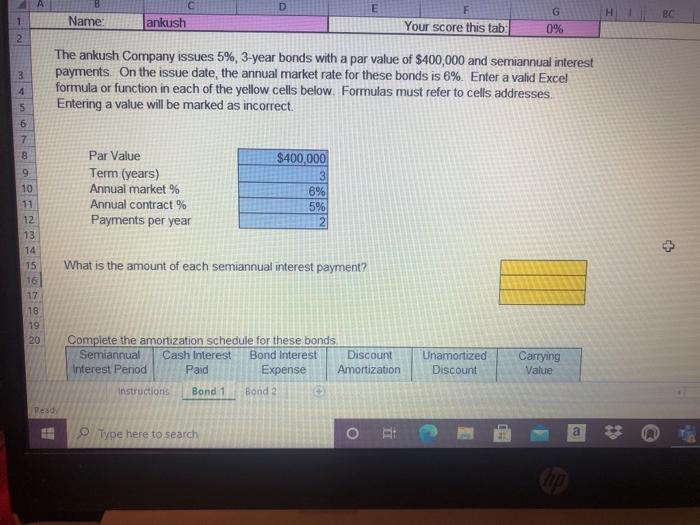

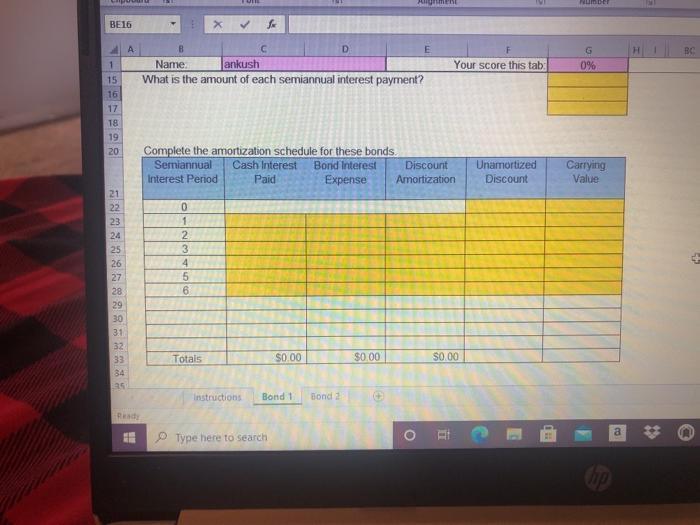

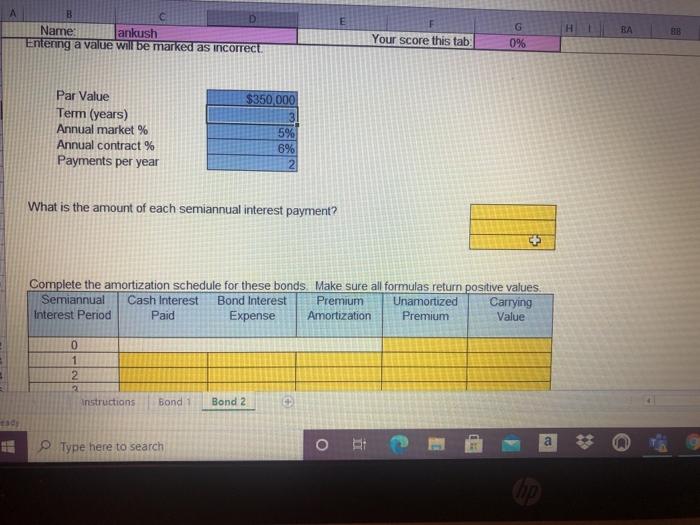

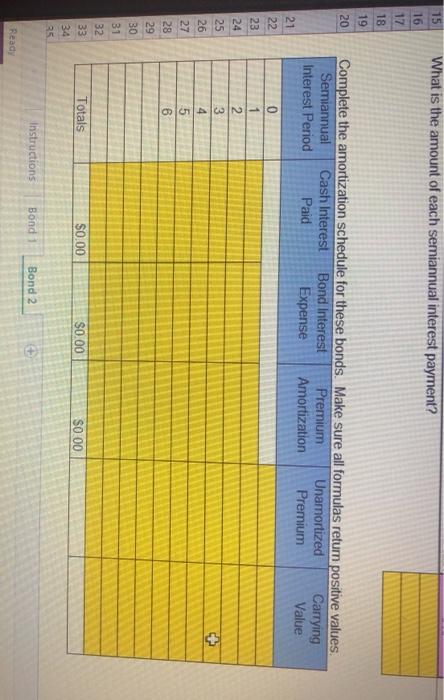

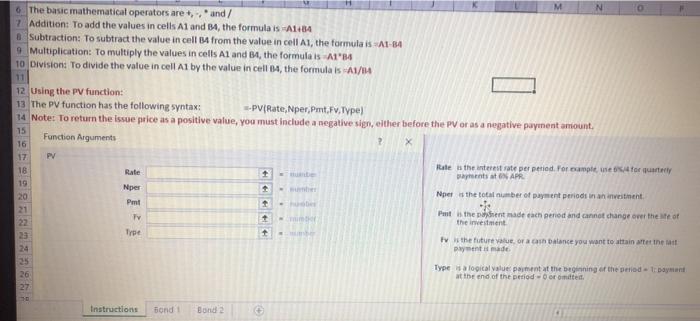

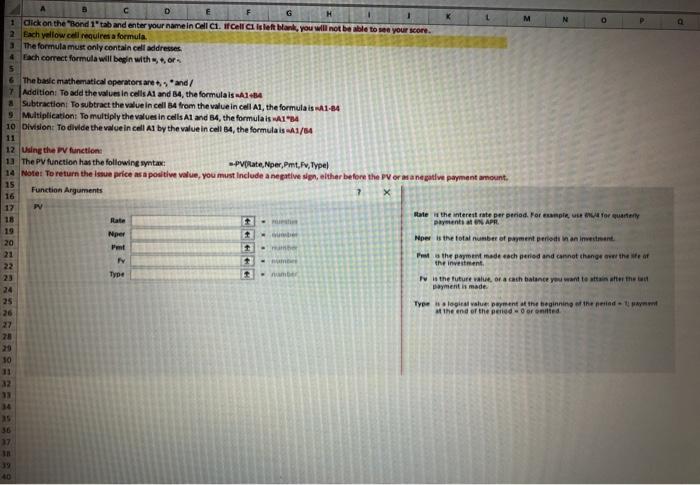

A H BC Name: ankush 1 2 Your score this tab: G 0% 3 The ankush Company issues 5%, 3-year bonds with a par value of $400,000 and semiannual interest payments. On the issue date, the annual market rate for these bonds is 6%. Enter a valid Excel formula or function in each of the yellow cells below. Formulas must refer to cells addresses Entering a value will be marked as incorrect. 4 5 $400,000 Par Value Term (years) Annual market % Annual contract % Payments per year 6% 5% 2 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 What is the amount of each semiannual interest payment? Complete the amortization schedule for these bonds Semiannual Cash Interest Bond Interest Discount Interest Perod Pad Expense Amortization Unamortized Discount Carrying Value Instructions Band 1 Bond 2 Pesde Type here to search a umber BE16 4 A D E BC B Name ankush What is the amount of each semiannual interest payment? Your score this tab: G 0% 1 15 16 17 T8 19 20 Complete the amortization schedule for these bonds Semiannual Cash Interest Bond Interest Discount Interest Period Paid Expense Amortization Unamortized Discount Carrying Value 21 22 23 24 25 26 27 28 29 30 3.1 32 33 34 as 0 1 2 3 4 5 6 Totals $0.00 $0.00 $0.00 Instructions Bond 1 Bond 2 a 13 Type here to search o IT A B D Name: ankush Entenng a value will be marked as incorrect. H BA Your score this tab G 0% $350,000 Par Value Term (years) Annual market % Annual contract % Payments per year 5% 6% What is the amount of each semiannual interest payment? Complete the amortization schedule for these bonds. Make sure all formulas return positive values Semiannual Cash Interest Bond Interest Premium Unamortized Carrying Interest Period Paid Expense Amortization Premium Value 0 1 2 2 Instructions Bond 1 Bond 2 E a Type here to search What is the amount of each semiannual interest payment? 