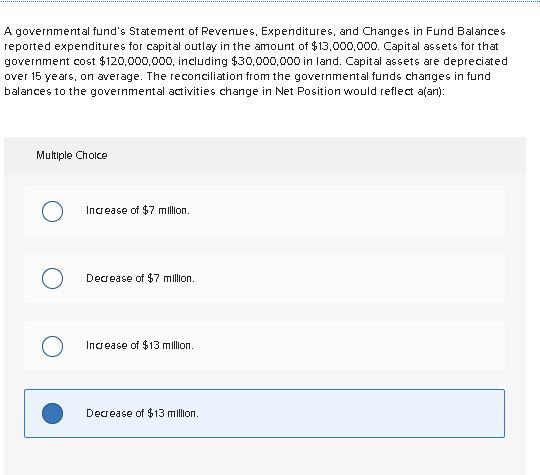

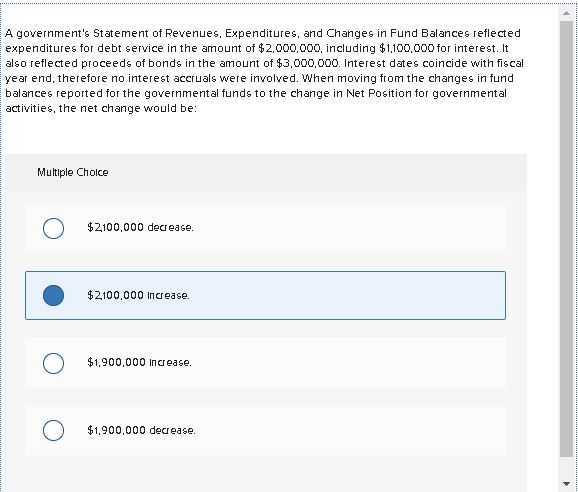

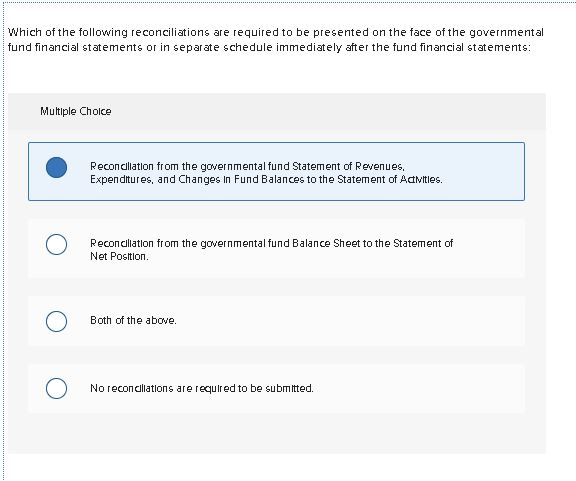

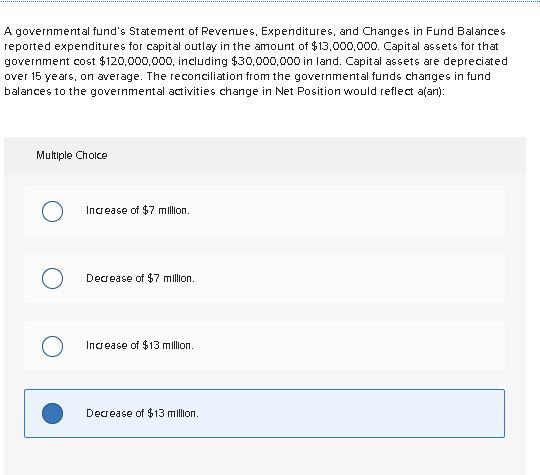

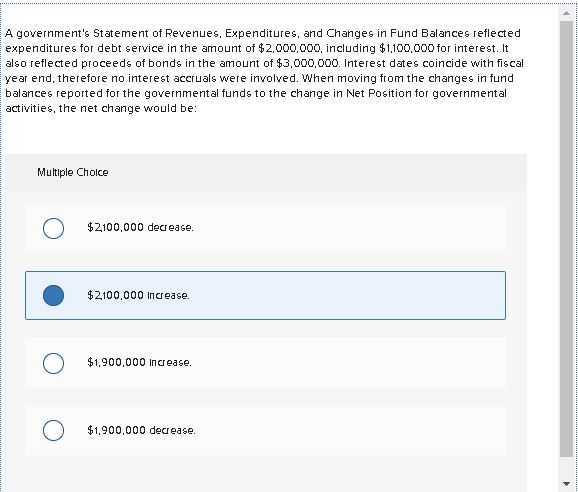

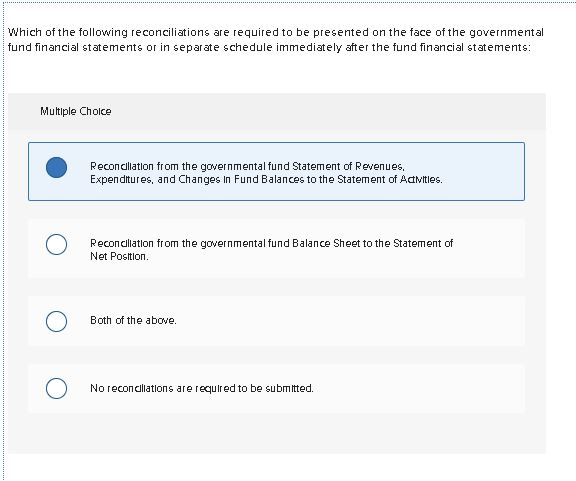

A governmental fund's Statement of Revenues. Expenditures, and Changes in Fund Balances reported expenditures for capital outlay in the amount of $13,000,000. Capital assets for that government cost $120,000,000, including $30,000,000 in land. Capital assets are depreciated over 15 years, on average. The reconciliation from the governmental funds changes in fund balances to the governmental activities change in Net Position would reflect alan): Multiple Choice O Increase of $7 million. O Decrease of $7 million O Increase of $13 million. O Decrease of $13 million A government's Statement of Revenues. Expenditures, and Changes in Fund Balances reflected expenditures for debt service in the amount of $2,000,000, including $1,100,000 for interest. It also reflected proceeds of bonds in the amount of $3,000,000. Interest dates coincide with fiscal year end, therefore no interest accruals were involved. When moving from the changes in fund balances reported for the governmental funds to the change in Net Position for governmental activities, the net change would be: Multiple Choice o $2100.000 decrease $2100,000 Increase. ( $1,900,000 Incease. O $1,900,000 decease. Which of the following reconciliations are required to be presented on the face of the governmental fund financial statements or in separate schedule immediately after the fund financial statements: Multiple Choice Reconciliation from the governmental fund Statement of Revenues, Expenditures, and Changes In Fund Balances to the Statement of Admitles. Reconciliation from the governmental