A) How do you calculate the ratio based on the income and balance statement?

| Degree of Financial Leverage |

| Percentage of Earnings Retained |

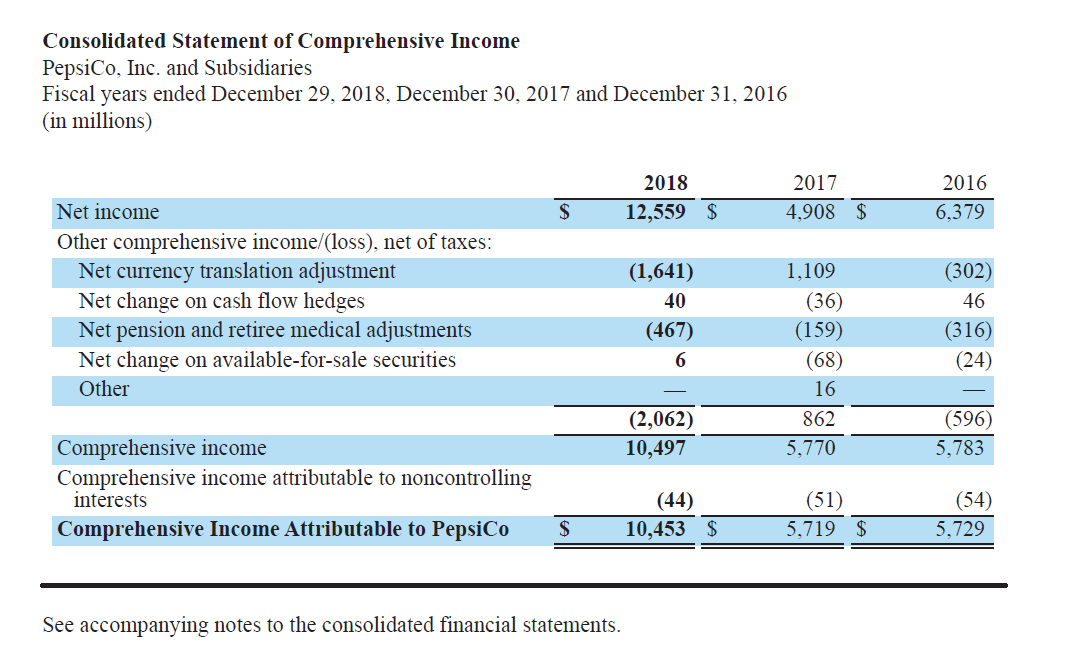

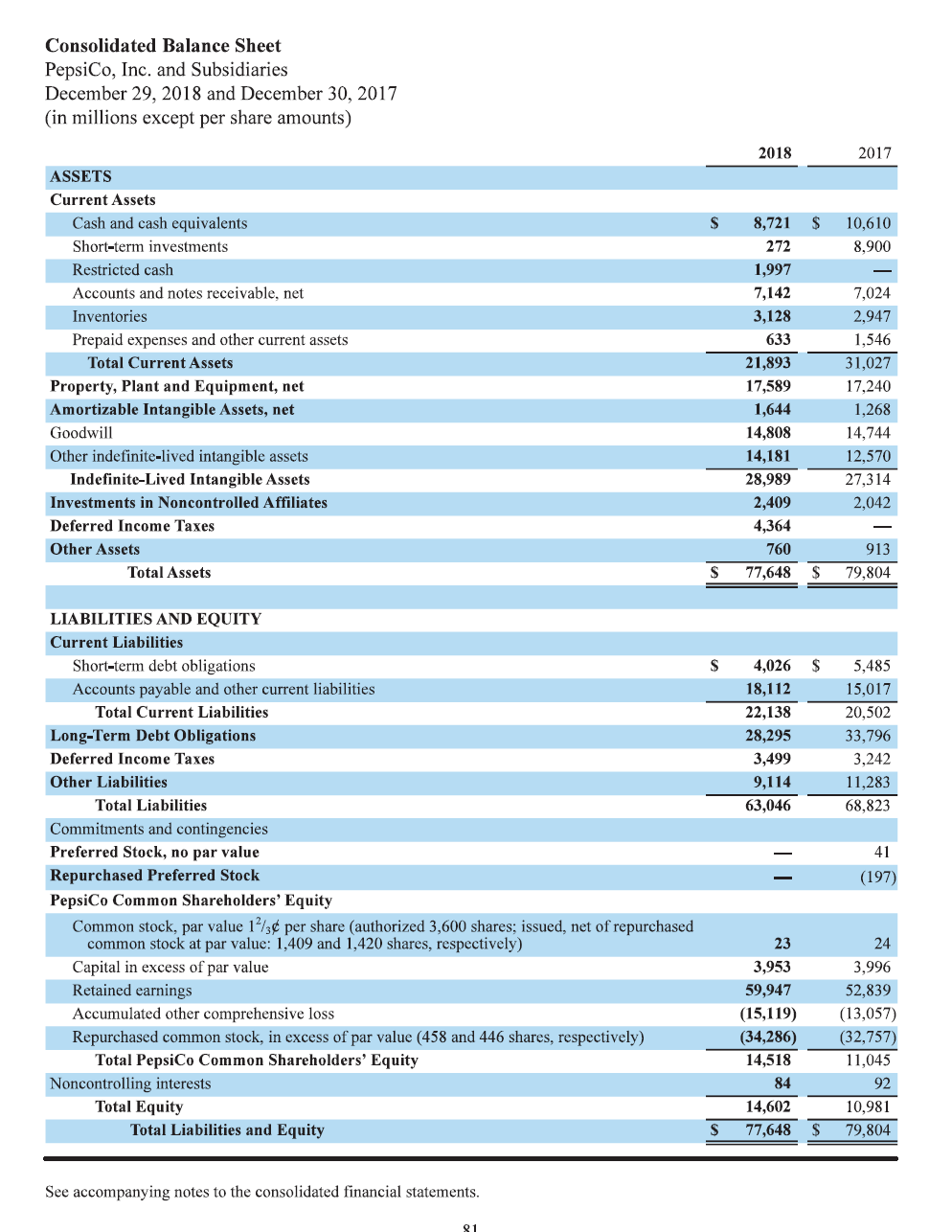

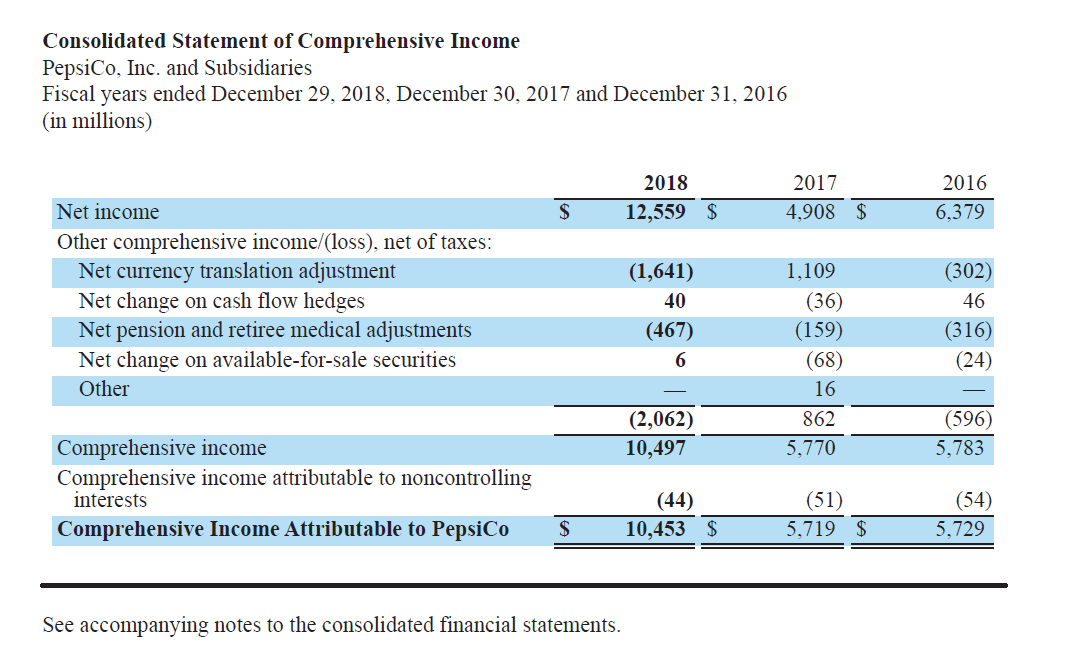

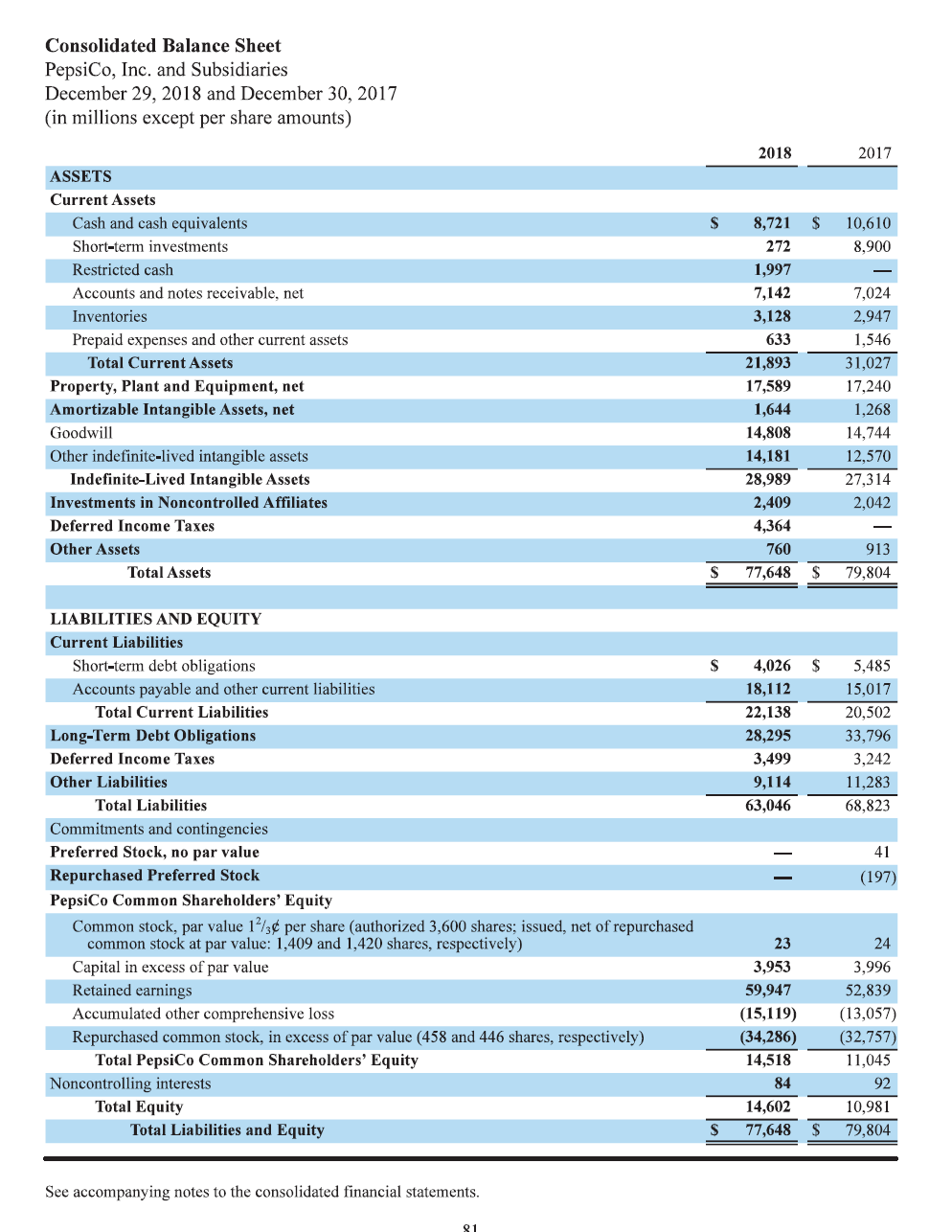

Consolidated Statement of Comprehensive Income PepsiCo, Inc. and Subsidiaries Fiscal years ended December 29, 2018, December 30, 2017 and December 31, 2016 (in millions) 2018 12,559 $ 2017 4,908 $ 2016 6,379 $ Net income Other comprehensive income/loss), net of taxes: Net currency translation adjustment Net change on cash flow hedges Net pension and retiree medical adjustments Net change on available-for-sale securities Other (1,641) 40 (467) 6 1,109 (36) (159) (68) 16 862 5,770 (302) 46 (316) (24) (2,062) 10,497 (596) 5,783 Comprehensive income Comprehensive income attributable to noncontrolling interests Comprehensive Income Attributable to PepsiCo (44) 10,453 $ (51) 5.719 $ (54) 5.729 $ See accompanying notes to the consolidated financial statements. Consolidated Balance Sheet PepsiCo, Inc. and Subsidiaries December 29, 2018 and December 30, 2017 (in millions except per share amounts) 2018 2017 S ASSETS Current Assets Cash and cash equivalents Short-term investments Restricted cash Accounts and notes receivable, net Inventories Prepaid expenses and other