Answered step by step

Verified Expert Solution

Question

1 Approved Answer

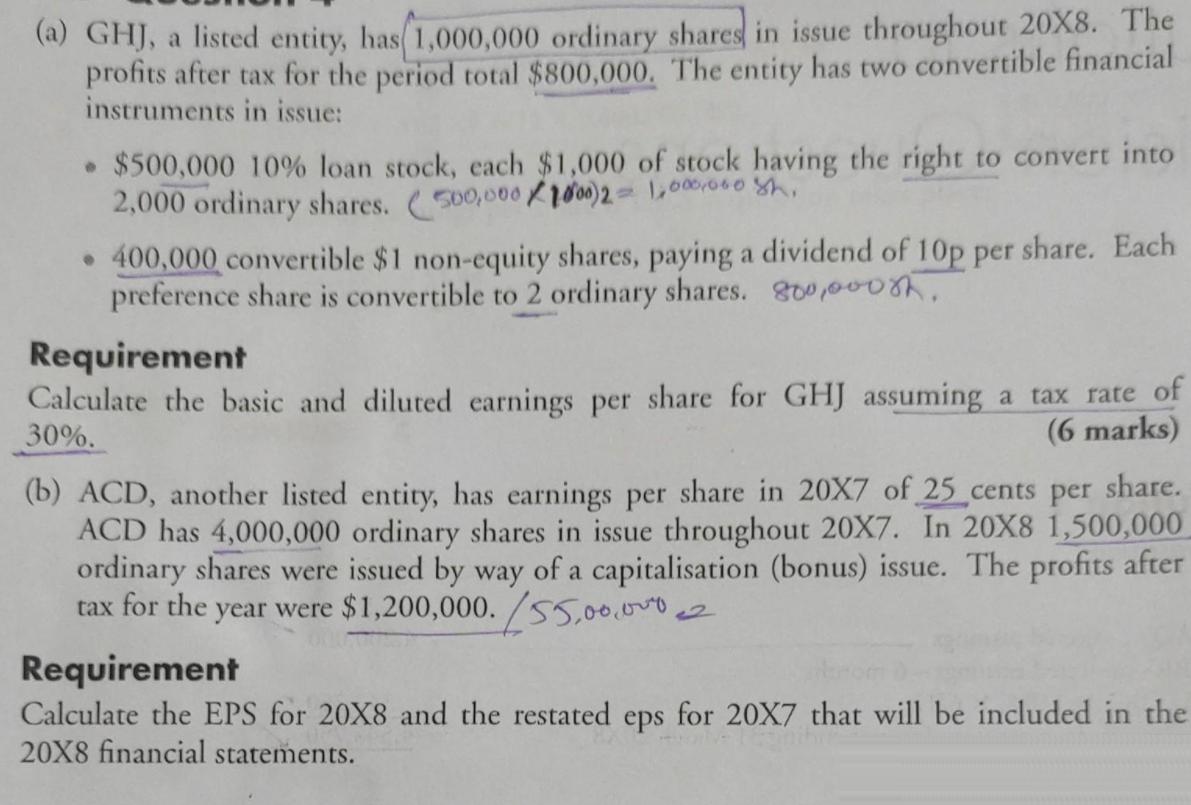

(a) GHJ, a listed entity, has 1,000,000 ordinary shares in issue throughout 20X8. The profits after tax for the period total $800,000. The entity

(a) GHJ, a listed entity, has 1,000,000 ordinary shares in issue throughout 20X8. The profits after tax for the period total $800,000. The entity has two convertible financial instruments in issue: $500,000 10% loan stock, each $1,000 of stock having the right to convert into 2,000 ordinary shares. (500,000R100)2=1,000/00o Shi 400,000 convertible $1 non-equity shares, paying a dividend of 10p per share. Each preference share is convertible to 2 ordinary shares. 800,0008h. Requirement Calculate the basic and diluted earnings per share for GHJ assuming a tax rate of 30%. (6 marks) share. (b) ACD, another listed entity, has earnings per share in 20X7 of 25 cents per ACD has 4,000,000 ordinary shares in issue throughout 20X7. In 20X8 1,500,000 ordinary shares were issued by way of a capitalisation (bonus) issue. The profits after tax for the year were $1,200,000./55.00.000 Requirement Calculate the EPS for 20X8 and the restated eps for 20X7 that will be included in the 20X8 financial statements.

Step by Step Solution

★★★★★

3.38 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Solution The formula for Basic EPS Basic EPS Net income Preferred Dividend Weighted Average no of co...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started