Question

12) Philip Corp's 12-year Bonds yield 7.50%; and 12-year Treasury Bonds yield 5.95%. The real risk-free rate is r= 2.50%; the average annual inflation

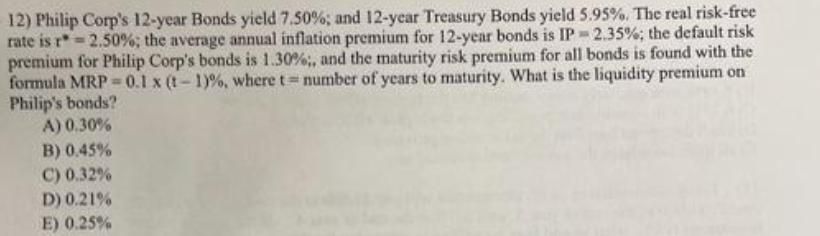

12) Philip Corp's 12-year Bonds yield 7.50%; and 12-year Treasury Bonds yield 5.95%. The real risk-free rate is r= 2.50%; the average annual inflation premium for 12-year bonds is IP-2.35%; the default risk premium for Philip Corp's bonds is 1.30%;, and the maturity risk premium for all bonds is found with the formula MRP=0.1 x (t-1) %, where t= number of years to maturity. What is the liquidity premium on Philip's bonds? A) 0.30% B) 0.45% C) 0.32% D) 0.21% E) 0.25%

Step by Step Solution

3.51 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Step 11 Liquidity premium on Philips bonds 025 Explanat...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Essentials Of Statistics For Business And Economics

Authors: David Anderson, Thomas Williams, Dennis Sweeney, Jeffrey Cam

7th Edition

1305081595, 978-1305081598

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App