Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A homeowner is granted a mortgage at a rate of 11,4% p.a. compounded monthly. The loan is to be amortised by means of 240

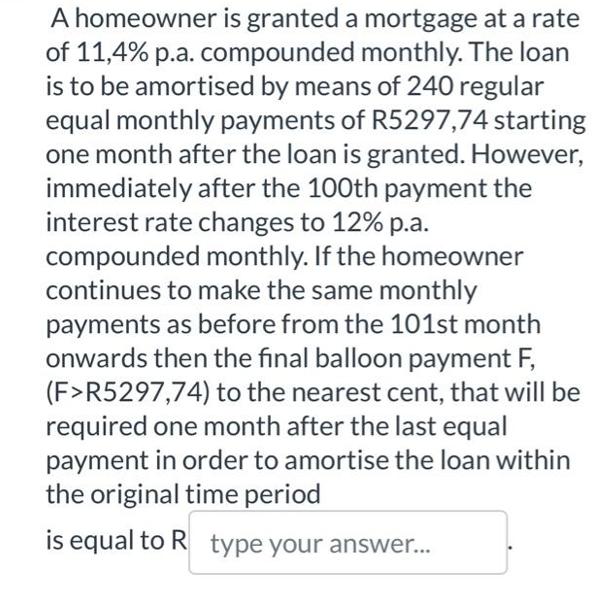

A homeowner is granted a mortgage at a rate of 11,4% p.a. compounded monthly. The loan is to be amortised by means of 240 regular equal monthly payments of R5297,74 starting one month after the loan is granted. However, immediately after the 100th payment the interest rate changes to 12% p.a. compounded monthly. If the homeowner continues to make the same monthly payments as before from the 101st month onwards then the final balloon payment F, (F>R5297,74) to the nearest cent, that will be required one month after the last equal payment in order to amortise the loan within the original time period is equal to R type your answer...

Step by Step Solution

★★★★★

3.52 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

To find the final balloon payment required to amortize the loan within the original time period we need to calculate the outstanding loan balance afte...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started