Question

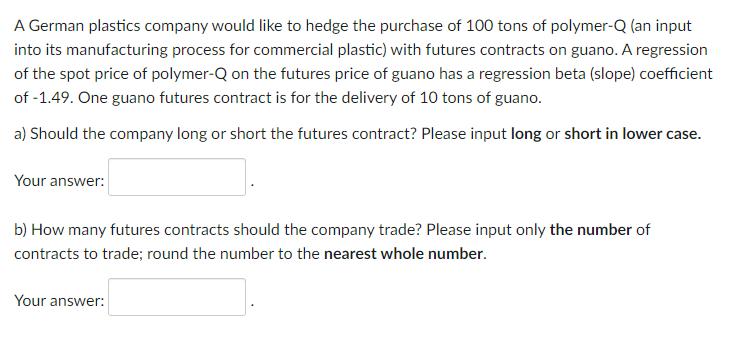

A German plastics company would like to hedge the purchase of 100 tons of polymer-Q (an input into its manufacturing process for commercial plastic)

A German plastics company would like to hedge the purchase of 100 tons of polymer-Q (an input into its manufacturing process for commercial plastic) with futures contracts on guano. A regression of the spot price of polymer-Q on the futures price of guano has a regression beta (slope) coefficient of -1.49. One guano futures contract is for the delivery of 10 tons of guano. a) Should the company long or short the futures contract? Please input long or short in lower case. Your answer: b) How many futures contracts should the company trade? Please input only the number of contracts to trade; round the number to the nearest whole number. Your answer:

Step by Step Solution

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

SPLUTION a Based on the regression beta coefficient of 149 we can conclude that there is an inverse ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Operations management

Authors: Jay Heizer, Barry Render

10th edition

978-0136119418, 136119417, 978-0132163927

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App