Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A government agency is considering the economic benefits of a program of preventative flu vaccinations. If vaccinations are not introduced then the estimated cost

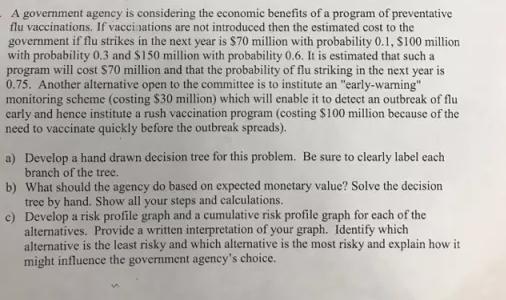

A government agency is considering the economic benefits of a program of preventative flu vaccinations. If vaccinations are not introduced then the estimated cost to the government if flu strikes in the next year is $70 million with probability 0.1, $100 million with probability 0.3 and $150 million with probability 0.6. It is estimated that such a program will cost $70 million and that the probability of flu striking in the next year is 0.75. Another alternative open to the committee is to institute an "early-warning" monitoring scheme (costing $30 million) which will enable it to detect an outbreak of flu early and hence institute a rush vaccination program (costing $100 million because of the need to vaccinate quickly before the outbreak spreads). a) Develop a hand drawn decision tree for this problem. Be sure to clearly label each branch of the tree. b) What should the agency do based on expected monetary value? Solve the decision tree by hand. Show all your steps and calculations. c) Develop a risk profile graph and a cumulative risk profile graph for each of the alternatives. Provide a written interpretation of your graph. Identify which alternative is the least risky and which alternative is the most risky and explain how it might influence the government agency's choice.

Step by Step Solution

★★★★★

3.64 Rating (191 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started