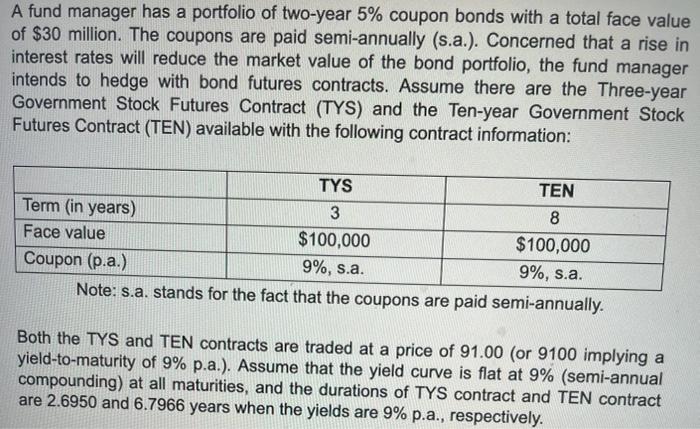

A fund manager has a portfolio of two-year 5% coupon bonds with a total face value of $30 million. The coupons are paid semi-annually (s.a.). Concerned that a rise in interest rates will reduce the market value of the bond portfolio, the fund manager intends to hedge with bond futures contracts. Assume there are the Three-year Government Stock Futures Contract (TYS) and the Ten-year Government Stock Futures Contract (TEN) available with the following contract information: Note: s.a. stands for the fact that the coupons are paid semi-annually. Both the TYS and TEN contracts are traded at a price of 91.00 (or 9100 implying a yield-to-maturity of 9% p.a.). Assume that the yield curve is flat at 9% (semi-annual compounding) at all maturities, and the durations of TYS contract and TEN contract are 2.6950 and 6.7966 years when the yields are 9% p.a., respectively. Required: (a). Specify which bond futures contracts (TYS or TEN) is more appropriate to hedge the interest risk from the fund manager's perspective, and briefly explain why (word limit 60). (2 marks) (b). Using the appropriate bond futures contract to determine the duration-based hedge ratio. Also clearly state if any position in the futures contract should be "long" or "short". (Note: Fractional contract is NOT allowed, and round to the nearest integer.) A fund manager has a portfolio of two-year 5% coupon bonds with a total face value of $30 million. The coupons are paid semi-annually (s.a.). Concerned that a rise in interest rates will reduce the market value of the bond portfolio, the fund manager intends to hedge with bond futures contracts. Assume there are the Three-year Government Stock Futures Contract (TYS) and the Ten-year Government Stock Futures Contract (TEN) available with the following contract information: Note: s.a. stands for the fact that the coupons are paid semi-annually. Both the TYS and TEN contracts are traded at a price of 91.00 (or 9100 implying a yield-to-maturity of 9% p.a.). Assume that the yield curve is flat at 9% (semi-annual compounding) at all maturities, and the durations of TYS contract and TEN contract are 2.6950 and 6.7966 years when the yields are 9% p.a., respectively. Required: (a). Specify which bond futures contracts (TYS or TEN) is more appropriate to hedge the interest risk from the fund manager's perspective, and briefly explain why (word limit 60). (2 marks) (b). Using the appropriate bond futures contract to determine the duration-based hedge ratio. Also clearly state if any position in the futures contract should be "long" or "short". (Note: Fractional contract is NOT allowed, and round to the nearest integer.)