Question

A homeowner is considering buying a one-year fire insurance policy. They are told that there is a 0.6% chance that their house their house

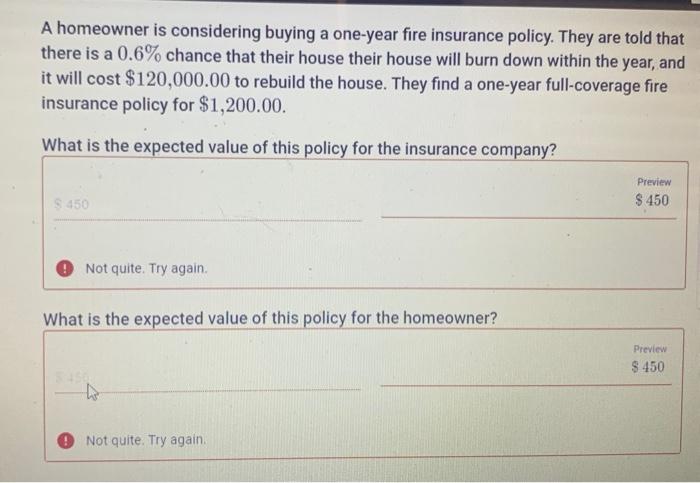

A homeowner is considering buying a one-year fire insurance policy. They are told that there is a 0.6% chance that their house their house will burn down within the year, and it will cost $120,000.00 to rebuild the house. They find a one-year full-coverage fire insurance policy for $1,200.00. What is the expected value of this policy for the insurance company? Preview $ 450 $ 450 Not quite. Try again. What is the expected value of this policy for the homeowner? Preview $ 450 Not quite. Try again.

Step by Step Solution

3.45 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

Ame Given 06 chances of gelting fire Probabi lity of getting Fire pz006 Porobab...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Thermodynamics An Engineering Approach

Authors: Yunus A. Cengel, Michael A. Boles

8th edition

73398179, 978-0073398174

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App