Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A group of surgeons are considering opening a surgical center in downtown Vancouver, offering foot, ankle, knee and hip surgery to the general public.

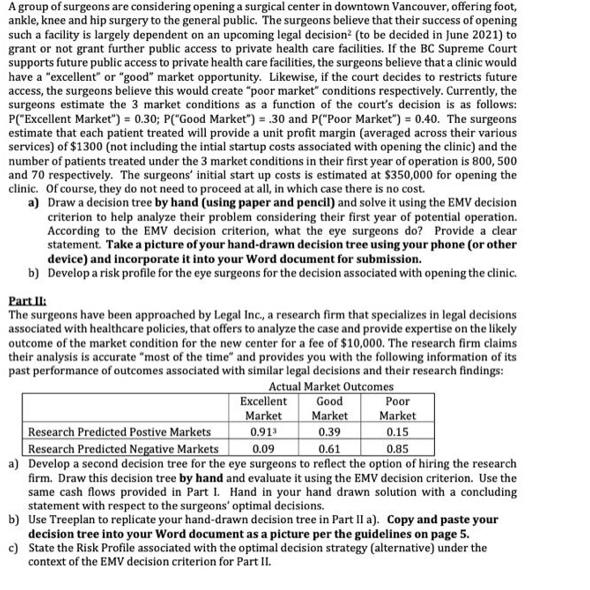

A group of surgeons are considering opening a surgical center in downtown Vancouver, offering foot, ankle, knee and hip surgery to the general public. The surgeons believe that their success of opening such a facility is largely dependent on an upcoming legal decision (to be decided in June 2021) to grant or not grant further public access to private health care facilities. If the BC Supreme Court supports future public access to private health care facilities, the surgeons believe that a clinic would have a "excellent" or "good" market opportunity. Likewise, if the court decides to restricts future access, the surgeons believe this would create "poor market" conditions respectively. Currently, the surgeons estimate the 3 market conditions as a function of the court's decision is as follows: P("Excellent Market") = 0.30; P("Good Market") = .30 and P("Poor Market") = 0.40. The surgeons estimate that each patient treated will provide a unit profit margin (averaged across their various services) of $1300 (not including the intial startup costs associated with opening the clinic) and the number of patients treated under the 3 market conditions in their first year of operation is 800, 500 and 70 respectively. The surgeons' initial start up costs is estimated at $350,000 for opening the clinic. Of course, they do not need to proceed at all, in which case there is no cost. a) Draw a decision tree by hand (using paper and pencil) and solve it using the EMV decision criterion to help analyze their problem considering their first year of potential operation. According to the EMV decision criterion, what the eye surgeons do? Provide a clear statement. Take a picture of your hand-drawn decision tree using your phone (or other device) and incorporate it into your Word document for submission. b) Develop a risk profile for the eye surgeons for the decision associated with opening the clinic. Part II: The surgeons have been approached by Legal Inc., a research firm that specializes in legal decisions associated with healthcare policies, that offers to analyze the case and provide expertise on the likely outcome of the market condition for the new center for a fee of $10,000. The research firm claims their analysis is accurate "most of the time" and provides you with the following information of its past performance of outcomes associated with similar legal decisions and their research findings: Actual Market Outcomes Excellent Good Poor Market Market Market Research Predicted Postive Markets 0.91 0.39 0.15 Research Predicted Negative Markets 0.09 0.61 0.85 a) Develop a second decision tree for the eye surgeons to reflect the option of hiring the research firm. Draw this decision tree by hand and evaluate it using the EMV decision criterion. Use the same cash flows provided in Part 1. Hand in your hand drawn solution with a concluding statement with respect to the surgeons' optimal decisions. b) Use Treeplan to replicate your hand-drawn decision tree in Part II a). Copy and paste your decision tree into your Word document as a picture per the guidelines on page 5. c) State the Risk Profile associated with the optimal decision strategy (alternative) under the context of the EMV decision criterion for Part II.

Step by Step Solution

★★★★★

3.46 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Part I a To draw a decision tree by hand start by representing the initial decision of whether to proceed with opening the clinic or not From there cr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started