Question

(a) Gary, Moss, and Curley are brothers. They are all serious investors but each has a different approach to valuing stocks. Gary, the oldest, likes

(a)

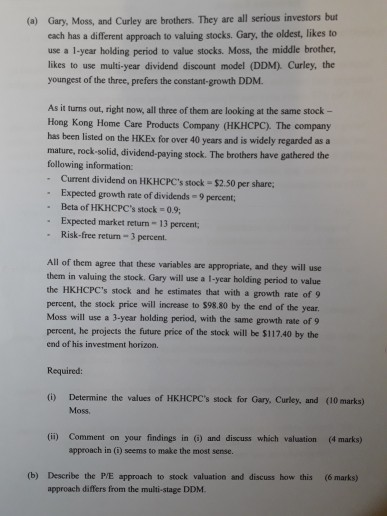

Gary, Moss, and Curley are brothers. They are all serious investors but each has a different approach to valuing stocks. Gary, the oldest, likes to use a 1-year holding period to value stocks. Moss, the middle brother likes to use multi-year dividend discount model (DDM). Curley, the youngest of the three, prefers the constant-growth DDM. As it turns out, right now, all three of them are looking at the same stock- Hong Kong Home Care Products Company (HKHCPC). The company has been listed on the HKEx for over 40 years and is widely regarded as a mature, rock-solid, dividend-paying stock.

The brothers have gathered the following information -Current dividend on HKHCPC's stock = $2.50 per share; Expected growth rate of dividends = 9 percent; Beta of HKHCPC's stock = 0.9; Expected market return = 13 percent; Risk-free return = 3 percent

All of them agree that these variables are appropriate, and they will use them in valuing the stock. Gary will use a I-year holding period to value the HKHCPC's stock and he estimates that with a growth rate of 9 percent, the stock price will increase to $98.80 by the end of the year Moss will use a 3-year holding period, with the same growth rate of 9 percent, he projects the future price of the stock will be $117.40 by the end of his investment horizon.

Required:

(i) Determine the values of HKHCPC's stock for Gary, Curley, and Moss, (10marks)

(ii) Comment on your findings in (i) and discuss which valuation approach in (i) seems to make the most sense. (4marks)

(b) Describe the P/E approach to stock valuation and discuss how this approach differs from the multi-stage DDM. (6marks)

(a) Gary, Moss, and Curley are brothers. They are all serious investors but each has a different approach to valuing stocks. Gary, the oldest, likes to use a 1-year holding period to value stocks. Moss, the middle brother likes to use multi-year dividend discount model (DDM). Curley, the youngest of the three, prefers the constant-growth DDM. As it turns out, right now, all three of them are looking at the same stock- Hong Kong Home Care Products Company (HKHCPC). The company has been listed on the HKEx for over 40 years and is widely regarded as a mature, rock-solid, dividend-paying stock. The brothers have gathered the following information - Current dividend on HKHCPC's stock $2.50 per share; Expected growth rate of dividends-9 percent - Beta of HKHCPC's stock -0.9; Expected market return - 13 percent - Risk-free return 3 percent. All of them agree that these variables are appropriate, and they will use them in valuing the stock. Gary will use a I-year holding period to value the HKHCPC's stock and he estimates that with a growth rate of 9 percent, the stock price will increase to $98.80 by the end of the year Moss will use a 3-year holding period, with the same growth rate of 9 percent, he projects the future price of the stock will be $117.40 by the end of his investment horizon. Required (i) Determine the values of HKHCPC's stock for Gary, Curley, and (10 marks) Moss, (ii) Comment on your findings in 6) and discuss which valuation (4 marks) approach in (1) seems to make the most sense (b) Describe the P/E approach to stock valuation and discuss how this (6 marks) approach differs from the multi-stage DDM (a) Gary, Moss, and Curley are brothers. They are all serious investors but each has a different approach to valuing stocks. Gary, the oldest, likes to use a 1-year holding period to value stocks. Moss, the middle brother likes to use multi-year dividend discount model (DDM). Curley, the youngest of the three, prefers the constant-growth DDM. As it turns out, right now, all three of them are looking at the same stock- Hong Kong Home Care Products Company (HKHCPC). The company has been listed on the HKEx for over 40 years and is widely regarded as a mature, rock-solid, dividend-paying stock. The brothers have gathered the following information - Current dividend on HKHCPC's stock $2.50 per share; Expected growth rate of dividends-9 percent - Beta of HKHCPC's stock -0.9; Expected market return - 13 percent - Risk-free return 3 percent. All of them agree that these variables are appropriate, and they will use them in valuing the stock. Gary will use a I-year holding period to value the HKHCPC's stock and he estimates that with a growth rate of 9 percent, the stock price will increase to $98.80 by the end of the year Moss will use a 3-year holding period, with the same growth rate of 9 percent, he projects the future price of the stock will be $117.40 by the end of his investment horizon. Required (i) Determine the values of HKHCPC's stock for Gary, Curley, and (10 marks) Moss, (ii) Comment on your findings in 6) and discuss which valuation (4 marks) approach in (1) seems to make the most sense (b) Describe the P/E approach to stock valuation and discuss how this (6 marks) approach differs from the multi-stage DDM

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started