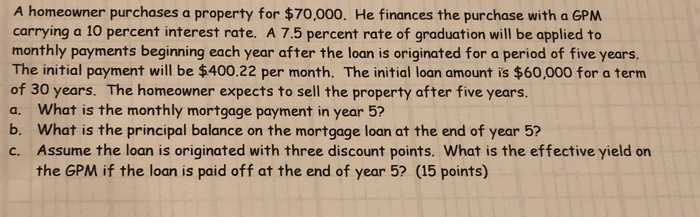

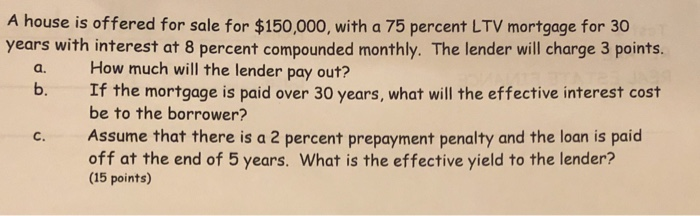

A homeowner purchases a property for $70,000. He finances the purchase with a GPM carrying a 10 percent interest rate. A 7.5 percent rate of graduation will be applied to monthly payments beginning each year after the loan is originated for a period of five years. The initial payment will be $400.22 per month. The initial loan amount is $60,000 for a term of 30 years. The homeowner expects to sell the property after five years a. What is the monthly mortgage payment in year 5? b. What is the principal balance on the mortgage loan at the end of year 5? c. Assume the loan is originated with three discount points. What is the effective yield on the GPM if the loan is paid off at the end of year 5? (15 points) A house is offered for sale for $150,000, with a 75 percent LTV mortgage for 30 years with interest at 8 percent compounded monthly. The lender will charge 3 points. a. How much will the lender pay out? b. If the mortgage is paid over 30 years, what will the effective interest cost be to the borrower? Assume that there is a 2 percent prepayment penalty and the loan is paid off at the end of 5 years. What is the effective yield to the lender? (15 points) c. A homeowner purchases a property for $70,000. He finances the purchase with a GPM carrying a 10 percent interest rate. A 7.5 percent rate of graduation will be applied to monthly payments beginning each year after the loan is originated for a period of five years. The initial payment will be $400.22 per month. The initial loan amount is $60,000 for a term of 30 years. The homeowner expects to sell the property after five years a. What is the monthly mortgage payment in year 5? b. What is the principal balance on the mortgage loan at the end of year 5? c. Assume the loan is originated with three discount points. What is the effective yield on the GPM if the loan is paid off at the end of year 5? (15 points) A house is offered for sale for $150,000, with a 75 percent LTV mortgage for 30 years with interest at 8 percent compounded monthly. The lender will charge 3 points. a. How much will the lender pay out? b. If the mortgage is paid over 30 years, what will the effective interest cost be to the borrower? Assume that there is a 2 percent prepayment penalty and the loan is paid off at the end of 5 years. What is the effective yield to the lender? (15 points) c