Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A group of investors is intent on purchasing a publicly troded company and wants to estimate the highest price they can ressonsbly justify poying. The

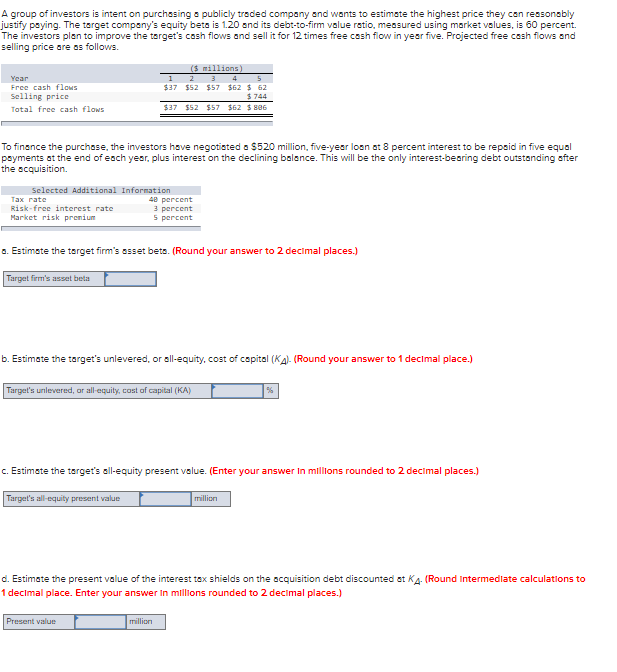

A group of investors is intent on purchasing a publicly troded company and wants to estimate the highest price they can ressonsbly justify poying. The target compony's equity beta is 1.20 ond its debt-to-firm volue ratio, messured using market volues, is 60 percent. The investors plen to improve the target's cosh flows and sell it for 12 times free cosh flow in year five. Projected free cosh flows and selling price are as follows. To finsence the purchase, the investors hove negotisted o $520 million, five-yeor loon ot 8 percent intereat to be repoid in five equal payments at the end of each year, plus interest on the declining bolance. This will be the only interest-bearing debt outstanding after the acquisition. 0. Estimste the target firm's asset beta. (Round your answer to 2 decimal places.) b. Estimate the target's unlevered, or all-equity, cost of capital ( K A). (Round your answer to 1 declmal place.) c. Estimste the target's all-equity present volue. (Enter your answer In millions rounded to 2 decimal places.) d. Estimate the present volue of the interest tax shields on the acquisition debt discounted at KA. (Round Intermedlate calculations to 1 decimal place. Enter your answer in millions rounded to 2 decimal places.)

A group of investors is intent on purchasing a publicly troded company and wants to estimate the highest price they can ressonsbly justify poying. The target compony's equity beta is 1.20 ond its debt-to-firm volue ratio, messured using market volues, is 60 percent. The investors plen to improve the target's cosh flows and sell it for 12 times free cosh flow in year five. Projected free cosh flows and selling price are as follows. To finsence the purchase, the investors hove negotisted o $520 million, five-yeor loon ot 8 percent intereat to be repoid in five equal payments at the end of each year, plus interest on the declining bolance. This will be the only interest-bearing debt outstanding after the acquisition. 0. Estimste the target firm's asset beta. (Round your answer to 2 decimal places.) b. Estimate the target's unlevered, or all-equity, cost of capital ( K A). (Round your answer to 1 declmal place.) c. Estimste the target's all-equity present volue. (Enter your answer In millions rounded to 2 decimal places.) d. Estimate the present volue of the interest tax shields on the acquisition debt discounted at KA. (Round Intermedlate calculations to 1 decimal place. Enter your answer in millions rounded to 2 decimal places.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started