current assets Total Current Assets Property, Plant and Equipment, net Amortizable Intangible Assets, net Goodwill Other indefinite-lived intangible assets Indefinite-Lived Intangible Assets Investments in Noncontrolled Affiliates Deferred Income Taxes Other Assets Total Assets 8,721 $ 10,610 2728,900 1,997 7,142 7,024 3,128 2,947 633 1,546 21,893 31,027 17,589 17,240 1,644 1,268 14,808 14,744 14,181 1 2,570 28,989 27,314 2,409 2,042 4,364 760 913 77,648 $ 79,804 S $ $ 4,026 18,112 22,138 28,295 3,499 5,485 15,017 20,502 33,796 3,242 11,283 68,823 9,114 63,046 LIABILITIES AND EQUITY Current Liabilities Short-term debt obligations Accounts payable and other current liabilities Total Current Liabilities Long-Term Debt Obligations Deferred Income Taxes Other Liabilities Total Liabilities Commitments and contingencies Preferred Stock, no par value Repurchased Preferred Stock PepsiCo Common Shareholders' Equity Common stock, par value 1/3 per share (authorized 3,600 shares; issued, net of repurchased common stock at par value: 1,409 and 1,420 shares, respectively) Capital in excess of par value Retained earnings Accumulated other comprehensive loss Repurchased common stock, in excess of par value (458 and 446 shares, respectively) Total PepsiCo Common Shareholders' Equity Noncontrolling interests Total Equity Total Liabilities and Equity - . 