Question

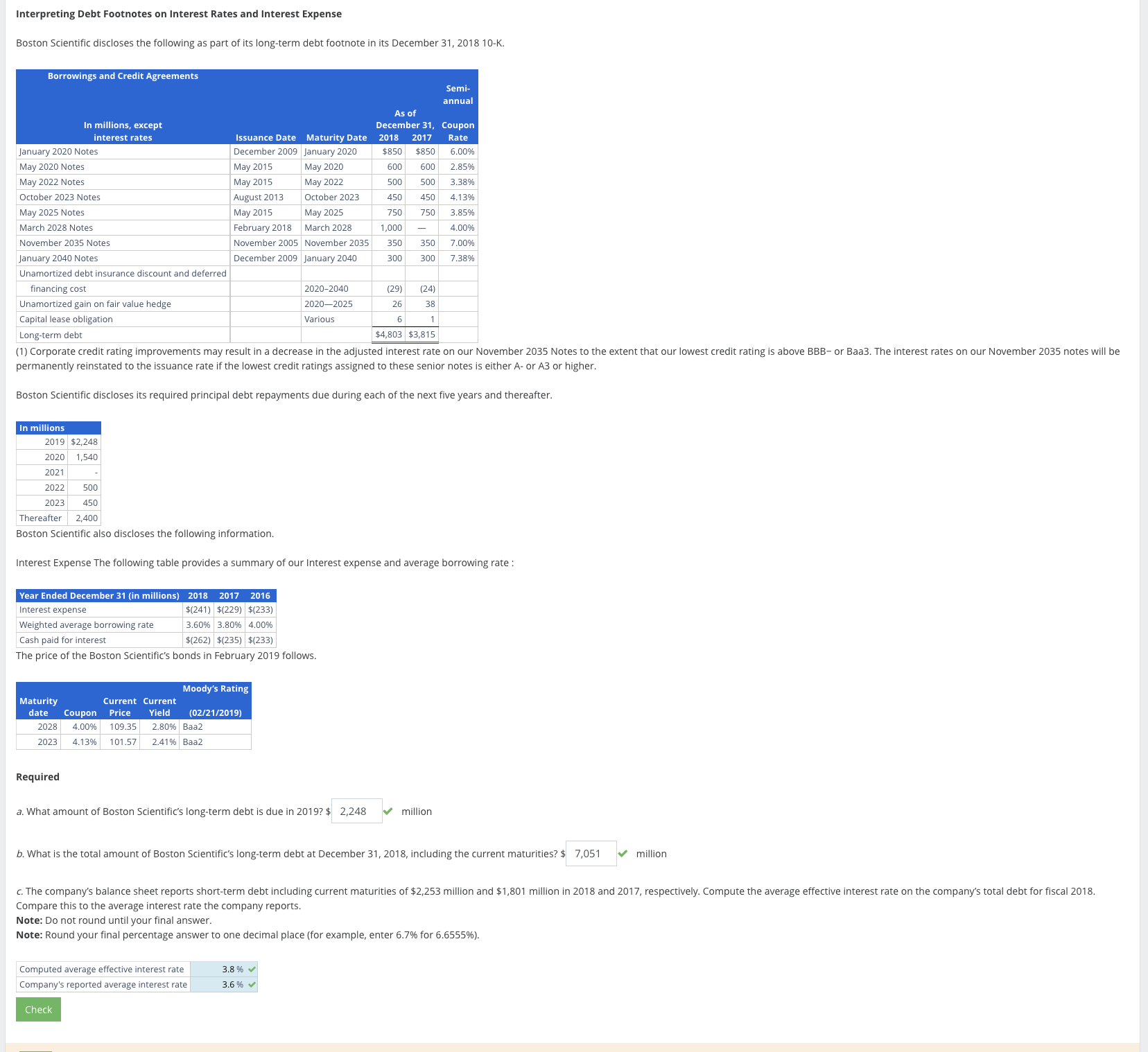

a. given under table for 2019. b. Total amount of long-term debt including current maturities = Long-term debt as of December 31, 2018 + Long-term

a. given under table for 2019.

b. Total amount of long-term debt including current maturities = Long-term debt as of December 31, 2018 + Long-term debt due in 2019 = $4,803 + $2,248 = $7,051 million

Answer: The total amount of Boston Scientifics long-term debt at December 31, 2018, including the current maturities is $7,051 million.

c. Average interest Rate for 2018 = Int Exp for 2018 / Average Debt outstanding

= 241 / ((7056 + 5616)/2)

= 241 / 6336

= 3.80%

d. (ii) Company's reported Average Interest rate (2018):

= 3.60%

(Given Directly in question as Weighted Average Borrowing Rate)

Interpreting Debt Footnotes on Interest Rates and Interest Expense Boston Scientific discloses the following as part of its long-term debt footnote in its December 31, 2018 10-K. permanently reinstated to the issuance rate if the lowest credit ratings assigned to these senior notes is either A- or A3 or higher. Boston Scientific discloses its required principal debt repayments due during each of the next five years and thereafter. Boston Scientific also discloses the following information. Interest Expense The following table provides a summary of our Interest expense and average borrowing rate : Required a. What amount of Boston Scientific's long-term debt is due in 2019 ? $ million b. What is the total amount of Boston Scientific's long-term debt at December 31,2018 , including the current maturities? $ million Compare this to the average interest rate the company reports. Note: Do not round until your final answer. Note: Round your final percentage answer to one decimal place (for example, enter 6.7% for 6.6555\%)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started