Question

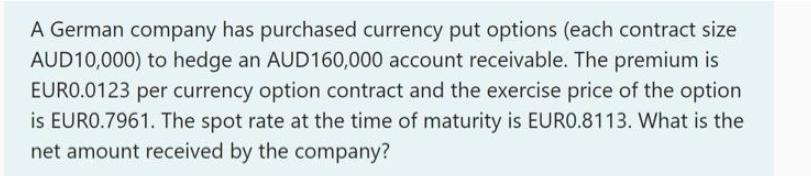

A German company has purchased currency put options (each contract size AUD10,000) to hedge an AUD160,000 account receivable. The premium is EURO.0123 per currency

A German company has purchased currency put options (each contract size AUD10,000) to hedge an AUD160,000 account receivable. The premium is EURO.0123 per currency option contract and the exercise price of the option is EURO.7961. The spot rate at the time of maturity is EURO.8113. What is the net amount received by the company?

Step by Step Solution

3.40 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the net amount received by the company you can fol...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

International Financial Management

Authors: Cheol Eun, Bruce Resnick

7th Edition

0077861604, 9780077861605

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App