Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A fund manager announces that the fund's one-month 95% VaR is 6% of the size of the portfolio being managed. You have an investment

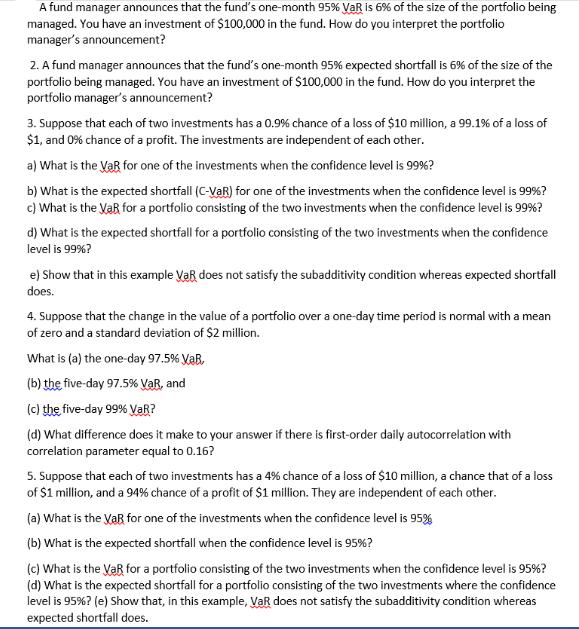

A fund manager announces that the fund's one-month 95% VaR is 6% of the size of the portfolio being managed. You have an investment of $100,000 in the fund. How do you interpret the portfolio manager's announcement? 2. A fund manager announces that the fund's one-month 95% expected shortfall is 6% of the size of the portfolio being managed. You have an investment of $100,000 in the fund. How do you interpret the portfolio manager's announcement? 3. Suppose that each of two investments has a 0.9% chance of a loss of $10 million, a 99.1% of a loss of $1, and 0% chance of a profit. The investments are independent of each other. a) What is the VaR for one of the investments when the confidence level is 99%? b) What is the expected shortfall (C-VaR) for one of the investments when the confidence level is 99%? c) What is the VaR for a portfolio consisting of the two investments when the confidence level is 99%? d) What is the expected shortfall for a portfolio consisting of the two investments when the confidence level is 99%? e) Show that in this example VaR does not satisfy the subadditivity condition whereas expected shortfall does. 4. Suppose that the change in the value of a portfolio over a one-day time period is normal with a mean of zero and a standard deviation of $2 million. What is (a) the one-day 97.5% VaR, (b) the five-day 97.5% VaR, and (c) the five-day 99% VaR? (d) What difference does it make to your answer if there is first-order daily autocorrelation with correlation parameter equal to 0.16? 5. Suppose that each of two investments has a 4% chance of a loss of $10 million, a chance that of a loss of $1 million, and a 94% chance of a profit of $1 million. They are independent of each other. (a) What is the VaR for one of the investments when the confidence level is 95% (b) What is the expected shortfall when the confidence level is 95%? (c) What is the VaR for a portfolio consisting of the two investments when the confidence level is 95%? (d) What is the expected shortfall for a portfolio consisting of the two investments where the confidence level is 95% ? (e) Show that, in this example, VaR does not satisfy the subadditivity condition whereas expected shortfall does.

Step by Step Solution

★★★★★

3.39 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

1 When the fund manager announces that the funds onemonth 95 Value at Risk VaR is 6 of the size of the portfolio being managed it means that there is a 95 confidence level that the maximum potential l...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started