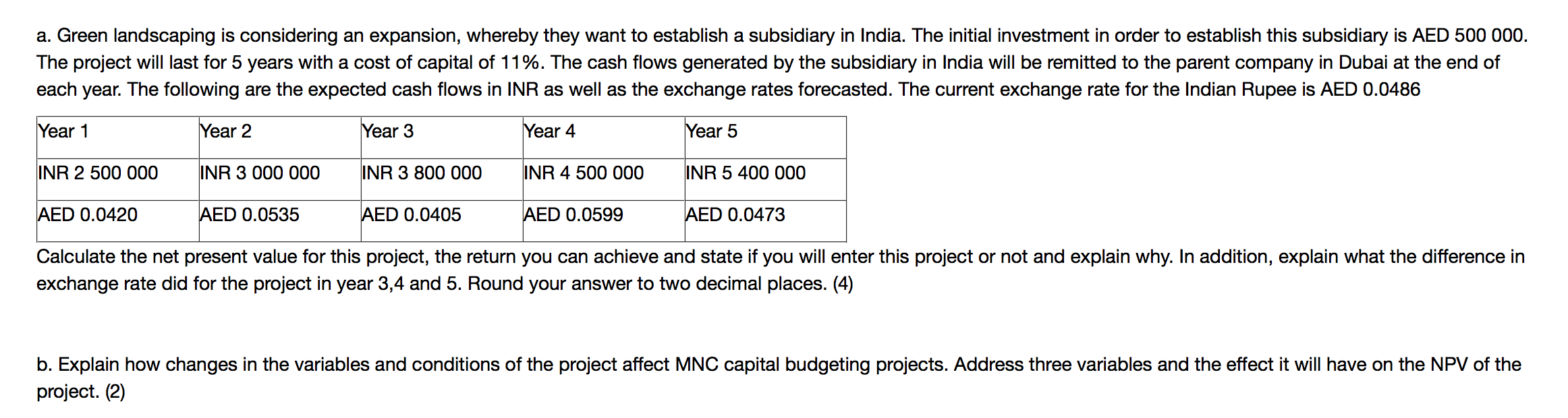

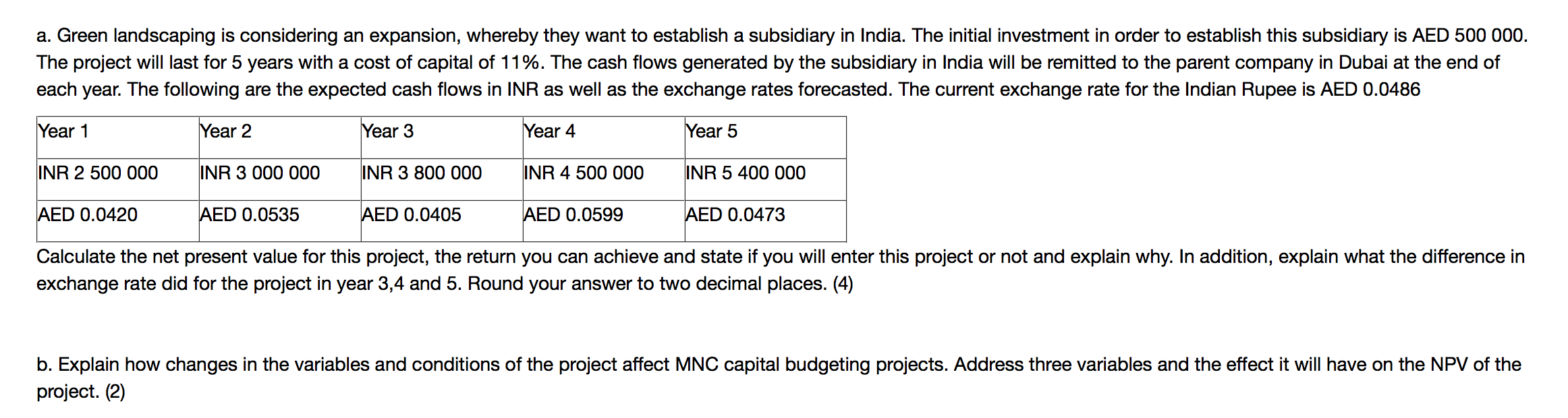

a. Green landscaping is considering an expansion, whereby they want to establish a subsidiary in India. The initial investment in order to establish this subsidiary is AED 500 000. The project will last for 5 years with a cost of capital of 11%. The cash flows generated by the subsidiary in India will be remitted to the parent company in Dubai at the end of each year. The following are the expected cash flows in INR as well as the exchange rates forecasted. The current exchange rate for the Indian Rupee is AED 0.0486 Year 1 Year 2 Year 3 Year 4 Year 5 INR 2 500 000 INR 3 000 000 INR 3 800 000 INR 4 500 000 INR 5 400 000 AED 0.0420 AED 0.0535 AED 0.0405 AED 0.0599 AED 0.0473 Calculate the net present value for this project, the return you can achieve and state if you will enter this project or not and explain why. In addition, explain what the difference in exchange rate did for the project in year 3,4 and 5. Round your answer to two decimal places. (4) b. Explain how changes in the variables and conditions of the project affect MNC capital budgeting projects. Address three variables and the effect it will have on the NPV of the project. (2) a. Green landscaping is considering an expansion, whereby they want to establish a subsidiary in India. The initial investment in order to establish this subsidiary is AED 500 000. The project will last for 5 years with a cost of capital of 11%. The cash flows generated by the subsidiary in India will be remitted to the parent company in Dubai at the end of each year. The following are the expected cash flows in INR as well as the exchange rates forecasted. The current exchange rate for the Indian Rupee is AED 0.0486 Year 1 Year 2 Year 3 Year 4 Year 5 INR 2 500 000 INR 3 000 000 INR 3 800 000 INR 4 500 000 INR 5 400 000 AED 0.0420 AED 0.0535 AED 0.0405 AED 0.0599 AED 0.0473 Calculate the net present value for this project, the return you can achieve and state if you will enter this project or not and explain why. In addition, explain what the difference in exchange rate did for the project in year 3,4 and 5. Round your answer to two decimal places. (4) b. Explain how changes in the variables and conditions of the project affect MNC capital budgeting projects. Address three variables and the effect it will have on the NPV of the project. (2)