15 16 17 18 19 20 Complete the amortization schedule for these bonds. Make sure all formulas retum positive values. Semiannual Cash Interest Bond Interest Premium Unamortized Carrying Interest Period Paid Expense Amortization Premium Value 21 22 23 24 25 26 27 28 29 30 31 32 0 1 2 3 4 5 Totals $0.00 SO 00 $0.00 33 34 25 Instructions Bond 1 Bond 2 Ready N 6. The basic mathematical operators are+, and/ 7 Addition: To add the values in cells A1 and 34, the formula is =A1184 Subtraction: To subtract the value in cell B4 from the value in cell Al, the formula is A1-84 9 Multiplication: To multiply the values in cells A1 and B4, the formula is A1'M 10 Division: To divide the value in cell A1 by the value in cell 04, the formula is 1/04 12 Using the PV function: 13 The P function has the following syntax --PV Rate, per, Pmt.F. Type) 14 Note: To return the issue price as a positive value, you must include a negative sign, either before the PV or as a negative paynent amount Function Arguments 15 16 PV + 18 19 20 Rate Nper Pmt Rate is the interest rate per period. For comple, used for at payments at NAPR Nper the total number of payment period in an investment 1 - 21 Tv + Trpe Pet the parent made each pened and cannot change over the of the investment v the future value of a cash balance you want to attain after the ply made 23 24 25 26 27 Type a logical value payment at the beginning of the period bayan at the end of the perioder mitte Instructions Fond Bund 2 C D M N 0 1 dick on the "Bond 1 tab and enter your name in Cell C1. Cell C islett blank, you will not be able to see your score. 2 Each yellow cell requires a formula 3 The formula must only contain cell addresses 4 ach correct formula will begin with so 5 6 The basic mathematical operators are and/ 7 Addition: To add the values in cells A1 and 14, the formulais 144 Subtraction To subtract the value in cell 4 from the value in cell A1, the formula is A1-84 9. Multiplication: To multiply the values in cells A1 and 54, the formula is WA14 10 Division: To divide the value in cell Al by the value in cell 04, the formula is 11/ 11 12 Using the function 13 The PV function has the following syntax Plate, per,Pmt,, Type) 19 Motel To return the issue price as a positive value, you must include a negative sin, thar before the Permanentive payment amount 15 Function Arguments 16 PY 12 Rate the interest to get period. For example, we * 18 Ilate APR Nper + per the total number of payment period an investment 20 Pet + - Foto the payment made each period and cannot change over the seat 22 the investment Type number w the future value of a cash balance you want to attainer 24 