Answered step by step

Verified Expert Solution

Question

1 Approved Answer

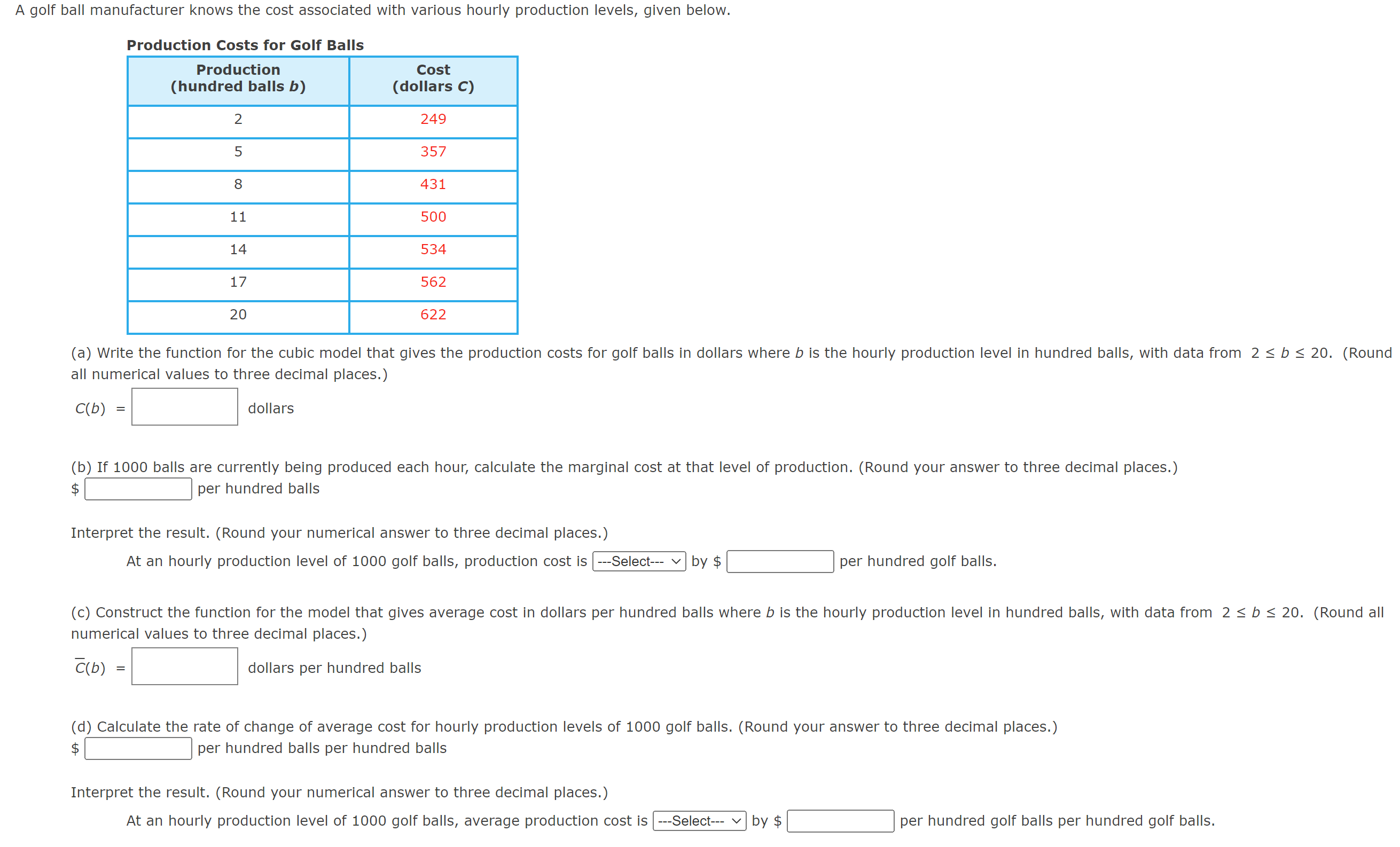

A golf ball manufacturer knows the cost associated with various hourly production levels, given below. Production Costs for Golf Balls Production (hundred balls b)

A golf ball manufacturer knows the cost associated with various hourly production levels, given below. Production Costs for Golf Balls Production (hundred balls b) 2 5 C(b) 8 = 11 14 17 20 Cost (dollars C) 249 357 431 dollars 500 534 (a) Write the function for the cubic model that gives the production costs for golf balls in dollars where b is the hourly production level in hundred balls, with data from 2 b 20. (Round all numerical values to three decimal places.) C(b) 562 622 (b) If 1000 balls are currently being produced each hour, calculate the marginal ost at that level of production. (Round your answer per hundred balls $ Interpret the result. (Round your numerical answer to three decimal places.) At an hourly production level of 1000 golf balls, production cost is ---Select--- by $ (c) Construct the function for the model that gives average cost in dollars per hundred balls where b is the hourly production level in hundred balls, with data from 2 b 20. (Round all numerical values to three decimal places.) dollars per hundred balls per hundred golf balls. three decimal places.) Interpret the result. (Round your numerical answer to three decimal places.) At an hourly production level of 1000 golf balls, average production cost is ---Select--- by $ (d) Calculate the rate of change of average cost for hourly production levels of 1000 golf balls. (Round your answer to three decimal places.) $ per hundred balls per hundred balls per hundred golf balls per hundred golf balls.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To answer the questions lets go step by step a Write the function for the cubic model that gives the production costs for golf balls in dollars We nee...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started