Question

A German firm has sold some equipment to a firm in the U.S. The cost to the U.S. firm is 20 million euros and the

A German firm has sold some equipment to a firm in the U.S. The cost to the U.S. firm is 20 million euros and the current dollar/euro exchange rate is $1.10 = € 1. Explain, and illustrate with "T-accounts", how the 20 million euro payment is actually made to the German firm (be sure to accurately identify the various parties to the transaction).

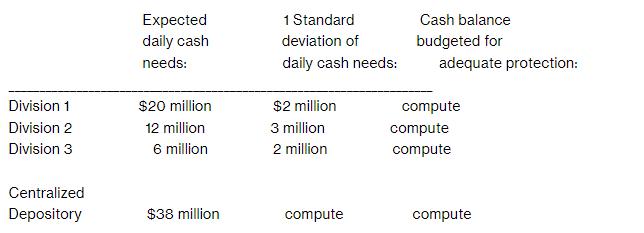

b. Given the information below, how much could a firm save if it instructed its three divisions to use a single account at one bank (a centralized depository) rather than three accounts at the same or three different banks?

Assume that the firm wants to make sure that 95% of the time no division runs an overdraft for its daily cash use. Why does this work?

Division 1 Division 2 Division 3 Centralized Depository Expected daily cash needs: $20 million 12 million 6 million $38 million 1 Standard deviation of daily cash needs: $2 million 3 million 2 million compute Cash balance budgeted for adequate protection: compute compute compute compute

Step by Step Solution

3.31 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION a To illustrate how the 20 million euro payment is made to the German firm lets use Taccounts to track the different parties involved in the transaction 1 German Firm Assets 20 million Liabil...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started