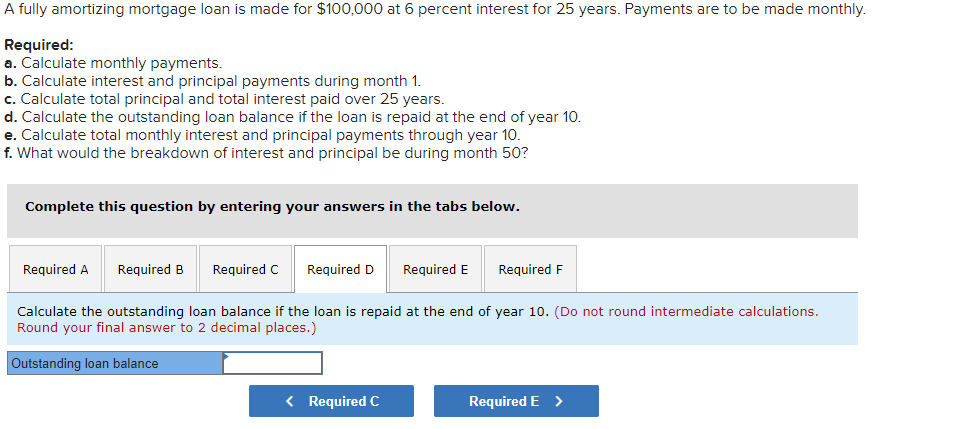

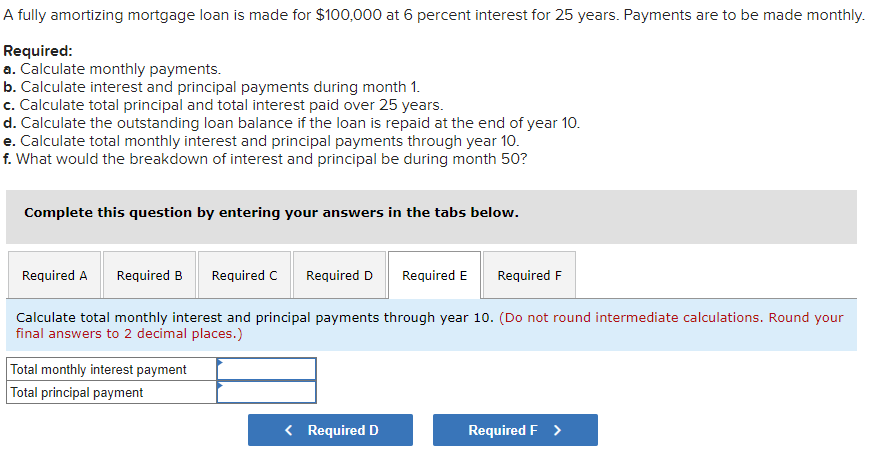

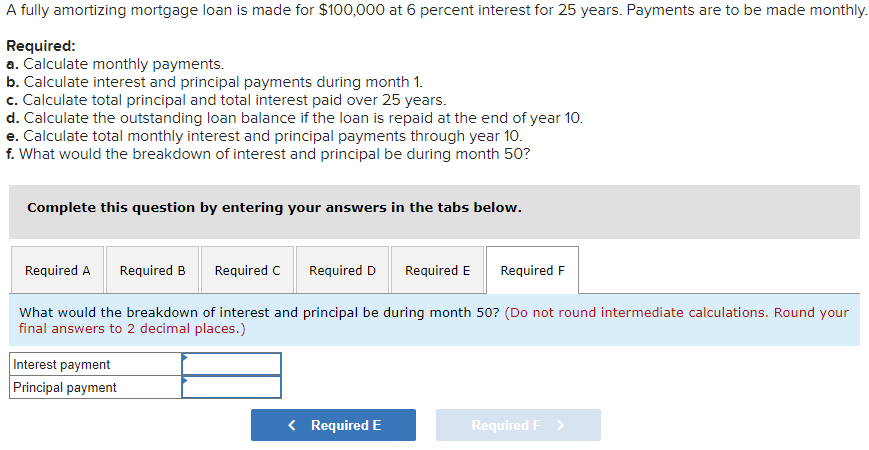

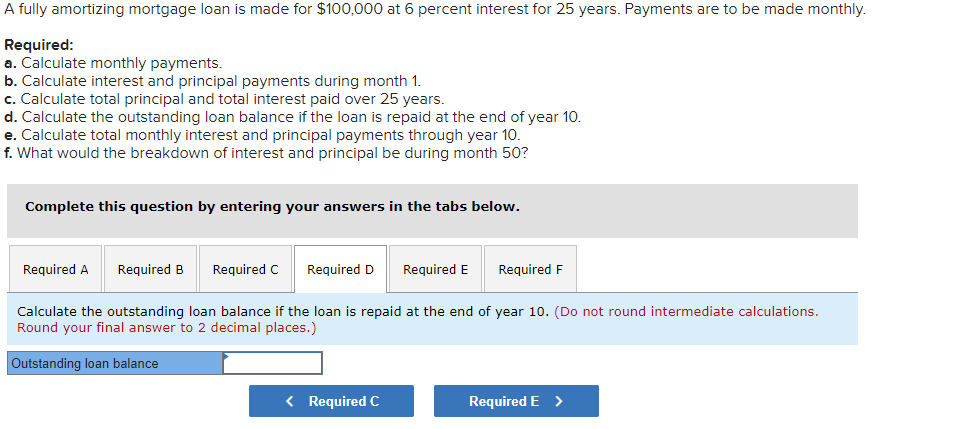

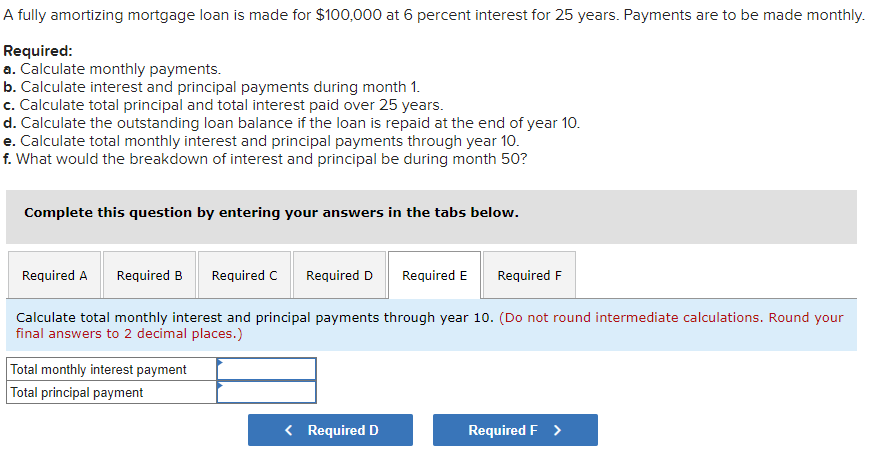

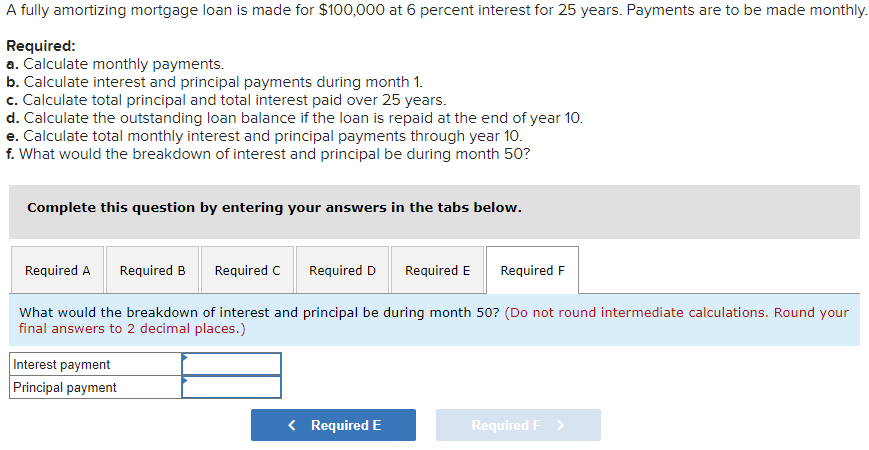

A fully amortizing mortgage loan is made for $100,000 at 6 percent interest for 25 years. Payments are to be made monthly. Required: a. Calculate monthly payments. b. Calculate interest and principal payments during month c. Calculate total principal and total interest paid over 25 years. d. Calculate the outstanding loan balance if the loan is repaid at the end of year 10. e. Calculate total monthly interest and principal payments through year 10. f. What would the breakdown of interest and principal be during month 50? Complete this question by entering your answers in the tabs below. Required A Required B Required c Required D Required E Required F Calculate the outstanding loan balance if the loan is repaid at the end of year 10. (Do not round intermediate calculations. Round your final answer to 2 decimal places.) Outstanding loan balance A fully amortizing mortgage loan is made for $100,000 at 6 percent interest for 25 years. Payments are to be made monthly. Required: a. Calculate monthly payments. b. Calculate interest and principal payments during month 1. c. Calculate total principal and total interest paid over 25 years. d. Calculate the outstanding loan balance if the loan is repaid at the end of year 10. e. Calculate total monthly interest and principal payments through year 10. f. What would the breakdown of interest and principal be during month 50? Complete this question by entering your answers in the tabs below. Required A Required B Required Required D Required E Required F Calculate total monthly interest and principal payments through year 10. (Do not round intermediate calculations. Round your final answers to 2 decimal places.) Total monthly interest payment Total principal payment A fully amortizing mortgage loan is made for $100,000 at 6 percent interest for 25 years. Payments are to be made monthly. Required: a. Calculate monthly payments. b. Calculate interest and principal payments during month 1. c. Calculate total principal and total interest paid over 25 years. d. Calculate the outstanding loan balance if the loan is repaid at the end of year 10. e. Calculate total monthly interest and principal payments through year 10. f. What would the breakdown of interest and principal be during month 50? Complete this question by entering your answers in the tabs below. Required A Required B Required Required D Required E Required F What would the breakdown of interest and principal be during month 50? (Do not round intermediate calculations. Round your final answers to 2 decimal places.) Interest payment Principal payment