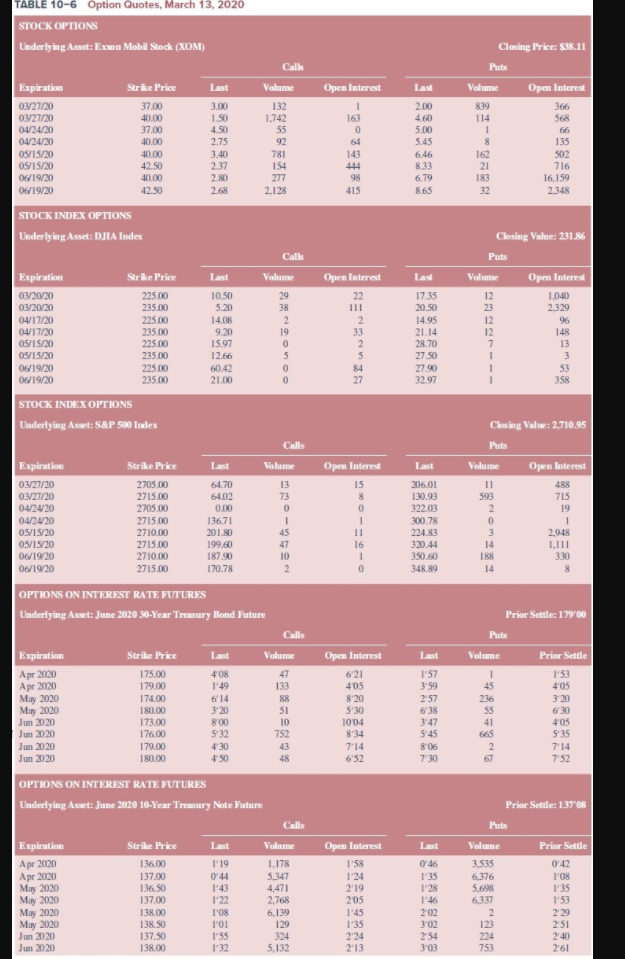

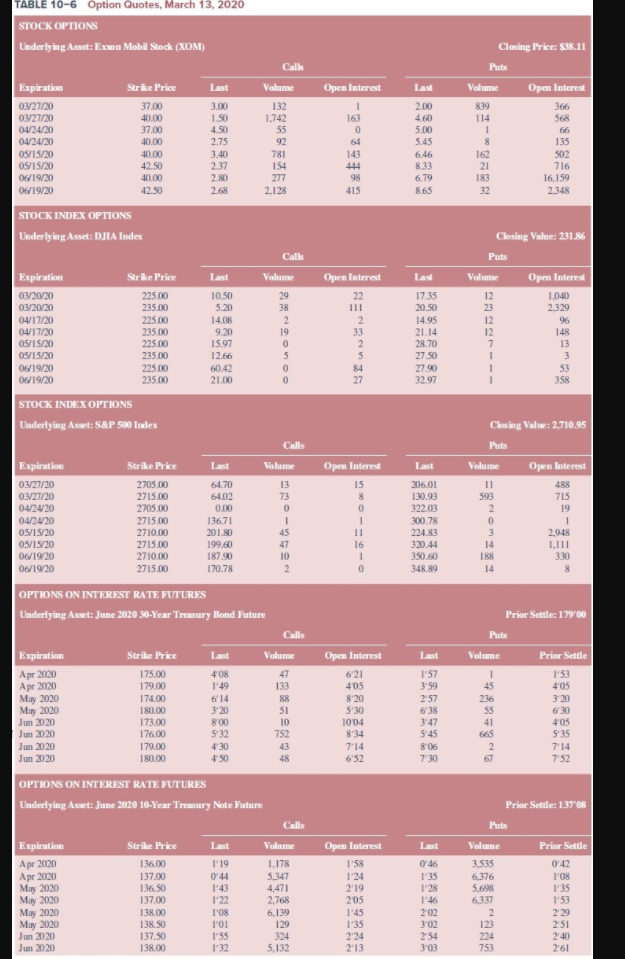

a. How many Exxon Mobil April 2020 $42.5 put options were outstanding at the open of trading on March 13, 2020? (Round your answers to 3 decimal places. (e.g., 32.161)) b. What was the settlement price of a 10-year Treasury note May 138.5 futures call option on March 13, 2020? (Round your answers to 4 decimal places. (e.g., 32.1616)) c. What was the closing price of a March 2,715 call option on the S&P 500 Stock Index futures contract on March 13, 2020? Calculate the dollar price of the March 2,715 call option on the S&P 500 Stock Index futures contract on March 13, 2020. (Round your answers to 2 decimal places. (e.g., 32.16)) d. What was the open interest on April 2020 put options (with an exercise price of 225) on the Dow Jones Industrial Average stock index on March 13, 2020?

