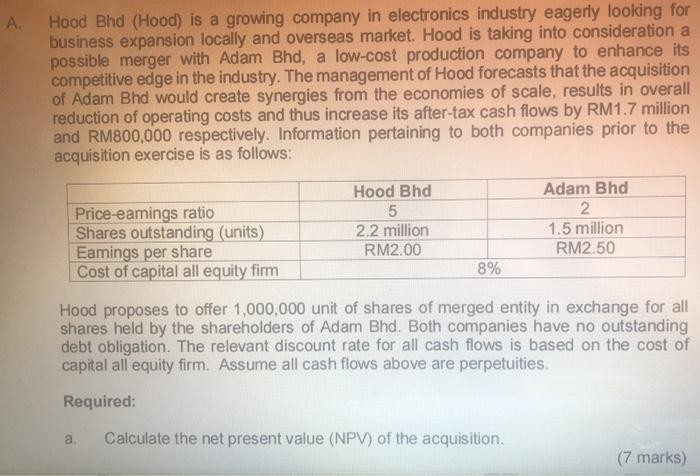

A Hood Bhd (Hood) is a growing company in electronics industry eagerly looking for business expansion locally and overseas market. Hood is taking into consideration a possible merger with Adam Bhd, a low-cost production company to enhance its competitive edge in the industry. The management of Hood forecasts that the acquisition of Adam Bhd would create synergies from the economies of scale, results in overall reduction of operating costs and thus increase its after-tax cash flows by RM1.7 million and RM800,000 respectively. Information pertaining to both companies prior to the acquisition exercise is as follows: Hood Bhd Adam Bhd Price-eamings ratio 5 2 Shares outstanding (units) 2.2 million 1.5 million Eamings per share RM2.00 RM2.50 Cost of capital all equity firm 8% Hood proposes to offer 1,000,000 unit of shares of merged entity in exchange for all shares held by the shareholders of Adam Bhd. Both companies have no outstanding debt obligation. The relevant discount rate for all cash flows is based on the cost of capital all equity firm. Assume all cash flows above are perpetuities. Required: . Calculate the net present value (NPV) of the acquisition (7 marks) b. Advise whether shareholders of Hood Bhd should proceed with the acquisition proposal. (2 marks) C. Based on answer in (b) above, suggest the best financing option that Hood Bhd would choose if the firm offers to buy shares of Adam Bhd at a premium of 20% over its current market price. (3 marks) A Hood Bhd (Hood) is a growing company in electronics industry eagerly looking for business expansion locally and overseas market. Hood is taking into consideration a possible merger with Adam Bhd, a low-cost production company to enhance its competitive edge in the industry. The management of Hood forecasts that the acquisition of Adam Bhd would create synergies from the economies of scale, results in overall reduction of operating costs and thus increase its after-tax cash flows by RM1.7 million and RM800,000 respectively. Information pertaining to both companies prior to the acquisition exercise is as follows: Hood Bhd Adam Bhd Price-eamings ratio 5 2 Shares outstanding (units) 2.2 million 1.5 million Eamings per share RM2.00 RM2.50 Cost of capital all equity firm 8% Hood proposes to offer 1,000,000 unit of shares of merged entity in exchange for all shares held by the shareholders of Adam Bhd. Both companies have no outstanding debt obligation. The relevant discount rate for all cash flows is based on the cost of capital all equity firm. Assume all cash flows above are perpetuities. Required: . Calculate the net present value (NPV) of the acquisition (7 marks) b. Advise whether shareholders of Hood Bhd should proceed with the acquisition proposal. (2 marks) C. Based on answer in (b) above, suggest the best financing option that Hood Bhd would choose if the firm offers to buy shares of Adam Bhd at a premium of 20% over its current market price