Question

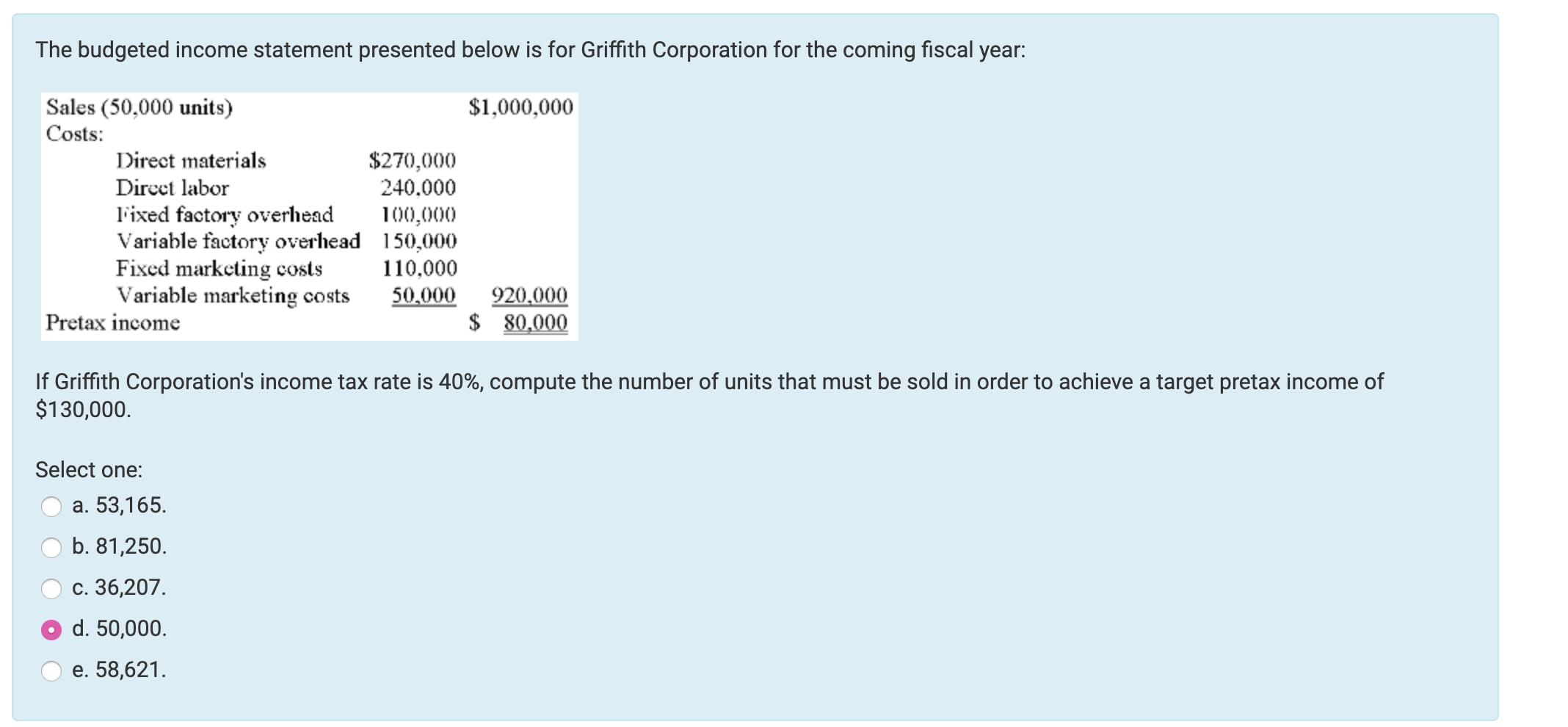

The budgeted income statement presented below is for Griffith Corporation for the coming fiscal year: Sales (50,000 units) Costs: Direct materials Direct labor Fixed

The budgeted income statement presented below is for Griffith Corporation for the coming fiscal year: Sales (50,000 units) Costs: Direct materials Direct labor Fixed factory overhead Variable factory overhead Fixed marketing costs Variable marketing costs Pretax income Select one: $270,000 240.000 a. 53,165. b. 81,250. c. 36,207. d. 50,000. e. 58,621. $1,000,000 If Griffith Corporation's income tax rate is 40%, compute the number of units that must be sold in order to achieve a target pretax income of $130,000. 100,000 150,000 110,000 50,000 920,000 $ 80,000

Step by Step Solution

3.35 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Sales per unit 100000050000 Less Variable cost per unit D...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

College Physics

Authors: Jerry D. Wilson, Anthony J. Buffa, Bo Lou

7th edition

9780321571113, 321601831, 978-0321601834

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App