fund Balance Sheet to the Statement of Net Position. Both of the above. O C) No reconciliations are required to be submitted. O A governmental fund's Statement of Revenues. Expenditures, and Changes in Fund Balances reported expenditures for capital outlay in the amount of $13,000,000. Capital assets for that government cost $120,000,000, including $30,000,000 in land. Capital assets are depreciated over 15 years, on average. The reconciliation from the governmental funds changes in fund balances to the governmental activities change in Net Position would reflect alan): Multiple Choice O Increase of $7 million. O Decrease of $7 million O Increase of $13 million. O Decrease of $13 million A government's Statement of Revenues. Expenditures, and Changes in Fund Balances reflected expenditures for debt service in the amount of $2,000,000, including $1,100,000 for interest. It also reflected proceeds of bonds in the amount of $3,000,000. Interest dates coincide with fiscal year end, therefore no interest accruals were involved. When moving from the changes in fund balances reported for the governmental funds to the change in Net Position for governmental activities, the net change would be: Multiple Choice o $2100.000 decrease $2100,000 Increase. ( $1,900,000 Incease. O $1,900,000 decease. Which of the following reconciliations are required to be presented on the face of the governmental fund financial statements or in separate schedule immediately after the fund financial statements: Multiple Choice Reconciliation from the governmental fund Statement of Revenues, Expenditures, and Changes In Fund Balances to the Statement of Admitles. Reconciliation from the governmental fund Balance Sheet to the Statement of Net Position. Both of the above. O C) No reconciliations are required to be submitted. O