41 (197) - 23 3,953 59,947 (15,119) (34,286) 14,518 84 14,602 77,648 24 3,996 52,839 (13,057) (32,757) 11,045 92 10,981 79,804 $ $ See accompanying notes to the consolidated financial statements. 81 Consolidated Statement of Comprehensive Income PepsiCo, Inc. and Subsidiaries Fiscal years ended December 29, 2018, December 30, 2017 and December 31, 2016 (in millions) 2018 12,559 $ 2017 4,908 $ 2016 6,379 $ Net income Other comprehensive income/loss), net of taxes: Net currency translation adjustment Net change on cash flow hedges Net pension and retiree medical adjustments Net change on available-for-sale securities Other (1,641) 40 (467) 6 1,109 (36) (159) (68) 16 862 5,770 (302) 46 (316) (24) (2,062) 10,497 (596) 5,783 Comprehensive income Comprehensive income attributable to noncontrolling interests Comprehensive Income Attributable to PepsiCo (44) 10,453 $ (51) 5.719 $ (54) 5.729 $ See accompanying notes to the consolidated financial statements. Consolidated Balance Sheet PepsiCo, Inc. and Subsidiaries December 29, 2018 and December 30, 2017 (in millions except per share amounts) 2018 2017 S ASSETS Current Assets Cash and cash equivalents Short-term investments Restricted cash Accounts and notes receivable, net Inventories Prepaid expenses and other current assets Total Current Assets Property, Plant and Equipment, net Amortizable Intangible Assets, net Goodwill Other indefinite-lived intangible assets