Question

A German company has a subsidiary in Switzerland. The subsidiary produces a particular product in Switzerland and sells it in the Eurozone. At the beginning

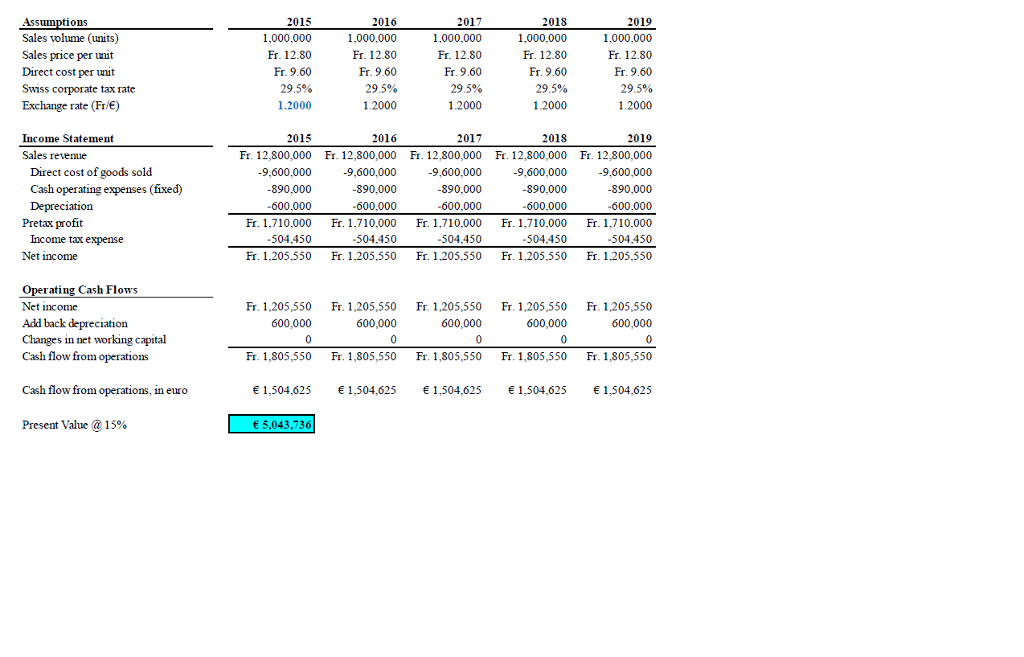

A German company has a subsidiary in Switzerland. The subsidiary produces a particular product in Switzerland and sells it in the Eurozone. At the beginning of 2015, the exchange rate between the euro and the Swiss franc (Fr) is Fr1.20/. The expected cash flows (the baseline case) from the Swiss subsidiary for the next five years are presented in the table below.

20. Assume that the subsidiary chooses to price to market and keeps its sales price per unit in euro unchanged, and everything else the same. What is the PV of the expected operating cash flows from the Swiss subsidiary after the exchange rate change? Your answer: ___________________. (Keep two decimals.)

Assum ons Sales volume (units) Sales price per unit Direct cost per unit Swiss corporate tax rate Exchange rate (Fre) Income Statement Sales revenue Direct cost of goods sold Cash operating expenses (fixed) Depreciation Pretax profit Income tax expense Net income Operating Cash Flows Net income Add back depreciation Changes in net working capital Cash flow from operations Cash flow from operations, ineuro Present Value (a 15% 201 016 01 2018 2019 1,000,000 1.000.000 1,000,000 1,000,000 1.000.000 Fr. 12.80 Fr. 12.80 Fr. 12.80 Fr. 12.80 Fr. 12.80 Fr. 9.60 Fr. 9.60 Fr. 9.60 Fr. 9.60 Fr. 9.60 29.5% 29.5% 29.5% 29.5% 29.5% 1.2000 1.2000 1.2000 1.2000 1.2000 2015 2016 2017 2018 2019 Fr. 12,800,000 Fr. 12,800,000 Fr. 12,800,000 Fr. 12,800,000 Fr. 12,800,000 9,600,000 9,600,000 9,600,000 9,600,000 9,600,000 890,000 890,000 890,000 890,000 890,000 -600.000 600,000 -600,000 600,000 600,000 Fr. 1,710.000 Fr. 1,710.000 Fr. 710.000 Fr. 1.710.000 Fr 1.710.000 -504,450 504.450 504,450 504,450 504,450 Fr. 1.205.550 Fr. 1.205.550 Fr. 1,205.550 Fr. 1.205.550 Fr. 1.205.550 Fr. 1,205,550 Fr. 1,205,550 Fr. 1,205,550 Fr. 1,205,550 Fr. 1,205,550 600,000 600,000 600,000 600,000 600,000 Fr. 1,805,550 Fr. 805,550 Fr. 805,550 Fr. 1,805,550 Fr. 1,805,550 1,504,625 1,504,625 1,504,625 1,504,625 1,504,625 5.043.736Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started