TABLE 10-6 Option Quotes, March 13, 2020 STOCK OPTIONS Underlying Asset: Exawn Mobil Stock (XOM) Closing Price: $38.11 Call Puls Volume Open Interest 1 163 0 Expiration 03/27/20 0327/20 04/24/20 04/24/20 OS/15/20 OS/15/20 06/19/20 06/19/20 Strike Price 37.00 40.00 37.00 40.00 40.00 42 50 40.00 42.50 3.00 1.50 4.50 2.75 3.40 237 2.80 2.68 Volume 132 1.742 55 92 781 154 277 2.128 2.00 4.60 5.00 5.45 6.46 8.33 & Open Interest 366 568 66 135 S02 716 16,159 2.348 839 114 1 & 162 21 183 32 143 444 98 415 6.79 8.65 STOCK INDEX OPTIONS Underlying Asset: DJIA Index Calls Volume Las Expiration 03/20/20 03/20/20 04/17/20 04/17/20 OS/15/20 05/15/20 06/19/20 06/19/20 Strike Price 225.00 235.00 225.00 235.00 225.00 235.00 225.00 235.00 Last 10.50 5.20 14.08 9.20 15.97 12.66 60.42 21.00 38 2 19 Open Interest 22 111 2 33 2 17.35 20.50 14.95 21.14 28.70 27.50 27.90 32.97 Closing Value: 231.86 Puts Volume Open Interest 12 1,040 23 2.329 12 96 12 148 13 3 53 358 84 27 STOCK INDEX OPTIONS Underlying Asset: S&P 500 Index Closing Value: 2,710.95 Calls Puts Last Volume Volume 13 73 0 Expiration 03/27/20 03/27/20 04/24/20 04/24/20 05/15/20 OS/IS/20 06/19/20 06/19/20 Strike Price 2705.00 2715.00 2705.00 2715.00 2710.00 2715.00 2710,00 2715.00 64.70 64.02 0.00 136.71 201.80 199.60 187.90 170.78 Open Interes 15 8 0 1 11 16 1 0 206.01 130.93 322.03 300.78 224.83 320.44 350.60 348.89 11 593 2 0 3 14 Open Interest 488 715 19 1 2.948 1.111 330 8 188 14 OPTIONS ON INTEREST RATE FUTURES Underlying Asset: June 2020 30-Year 'Treasury Bond Future Prior Settle: 17900 Puls Strike Price Last Last Prior Settle Expiration Apr 2020 Apr 2020 May 2020 May 2020 Jun 2020 Jun 2020 Jun 2020 Jun 2020 175.00 179.00 174.00 180.00 173.00 176.00 179.00 180.00 408 1'49 614 3:20 800 Volume 47 133 88 51 10 752 43 48 Open Interest 621 405 8:20 5:30 1004 8:34 7'14 6'52 1:57 359 2:57 638 3:47 545 8:06 730 Volume 1 45 236 55 41 665 2 67 1'53 405 3:20 6 30 405 $32 535 4:30 450 714 7:52 OPTIONS ON INTEREST RATE FUTURES Underlying Asset: June 2020 10-Year Treasury Note Future Last Expiration Apr 2020 Apr 2020 May 2020 May 2020 May 2020 May 2020 Jun 2020 Jun 2020 Strike Price 136.00 137.00 136.50 137.00 138.00 138.50 137.50 138.00 Last 1'19 0 44 1'43 1:22 1'08 101 1'55 1'32 Volume 1,178 5.347 4,471 2,768 6,139 129 324 5,132 Open Interest 1'58 1.24 2:19 205 1'45 135 2 24 2'13 046 1'35 1:28 146 202 3:02 254 3'03 Prior Settle: 137'08 Huts Volume Prior Settle 3,535 042 6,376 l'Os 5,698 1'35 6,337 1:53 2 2 29 251 224 240 753 123 261 