ayment is made 25 Typelagical value payment at the beginning the need 26 at the end of the period - oronited 27 28 30 11 32 33 37 A H BC Name: ankush 1 2 Your score this tab: G 0% 3 The ankush Company issues 5%, 3-year bonds with a par value of $400,000 and semiannual interest payments. On the issue date, the annual market rate for these bonds is 6%. Enter a valid Excel formula or function in each of the yellow cells below. Formulas must refer to cells addresses Entering a value will be marked as incorrect. 4 5 $400,000 Par Value Term (years) Annual market % Annual contract % Payments per year 6% 5% 2 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 What is the amount of each semiannual interest payment? Complete the amortization schedule for these bonds Semiannual Cash Interest Bond Interest Discount Interest Perod Pad Expense Amortization Unamortized Discount Carrying Value Instructions Band 1 Bond 2 Pesde Type here to search a umber BE16 4 A D E BC B Name ankush What is the amount of each semiannual interest payment? Your score this tab: G 0% 1 15 16 17 T8 19 20 Complete the amortization schedule for these bonds Semiannual Cash Interest Bond Interest Discount Interest Period Paid Expense Amortization Unamortized Discount Carrying Value 21 22 23 24 25 26 27 28 29 30 3.1 32 33 34 as 0 1 2 3 4 5 6 Totals $0.00 $0.00 $0.00 Instructions Bond 1 Bond 2 a 13 Type here to search o IT A B D Name: ankush Entenng a value will be marked as incorrect. H BA Your score this tab G 0% $350,000 Par Value Term (years) Annual market % Annual contract % Payments per year 5% 6% What is the amount of each semiannual interest payment? Complete the amortization schedule for these bonds. Make sure all formulas return positive values Semiannual Cash Interest Bond Interest Premium Unamortized Carrying Interest Period Paid Expense Amortization Premium Value 0 1 2 2 Instructions Bond 1 Bond 2 E a Type here to search What is the amount of each semiannual interest payment? 15 16 17 18 19 20 Complete the amortization schedule for these bonds. Make sure all formulas retum positive values. Semiannual Cash Interest Bond Interest Premium Unamortized Carrying Interest Period Paid Expense Amortization Premium Value 21 22 23 24 25 26 27 28 29 30 31 32 0 1 2 3 4 5 Totals $0.00 SO 00 $0.00 33 34 25 Instructions Bond 1 Bond 2 Ready N 6. The basic mathematical operators are+, and/ 