Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A gold-mining firm's strategy is to manage its exposure to gold price risk and reduce fluctuations in its earnings as much as possible. Their rationale

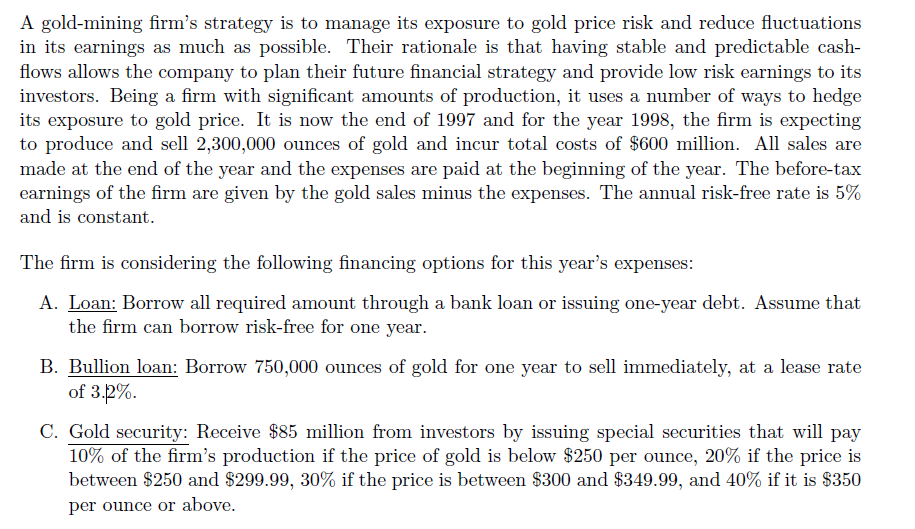

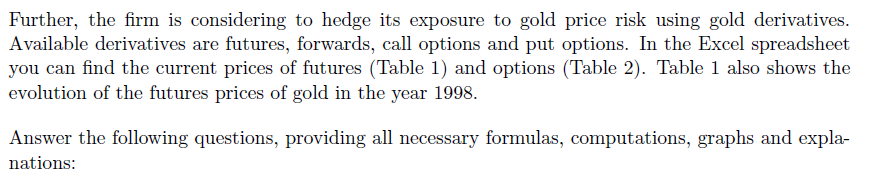

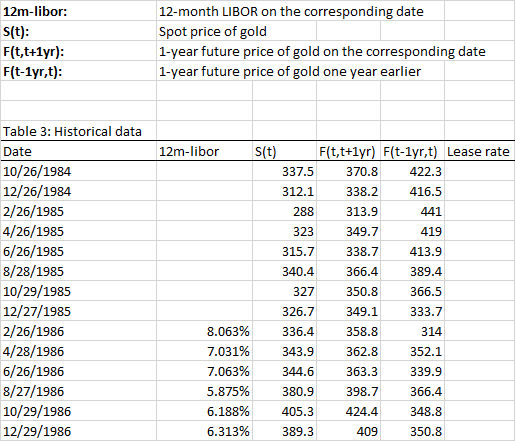

A gold-mining firm's strategy is to manage its exposure to gold price risk and reduce fluctuations in its earnings as much as possible. Their rationale is that having stable and predictable cash- flows allows the company to plan their future financial strategy and provide low risk earnings to its investors. Being a firm with significant amounts of production, it uses a number of ways to hedge its exposure to gold price. It is now the end of 1997 and for the year 1998, the firm is expecting to produce and sell 2,300,000 ounces of gold and incur total costs of $600 million. All sales are made at the end of the year and the expenses are paid at the beginning of the year. The before-tax earnings of the firm are given by the gold sales minus the expenses. The annual risk-free rate is 5% and is constant The firm is considering the following financing options for this year's expenses A. Loan: Borrow all required amount through a bank loan or issuing one-year debt. Assume that the firm can borrow risk-free for one vear B. Bullion loan: Borrow 750,000 ounces of gold for one year to sell immediately, at a lease rate of 3.2% C. Gold security: Receive $85 million from investors by issuing special securities that will pajy 10% of the firm's production if the price of gold is below $250 per ounce, 20% if the price is between $250 and $299.99, 30% if the price is between $300 and $349.99, and 40% if it is $350 er ounce or above A gold-mining firm's strategy is to manage its exposure to gold price risk and reduce fluctuations in its earnings as much as possible. Their rationale is that having stable and predictable cash- flows allows the company to plan their future financial strategy and provide low risk earnings to its investors. Being a firm with significant amounts of production, it uses a number of ways to hedge its exposure to gold price. It is now the end of 1997 and for the year 1998, the firm is expecting to produce and sell 2,300,000 ounces of gold and incur total costs of $600 million. All sales are made at the end of the year and the expenses are paid at the beginning of the year. The before-tax earnings of the firm are given by the gold sales minus the expenses. The annual risk-free rate is 5% and is constant The firm is considering the following financing options for this year's expenses A. Loan: Borrow all required amount through a bank loan or issuing one-year debt. Assume that the firm can borrow risk-free for one vear B. Bullion loan: Borrow 750,000 ounces of gold for one year to sell immediately, at a lease rate of 3.2% C. Gold security: Receive $85 million from investors by issuing special securities that will pajy 10% of the firm's production if the price of gold is below $250 per ounce, 20% if the price is between $250 and $299.99, 30% if the price is between $300 and $349.99, and 40% if it is $350 er ounce or above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started