Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A grouped plan is an arrangement where an employer agrees to acquire, fund and hold D . I. and C . I. contracts for the

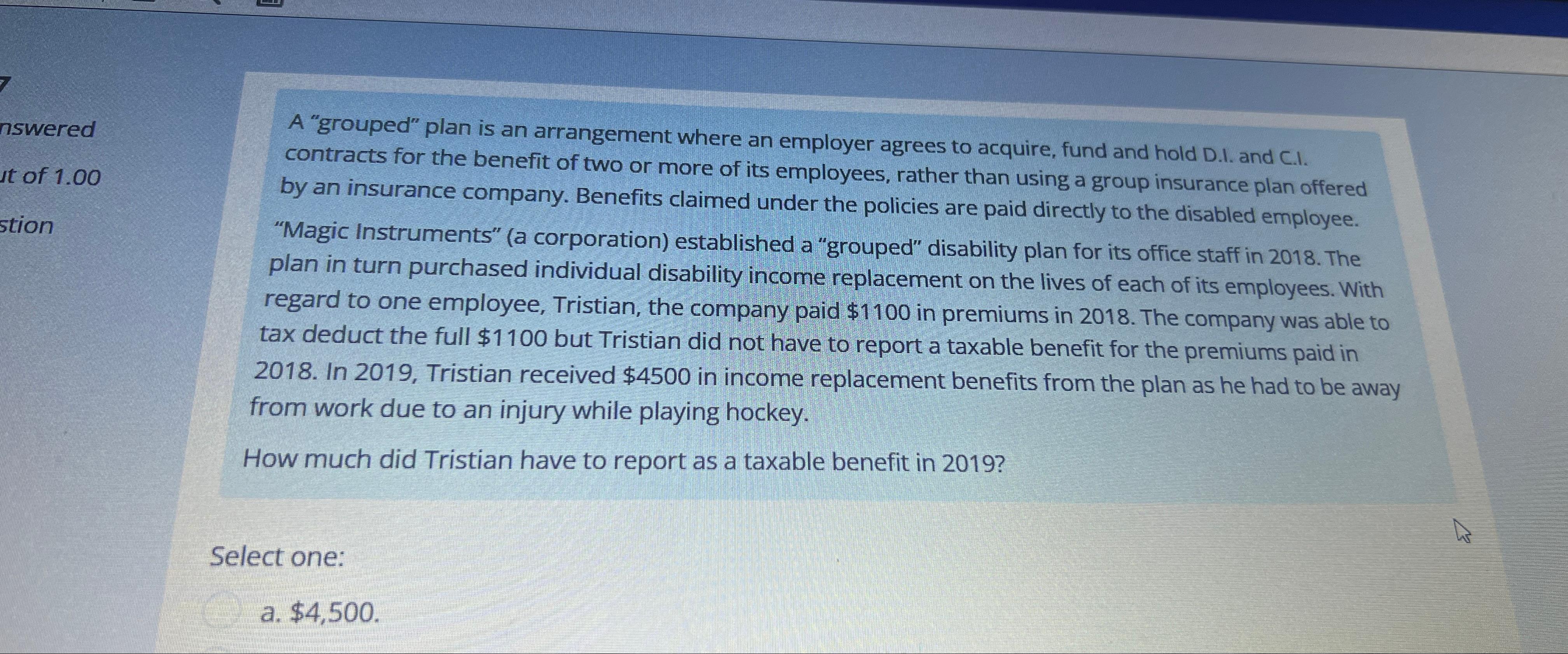

A "grouped" plan is an arrangement where an employer agrees to acquire, fund and hold DI. and CI. contracts for the benefit of two or more of its employees, rather than using a group insurance plan offered by an insurance company. Benefits claimed under the policies are paid directly to the disabled employee.

"Magic Instruments" a corporation established a "grouped" disability plan for its office staff in The plan in turn purchased individual disability income replacement on the lives of each of its employees. With regard to one employee, Tristian, the company paid $ in premiums in The company was able to tax deduct the full $ but Tristian did not have to report a taxable benefit for the premiums paid in In Tristian received $ in income replacement benefits from the plan as he had to be away from work due to an injury while playing hockey.

How much did Tristian have to report as a taxable benefit in

Select one:

a $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started