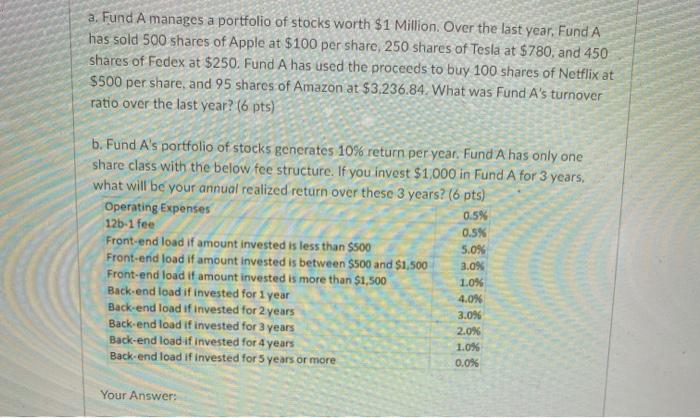

a. Fund A manages a portfolio of stocks worth $1 Million. Over the last year. Fund A has sold 500 shares of Apple at $100 per share, 250 shares of Tesla at $780, and 450 shares of Fedex at $250. Fund A has used the proceeds to buy 100 shares of Netflix at $500 per share, and 95 shares of Amazon at $3.236.84. What was Fund A's turnover ratio over the last year? (6 pts) b. Fund A's portfolio of stocks generates 10% return per year. Fund A has only one share class with the below fee structure. If you invest $1,000 in Fund A for 3 years, what will be your annual realized return over these 3 years? (6 pts) Operating Expenses 0.5% 12b-1 fee 0.5% Front-end load it amount invested is less than $500 5.0% Front-end load if amount invested is between $500 and $1,500 3.0% Front-end load if amount invested is more than $1,500 1.0% Back-end load if invested for 1 year 4.0% Back-end load if invested for 2 years 3.096 Back-end load if invested for 3 years 2.0% Back-end load if invested for 4 years 1.0% Back-end load if invested for 5 years or more 0.0% Your Answer: a. Fund A manages a portfolio of stocks worth $1 Million. Over the last year. Fund A has sold 500 shares of Apple at $100 per share, 250 shares of Tesla at $780, and 450 shares of Fedex at $250. Fund A has used the proceeds to buy 100 shares of Netflix at $500 per share, and 95 shares of Amazon at $3.236.84. What was Fund A's turnover ratio over the last year? (6 pts) b. Fund A's portfolio of stocks generates 10% return per year. Fund A has only one share class with the below fee structure. If you invest $1,000 in Fund A for 3 years, what will be your annual realized return over these 3 years? (6 pts) Operating Expenses 0.5% 12b-1 fee 0.5% Front-end load it amount invested is less than $500 5.0% Front-end load if amount invested is between $500 and $1,500 3.0% Front-end load if amount invested is more than $1,500 1.0% Back-end load if invested for 1 year 4.0% Back-end load if invested for 2 years 3.096 Back-end load if invested for 3 years 2.0% Back-end load if invested for 4 years 1.0% Back-end load if invested for 5 years or more 0.0% Your