Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A group of investors is considering acquiring a professional basketball team. They have conducted a thorough financial analysis of the team's operations and are now

A group of investors is considering acquiring a professional basketball team. They have conducted a thorough financial analysis of the team's operations and are now evaluating the feasibility of the acquisition. The team's financial statements indicate a strong revenue stream from ticket sales, merchandise, and sponsorships, but there are concerns about the team's capital structure and longterm investment opportunities. The team currently has a debttoequity ratio of which is higher than the industry average for sports franchises. Additionally, the team has been relying heavily on debt financing to fund player acquisitions and facility upgrades. However, the investors believe that the team has significant growth potential, especially with the recent signing of a superstar player and plans to build a stateoftheart training facility. The investors are considering two financing options for the acquisition: Issuing corporate bonds to raise capital for the acquisition, leveraging the team's strong revenue stream to secure favorable interest rates. Offering additional equity shares to investors to reduce the team's debt burden and strengthen its balance sheet. The investors are also evaluating the potential impact of the acquisition on the team's financial ratios and longterm capital budgeting decisions. They need to assess how each financing option will affect the team's ability to generate returns for shareholders, manage its debt obligations, and invest in future growth opportunities, such as stadium renovations and player development programs. Based on the scenario provided, analyze the following: Interpret the team's current debttoequity ratio, explain whether or not the team is highly leveraged, and discuss the concept of risk. Evaluate the advantages and disadvantages of issuing corporate bonds versus offering additional equity shares for financing acquisition. Recommend a financing option for the acquisition, considering the team's capital structure, longterm investment prospects, and potential impact on financial ratios.

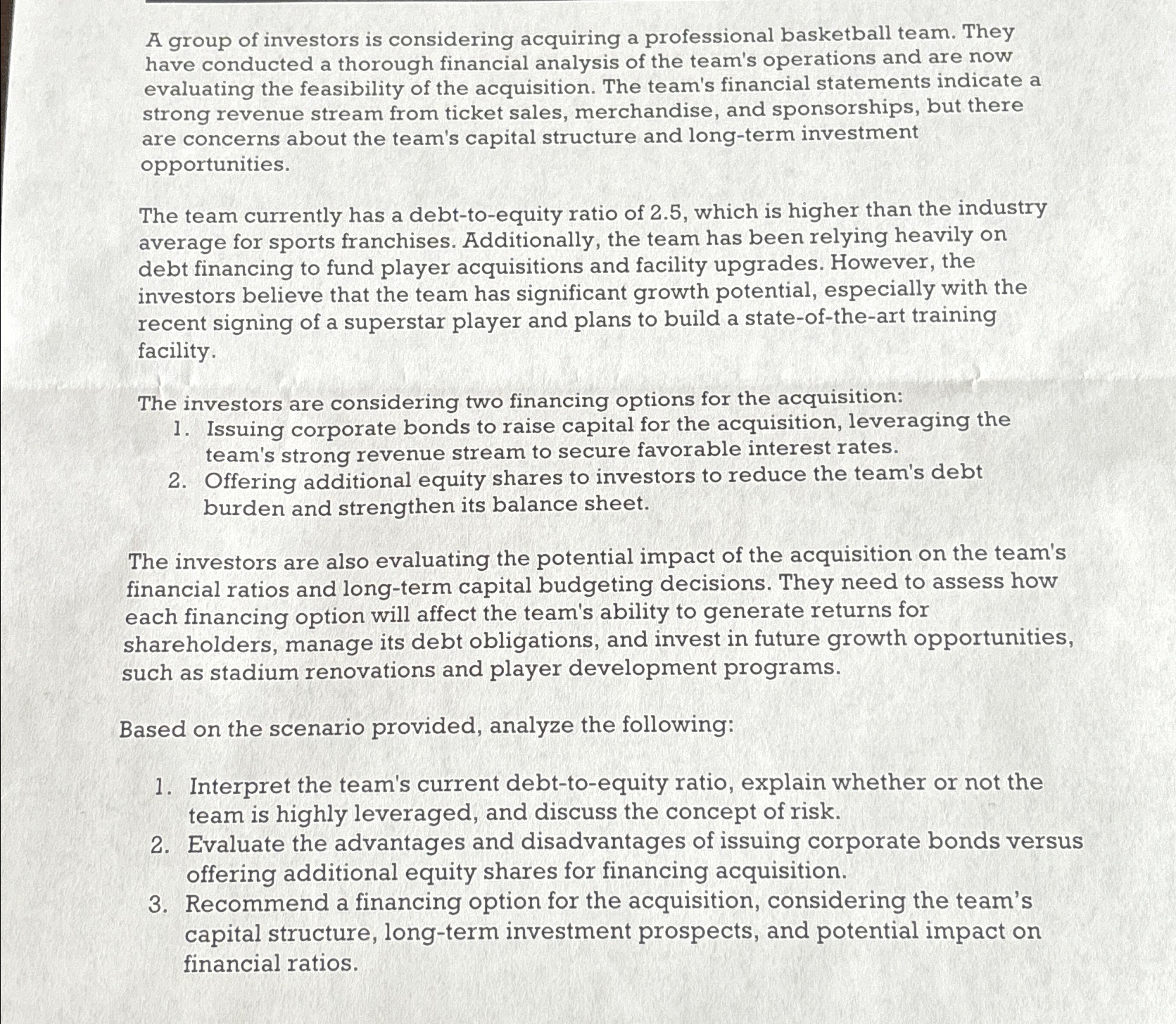

A group of investors is considering acquiring a professional basketball team. They have conducted a thorough financial analysis of the team's operations and are now evaluating the feasibility of the acquisition. The team's financial statements indicate a strong revenue stream from ticket sales, merchandise, and sponsorships, but there are concerns about the team's capital structure and longterm investment opportunities.

The team currently has a debttoequity ratio of which is higher than the industry average for sports franchises. Additionally, the team has been relying heavily on debt financing to fund player acquisitions and facility upgrades. However, the investors believe that the team has significant growth potential, especially with the recent signing of a superstar player and plans to build a stateoftheart training facility.

The investors are considering two financing options for the acquisition:

Issuing corporate bonds to raise capital for the acquisition, leveraging the team's strong revenue stream to secure favorable interest rates.

Offering additional equity shares to investors to reduce the team's debt burden and strengthen its balance sheet.

The investors are also evaluating the potential impact of the acquisition on the team's financial ratios and longterm capital budgeting decisions. They need to assess how each financing option will affect the team's ability to generate returns for shareholders, manage its debt obligations, and invest in future growth opportunities, such as stadium renovations and player development programs.

Based on the scenario provided, analyze the following:

Interpret the team's current debttoequity ratio, explain whether or not the team is highly leveraged, and discuss the concept of risk.

Evaluate the advantages and disadvantages of issuing corporate bonds versus offering additional equity shares for financing acquisition.

Recommend a financing option for the acquisition, considering the team's capital structure, longterm investment prospects, and potential impact on financial ratios.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started