7 Addition: To add the values in cells A1 and 34, the formula is =A1184 Subtraction: To subtract the value in cell B4 from the value in cell Al, the formula is A1-84 9 Multiplication: To multiply the values in cells A1 and B4, the formula is A1'M 10 Division: To divide the value in cell A1 by the value in cell 04, the formula is 1/04 12 Using the PV function: 13 The P function has the following syntax --PV Rate, per, Pmt.F. Type) 14 Note: To return the issue price as a positive value, you must include a negative sign, either before the PV or as a negative paynent amount Function Arguments 15 16 PV + 18 19 20 Rate Nper Pmt Rate is the interest rate per period. For comple, used for at payments at NAPR Nper the total number of payment period in an investment 1 - 21 Tv + Trpe Pet the parent made each pened and cannot change over the of the investment v the future value of a cash balance you want to attain after the ply made 23 24 25 26 27 Type a logical value payment at the beginning of the period bayan at the end of the perioder mitte Instructions Fond Bund 2 C D M N 0 1 dick on the "Bond 1 tab and enter your name in Cell C1. Cell C islett blank, you will not be able to see your score. 2 Each yellow cell requires a formula 3 The formula must only contain cell addresses 4 ach correct formula will begin with so 5 6 The basic mathematical operators are and/ 7 Addition: To add the values in cells A1 and 14, the formulais 144 Subtraction To subtract the value in cell 4 from the value in cell A1, the formula is A1-84 9. Multiplication: To multiply the values in cells A1 and 54, the formula is WA14 10 Division: To divide the value in cell Al by the value in cell 04, the formula is 11/ 11 12 Using the function 13 The PV function has the following syntax Plate, per,Pmt,, Type) 19 Motel To return the issue price as a positive value, you must include a negative sin, thar before the Permanentive payment amount 15 Function Arguments 16 PY 12 Rate the interest to get period. For example, we * 18 Ilate APR Nper + per the total number of payment period an investment 20 Pet + - Foto the payment made each period and cannot change over the seat 22 the investment Type number w the future value of a cash balance you want to attainer 24 ayment is made 25 Typelagical value payment at the beginning the need 26 at the end of the period - oronited 27 28 30 11 32 33 37