Indefinite-Lived Intangible Assets Investments in Noncontrolled Affiliates Deferred Income Taxes Other Assets Total Assets 8,721 $ 10,610 2728,900 1,997 7,142 7,024 3,128 2,947 633 1,546 21,893 31,027 17,589 17,240 1,644 1,268 14,808 14,744 14,181 1 2,570 28,989 27,314 2,409 2,042 4,364 760 913 77,648 $ 79,804 S $ $ 4,026 18,112 22,138 28,295 3,499 5,485 15,017 20,502 33,796 3,242 11,283 68,823 9,114 63,046 LIABILITIES AND EQUITY Current Liabilities Short-term debt obligations Accounts payable and other current liabilities Total Current Liabilities Long-Term Debt Obligations Deferred Income Taxes Other Liabilities Total Liabilities Commitments and contingencies Preferred Stock, no par value Repurchased Preferred Stock PepsiCo Common Shareholders' Equity Common stock, par value 1/3 per share (authorized 3,600 shares; issued, net of repurchased common stock at par value: 1,409 and 1,420 shares, respectively) Capital in excess of par value Retained earnings Accumulated other comprehensive loss Repurchased common stock, in excess of par value (458 and 446 shares, respectively) Total PepsiCo Common Shareholders' Equity Noncontrolling interests Total Equity Total Liabilities and Equity - . 41 (197) - 23 3,953 59,947 (15,119) (34,286) 14,518 84 14,602 77,648 24 3,996 52,839 (13,057) (32,757) 11,045 92 10,981 79,804 $ $ See accompanying notes to the consolidated financial statements. 81