Answered step by step

Verified Expert Solution

Question

1 Approved Answer

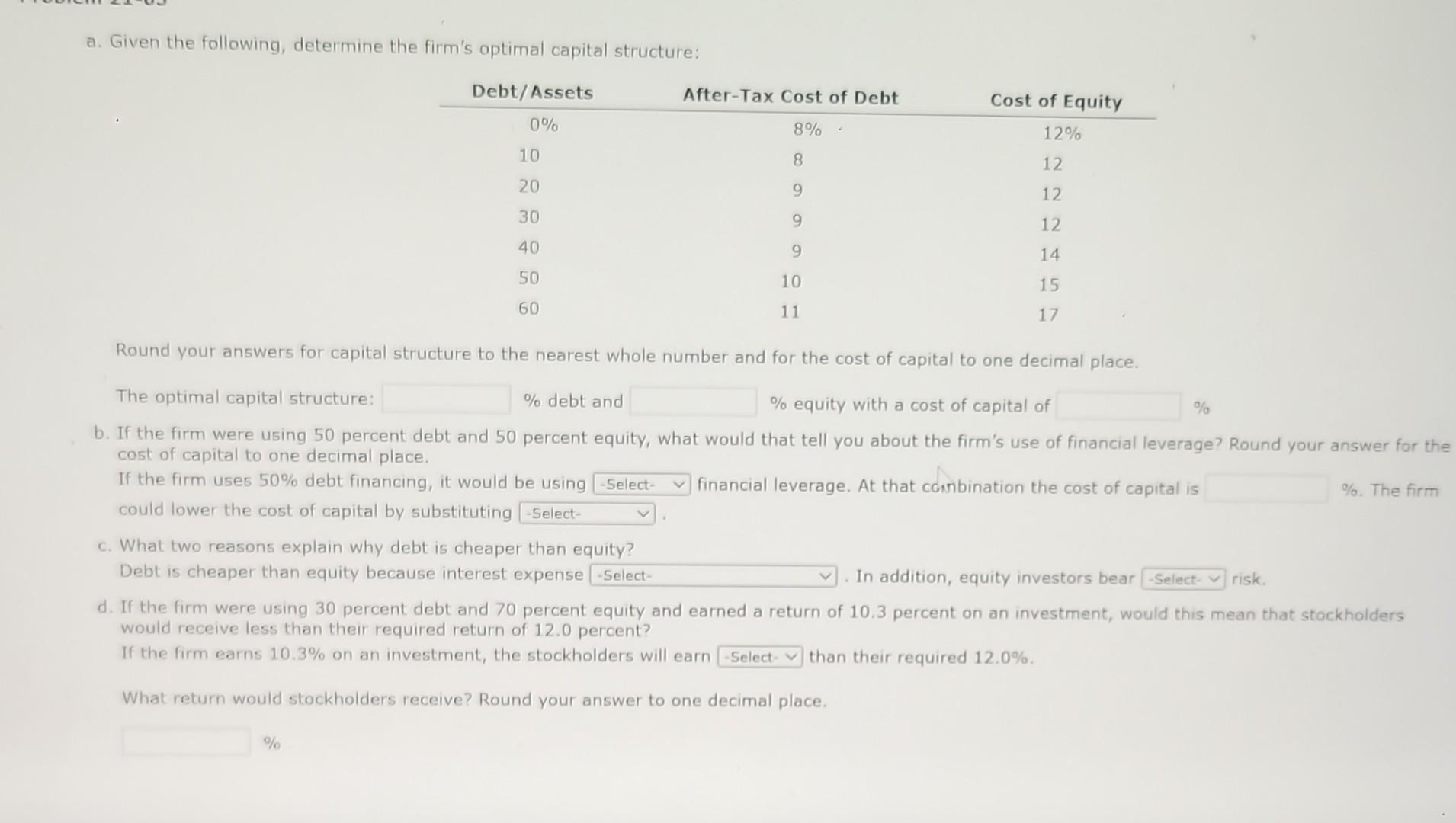

a. Given the following, determine the firm's optimal capital structure: Round your answers for capital structure to the nearest whole number and for the cost

a. Given the following, determine the firm's optimal capital structure: Round your answers for capital structure to the nearest whole number and for the cost of capital to one decimal place. The optimal capital structure: % debt and % equity with a cost of capital of % b. If the firm were using 50 percent debt and 50 percent equity, what would that tell you about the firm's use of financial leverage ? Round your answer for the cost of capital to one decimal place. If the firm uses 50% debt financing, it would be using financial leverage. At that combination the cost of capital is %. The firm could lower the cost of capital by substituting c. What two reasons explain why debt is cheaper than equity? Debt is cheaper than equity because interest expense . In addition, equity investors bear risk. d. If the firm were using 30 percent debt and 70 percent equity and earned a return of 10.3 percent on an investment, would this mean that stockholders would receive less than their required return of 12.0 percent? If the firm earns 10.3% on an investment, the stockholders will earn than their required 12.0%. What return would stockholders receive? Round your answer to one decimal place. %

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started