Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A home remodeling company is considering investing in two different house flips, Cantrell and Fuller. The company would like your help in determining which flip

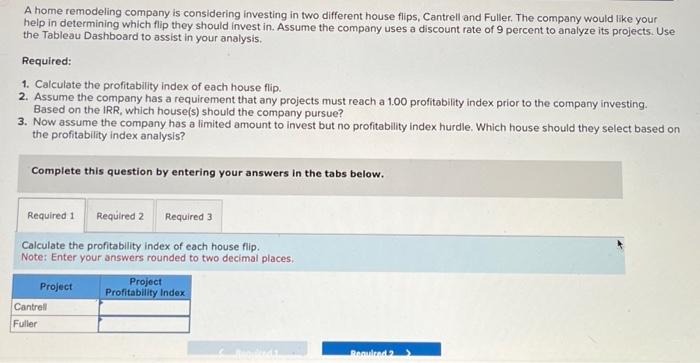

A home remodeling company is considering investing in two different house flips, Cantrell and Fuller. The company would like your help in determining which flip they should invest in. Assume the company uses a discount rate of 9 percent to analyze its projects. Use the Tableau Dashboard to assist in your analysis. Required: 1. Calculate the profitability index of each house flip. 2. Assume the company has a requirement that any projects must reach a 1.00 profitability index prior to the company investing. Based on the IRR, which house(s) should the company pursue? 3. Now assume the company has a limited amount to invest but no profitability index hurdle. Which house should they select based on the profitability index analysis? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Calculate the profitability index of each house flip. Note: Enter your answers rounded to two decimal places. Project Cantrell Fuller Project Profitability Index Required 1 Required 2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started