TABLE 10-6 Option Quotes, March 13, 2020 STOCK OPTIONS Underlying Asset: Exawn Mobil Stock (XOM) Closing Price: $38.11 Call Puls Volume Open Interest 1 163 0 Expiration 03/27/20 0327/20 04/24/20 04/24/20 OS/15/20 OS/15/20 06/19/20 06/19/20 Strike Price 37.00 40.00 37.00 40.00 40.00 42 50 40.00 42.50 3.00 1.50 4.50 2.75 3.40 237 2.80 2.68 Volume 132 1.742 55 92 781 154 277 2.128 2.00 4.60 5.00 5.45 6.46 8.33 & Open Interest 366 568 66 135 S02 716 16,159 2.348 839 114 1 & 162 21 183 32 143 444 98 415 6.79 8.65 STOCK INDEX OPTIONS Underlying Asset: DJIA Index Calls Volume Las Expiration 03/20/20 03/20/20 04/17/20 04/17/20 OS/15/20 05/15/20 06/19/20 06/19/20 Strike Price 225.00 235.00 225.00 235.00 225.00 235.00 225.00 235.00 Last 10.50 5.20 14.08 9.20 15.97 12.66 60.42 21.00 38 2 19 Open Interest 22 111 2 33 2 17.35 20.50 14.95 21.14 28.70 27.50 27.90 32.97 Closing Value: 231.86 Puts Volume Open Interest 12 1,040 23 2.329 12 96 12 148 13 3 53 358 84 27 STOCK INDEX OPTIONS Underlying Asset: S&P 500 Index Closing Value: 2,710.95 Calls Puts Last Volume Volume 13 73 0 Expiration 03/27/20 03/27/20 04/24/20 04/24/20 05/15/20 OS/IS/20 06/19/20 06/19/20 Strike Price 2705.00 2715.00 2705.00 2715.00 2710.00 2715.00 2710,00 2715.00 64.70 64.02 0.00 136.71 201.80 199.60 187.90 170.78 Open Interes 15 8 0 1 11 16 1 0 206.01 130.93 322.03 300.78 224.83 320.44 350.60 348.89 11 593 2 0 3 14 Open Interest 488 715 19 1 2.948 1.111 330 8 188 14 OPTIONS ON INTEREST RATE FUTURES Underlying Asset: June 2020 30-Year 'Treasury Bond Future Prior Settle: 17900 Puls Strike Price Last Last Prior Settle Expiration Apr 2020 Apr 2020 May 2020 May 2020 Jun 2020 Jun 2020 Jun 2020 Jun 2020 175.00 179.00 174.00 180.00 173.00 176.00 179.00 180.00 408 1'49 614 3:20 800 Volume 47 133 88 51 10 752 43 48 Open Interest 621 405 8:20 5:30 1004 8:34 7'14 6'52 1:57 359 2:57 638 3:47 545 8:06 730 Volume 1 45 236 55 41 665 2 67 1'53 405 3:20 6 30 405 $32 535 4:30 450 714 7:52 OPTIONS ON INTEREST RATE FUTURES Underlying Asset: June 2020 10-Year Treasury Note Future Last Expiration Apr 2020 Apr 2020 May 2020 May 2020 May 2020 May 2020 Jun 2020 Jun 2020 Strike Price 136.00 137.00 136.50 137.00 138.00 138.50 137.50 138.00 Last 1'19 0 44 1'43 1:22 1'08 101 1'55 1'32 Volume 1,178 5.347 4,471 2,768 6,139 129 324 5,132 Open Interest 1'58 1.24 2:19 205 1'45 135 2 24 2'13 046 1'35 1:28 146 202 3:02 254 3'03 Prior Settle: 137'08 Huts Volume Prior Settle 3,535 042 6,376 l'Os 5,698 1'35 6,337 1:53 2 2 29 251 224 240 753 123 261