for $20,000. The friend expects the truck to last 5 years and to have no resale value at that point. The friend's business plan projects driving the truck for 50,000 miles over the five years, with per year projections of 5000, 10,000, 12,000, 18,000 and 5,000 miles over the five years. Required: (a) Compute the annual depreciation expense for the first and second years with the following depreciation methods: (1) units-of-activity, (2) straight-line, and (3) double-declining-balance. Depreciation Method annual depreciation expense for year 1 annual depreciation expense for year 2 units-of-activity straight-line double-declining balance

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Depreciation Expense Calculations for Truck Heres a breakdown of the depreciation expense for your f...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting and Reporting a Global Perspective

Authors: Michel Lebas, Herve Stolowy, Yuan Ding

4th edition

978-1408066621, 1408066629, 1408076861, 978-1408076866

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App