Answered step by step

Verified Expert Solution

Question

1 Approved Answer

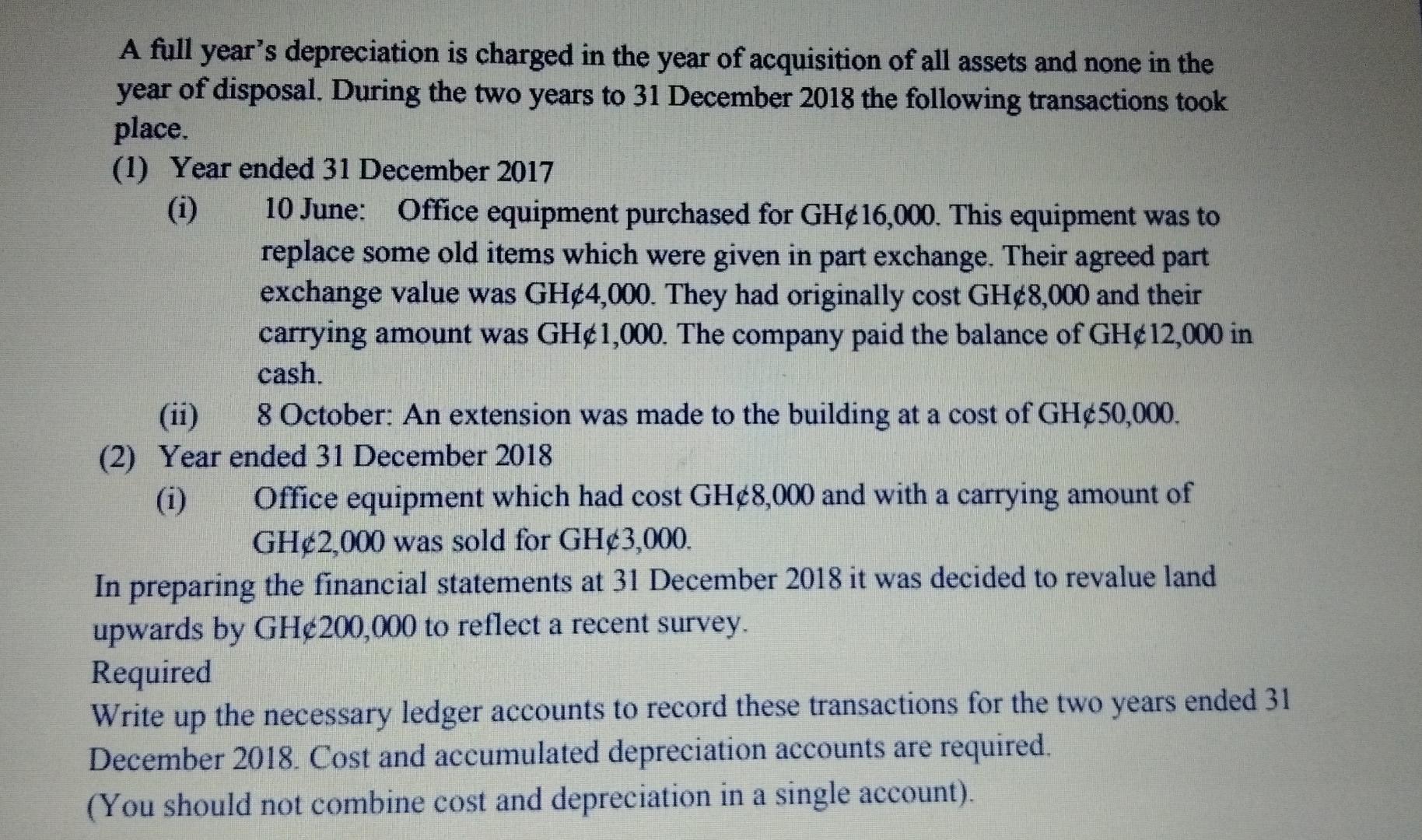

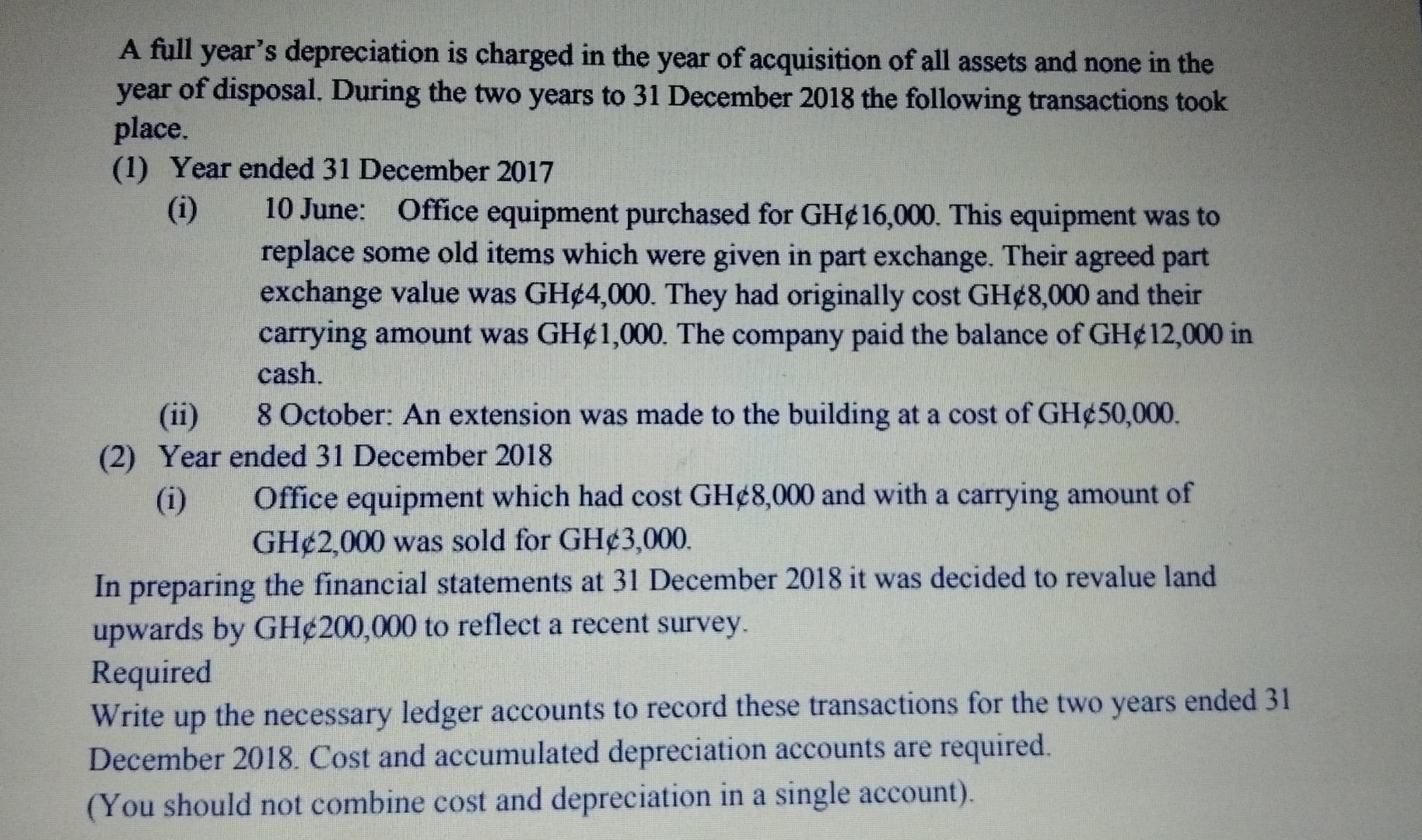

A full year's depreciation is charged in the year of acquisition of all assets and none in the year of disposal. During the two years

A full year's depreciation is charged in the year of acquisition of all assets and none in the year of disposal. During the two years to 31 December 2018 the following transactions took place. (1) Year ended 31 December 2017 (1) 10 June: Office equipment purchased for GH16,000. This equipment was to replace some old items which were given in part exchange. Their agreed part exchange value was GH 4,000. They had originally cost GH8,000 and their carrying amount was GH1,000. The company paid the balance of GH12,000 in cash. (11) 8 October: An extension was made to the building at a cost of GH 50,000. (2) Year ended 31 December 2018 (i) Office equipment which had cost GH8,000 and with a carrying amount of GH 2,000 was sold for GH 3,000. In preparing the financial statements at 31 December 2018 it was decided to revalue land upwards by GH 200,000 to reflect a recent survey. Required Write up the necessary ledger accounts to record these transactions for the two years ended 31 December 2018. Cost and accumulated depreciation accounts are required. (You should not combine cost and depreciation in a single account). A full year's depreciation is charged in the year of acquisition of all assets and none in the year of disposal. During the two years to 31 December 2018 the following transactions took place. (1) Year ended 31 December 2017 (1) 10 June: Office equipment purchased for GH16,000. This equipment was to replace some old items which were given in part exchange. Their agreed part exchange value was GH 4,000. They had originally cost GH8,000 and their carrying amount was GH1,000. The company paid the balance of GH12,000 in cash. (11) 8 October: An extension was made to the building at a cost of GH 50,000. (2) Year ended 31 December 2018 (i) Office equipment which had cost GH8,000 and with a carrying amount of GH 2,000 was sold for GH 3,000. In preparing the financial statements at 31 December 2018 it was decided to revalue land upwards by GH 200,000 to reflect a recent survey. Required Write up the necessary ledger accounts to record these transactions for the two years ended 31 December 2018. Cost and accumulated depreciation accounts are required. (You should not combine cost and depreciation in a single account)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started