Answered step by step

Verified Expert Solution

Question

1 Approved Answer

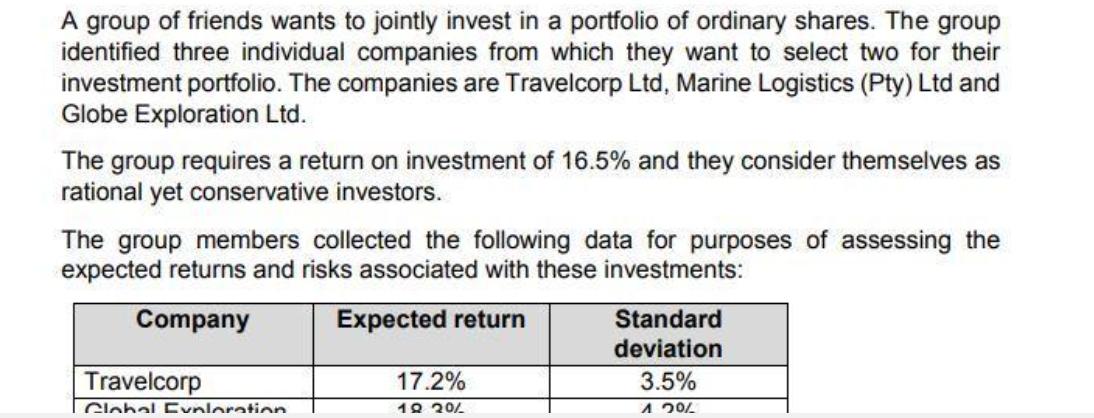

A group of friends wants to jointly invest in a portfolio of ordinary shares. The group identified three individual companies from which they want

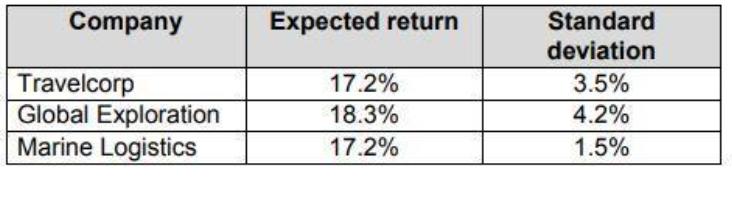

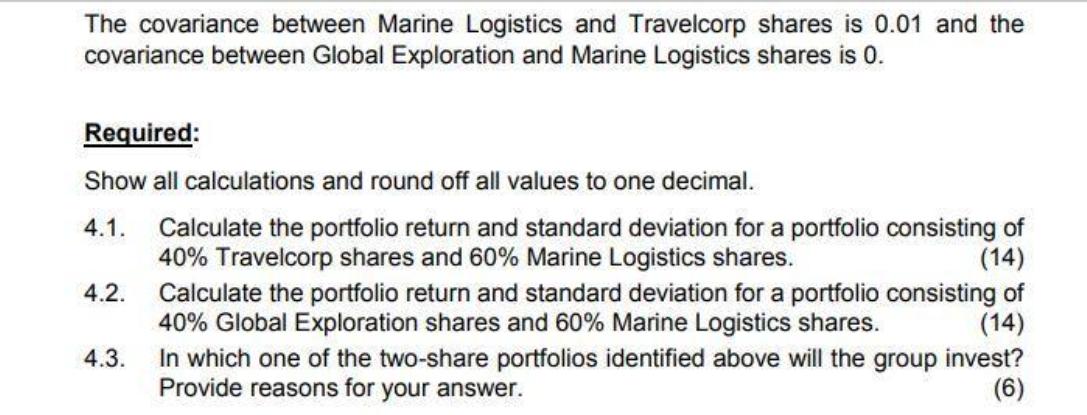

A group of friends wants to jointly invest in a portfolio of ordinary shares. The group identified three individual companies from which they want to select two for their investment portfolio. The companies are Travelcorp Ltd, Marine Logistics (Pty) Ltd and Globe Exploration Ltd. The group requires a return on investment of 16.5% and they consider themselves as rational yet conservative investors. The group members collected the following data for purposes of assessing the expected returns and risks associated with these investments: Company Travelcorp Expected return 17.2% Standard deviation 3.5% Global Evaloration 10 20% 1.20% Company Expected return Standard deviation Travelcorp 17.2% 3.5% Global Exploration 18.3% 4.2% Marine Logistics 17.2% 1.5% The covariance between Marine Logistics and Travelcorp shares is 0.01 and the covariance between Global Exploration and Marine Logistics shares is 0. Required: Show all calculations and round off all values to one decimal. 4.1. 4.2. Calculate the portfolio return and standard deviation for a portfolio consisting of 40% Travelcorp shares and 60% Marine Logistics shares. (14) Calculate the portfolio return and standard deviation for a portfolio consisting of 40% Global Exploration shares and 60% Marine Logistics shares. (14) 4.3. In which one of the two-share portfolios identified above will the group invest? Provide reasons for your answer. (6)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the portfolio return and standard deviation well use the following formulas Portfolio Return Portfolio Return Weight of Stock A Expected ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started